We present a medium-term investment overview of the SX5E index.

Since the beginning of November, active upward dynamics have been observed in the stock market: investors’ attention is focused on the publication of quarterly financial statements of components and the dynamics of consumer prices. On Friday, the Statistical Office of the European Union will release October inflation data: according to preliminary estimates, the indicator may slow down from 4.3% to 2.9% YoY and from 0.3% to 0.1% MoM. In turn, EU Q3 gross domestic product (GDP) contracted 0.1% after rising 0.2% earlier, pushing the rate down to 0.1% YoY from 0.5% previously and if inflationary pressures will continue, and the “hawkish” rhetoric of the European Central Bank (ECB) will continue to negatively affect the economy, then the region will face a recession. To prevent a negative scenario, the regulator needs to reduce the impact of high interest rates, and now is the right moment for this: food inflation is declining, and core inflation, which does not take into account food and fuel prices, may change from 4.5% to 4.2%.

However, investors have already adapted to tight monetary policy and are focusing their attention on the debt market, where the correctional trend continues. The higher the rate of return on bonds, the more attractive they are compared to stocks, which is associated with much less risk and fees for long-term holding, and conversely, the current decline in security yields supports stock indices. Thus, the indicator for the leading 10-year bonds of Germany is 2.5925%, below 2.8754% in mid-October, of Spain – 3.6550%, below the peak value of 4.0490% in mid-autumn, and of France – 3.1470 %, significantly inferior to 3.5550%, and the negative trend is actively developing.

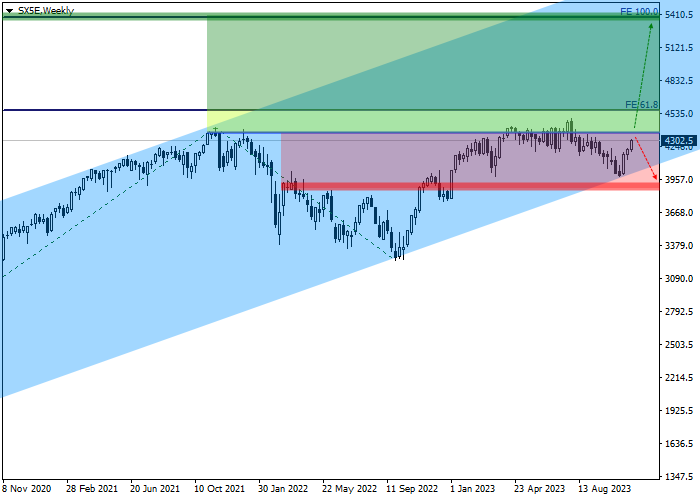

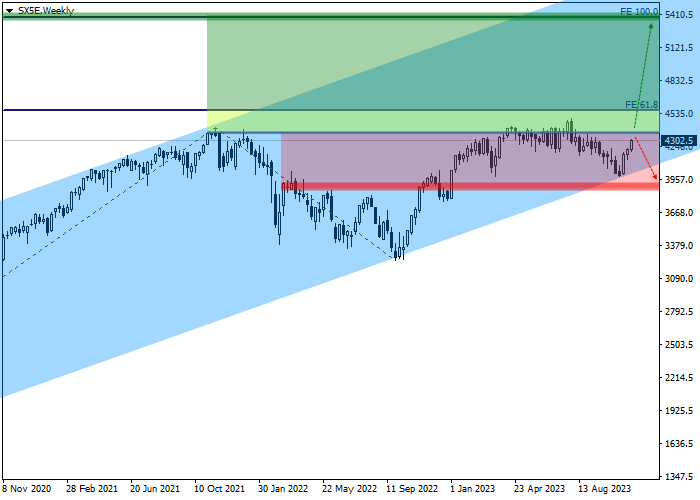

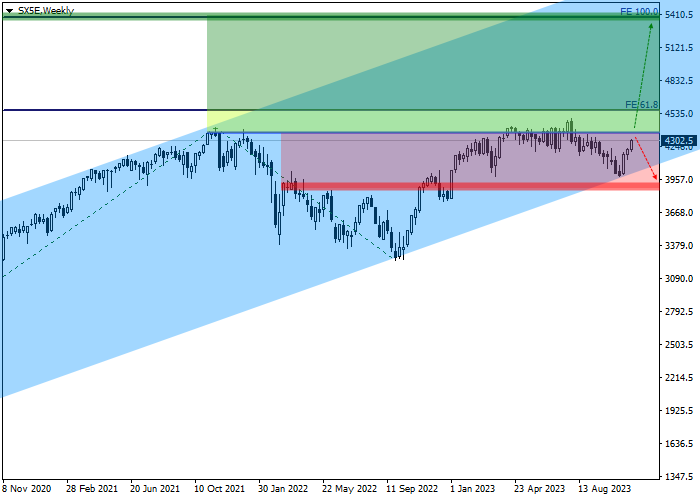

As a result, two key factors influencing the stock index are positive, which may lead to the continuation of the upward dynamics of SX5E quotes: on the weekly chart, the price is moving within the ascending channel with the boundaries of 5500.0–3600.0, staying close to the historical high of 4500.0.

The main signs indicate that this resistance level will soon be overcome, which will cause increased investor interest in the asset. In similar trading instruments DAX 40 and CAC 40, the year’s high has already been broken, and the upward dynamics are actively developing further.

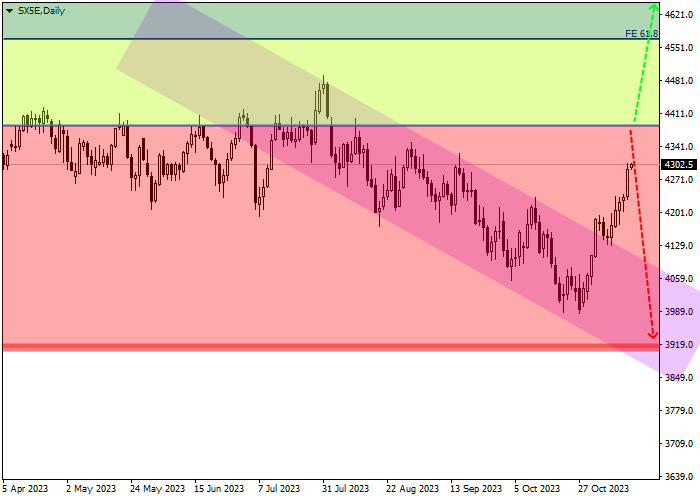

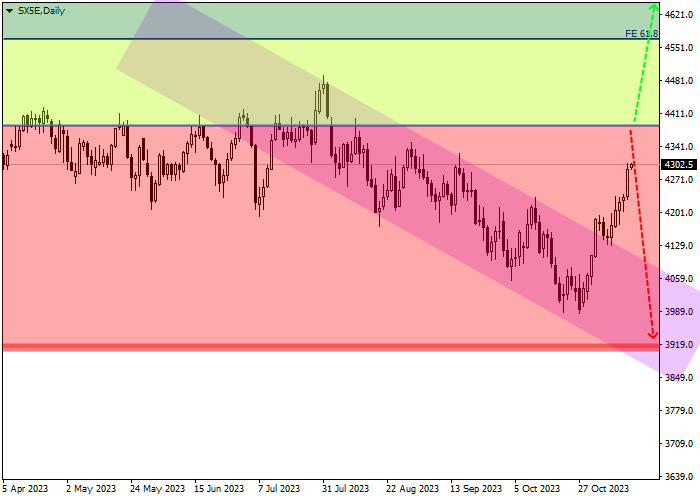

Let’s consider key levels on the daily chart.

As can be seen on the chart, the quotes are trading within an upward trend, and confidence in its continuation will increase after the price consolidates above the initial trend level of 61.8% in the Fibonacci extension at 4570.0, which will require renewing the year’s high of 4500.0. After a reversal, decline, and consolidation of the asset below the mid-October low at 4000.0 and reaching 3910.0, the upward scenario will either be canceled or noticeably delayed, and it is better to liquidate open buy positions. Around the core trend level of 100.0% according to the Fibonacci extension, around 5400.0, there is the target zone, if reached, it is worth taking profits on open buy positions.

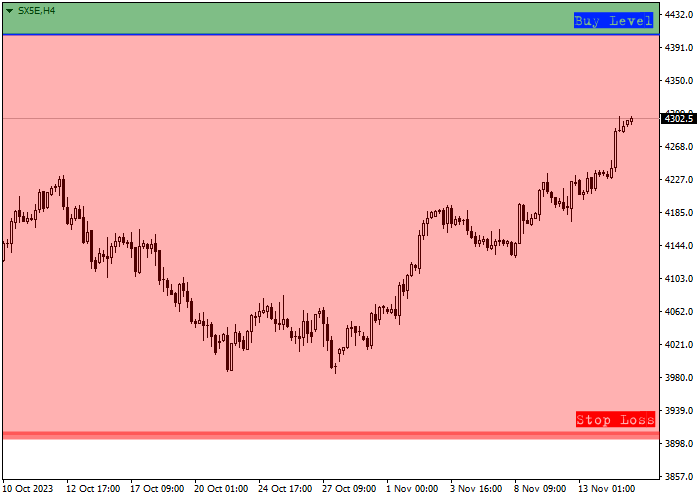

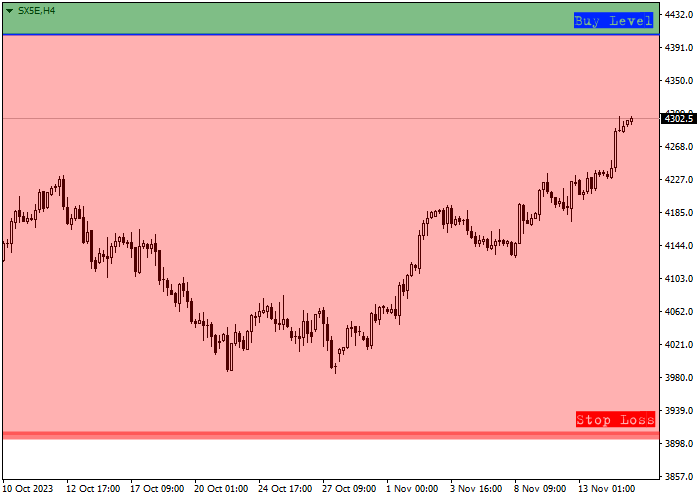

Trade entry levels may be assessed on the four-hour chart.

The entry level for buy transactions is at 4400.0, and a local signal can be received in the coming days after overcoming local highs and reaching the historical resistance level, after which there will be no obstacles on the way of the price to the target level of 5400.0, and positions may be implemented.

Considering the average daily volatility of the trading instrument for the last month, which is 587.0 points, the movement to the target zone of 5400.0 could take approximately 67 sessions but if volatility increases, this time can be reduced to 53 trading days.

Hot

No comment on record. Start new comment.