Current trend

The leading index of the London Stock Exchange FTSE 100 shows corrective dynamics at around 7451.0, showing the slowest growth compared to indicators of developed countries, the main reason for which can be attributed to a less sharp decline in domestic bond yields and weak macroeconomic statistics.

However, the day before, quotes received local support after the publication of data on the UK labor market. Unemployment Rate in September remained at the August level of 4.2%, which was facilitated by an increase in jobs by 54.0 thousand against the forecast of -198.0 thousand. Average Earnings Including Bonus fell to 7.9%, which is still better than the expected reduction to 7.4%.

The downward correction continues in the domestic bond market, which this week returned the yield on leading securities to the levels of the end of spring 2023. The 10-year bonds are trading at 4.197%, well below their mid-October peak of 4.645%, while the yield of 20-year ones is holding steady at 4.605%, well below the 5.045% recorded in mid-October.

The growth leaders in the index are DCC Plc. ( 12.47%), Ocado Group Plc. ( 10.10%), British Land Company Plc. ( 9.70%), Just Eat Takeaway ( 8.68%).

Among the leaders of the decline are Vodafone Group Plc. (-5.54%), BAE Systems Plc. (-3.16%), BT Group Plc. (-2.77%).

Support and resistance

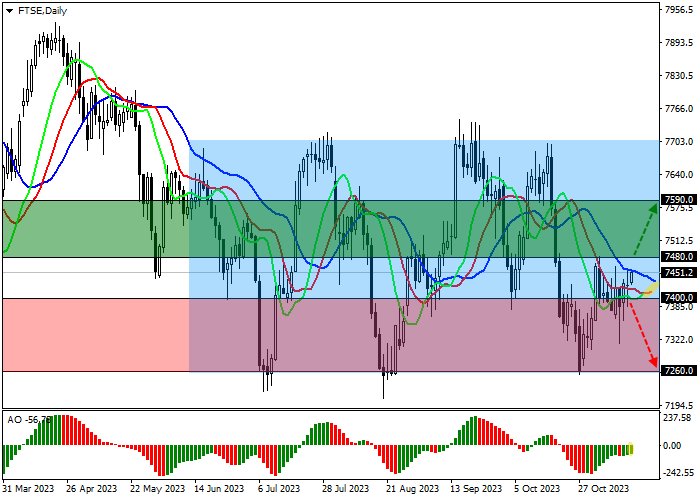

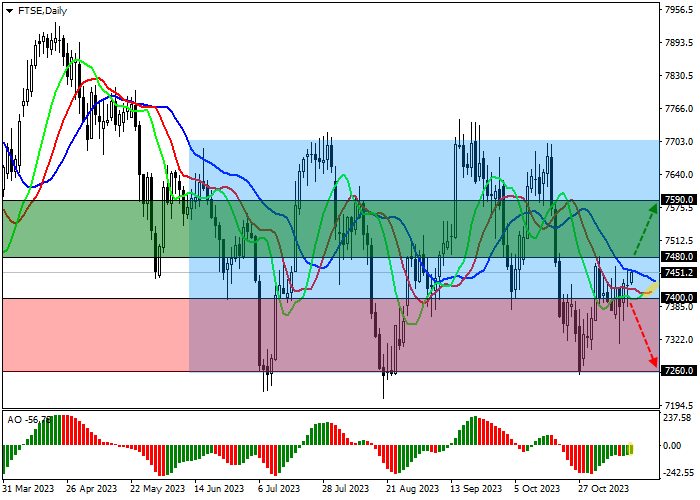

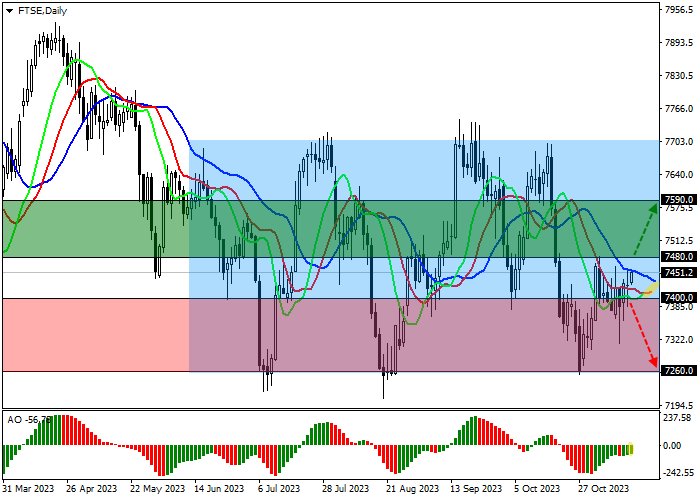

On the daily chart, the index quotes continue their local correction, rising again and approaching the resistance line of the side corridor with the boundaries of 7700.0–7250.0.

Technical indicators are in a sell signal state, which continues to slow down, indicating a local correction: the EMA fluctuation range began to narrow again, and the AO histogram formed new corrective bars, being in the sell zone.

Support levels: 7400.0, 7260.0.

Resistance levels: 7480.0, 7590.0.

Trading tips

If the asset continues growing, and the price consolidates above the local resistance at 7480.0, long positions with a target of 7590.0 and stop-loss of 7420.0 will be relevant. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 7400.0, short positions can be opened with the target at 7260.0. Stop-loss — 7460.0.

Hot

No comment on record. Start new comment.