Current trend

The XAG/USD pair remains virtually unchanged, being close to 23.40. The instrument demonstrates a tendency towards flat dynamics against the backdrop of fixing part of the long positions opened against the backdrop of macroeconomic statistics coming from the United States.

In October, the Consumer Price Index slowed down from 0.4% to 0.0%, while analysts expected 0.1%, and in annual terms it went from 3.7% to 3.2%, with a forecast of 3.3%. Investors took the inflation statistics as an additional signal to the possible end of the cycle of tightening monetary policy by the US Federal Reserve. In addition, the Producer Price Index decreased by 0.5% after rising by 0.4% in the previous month, and in annual terms the indicator fell from 2.2% to 1.3%, with expectations at 1.9%. At the same time, Retail Sales volumes decreased by 0.1% after an increase of 0.9% in September, while experts expected -0.3%. The focus of investors today will be the speeches of representatives of the US Federal Reserve, who can comment on the latest data on inflation in the country, and in addition, trading participants will pay attention to data on Jobless Claims and Industrial Production volumes for October.

Meanwhile, according to the latest report from the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in silver decreased to 18.3 thousand from 20.3 thousand the week before. The "bulls" again regained their advantage against the backdrop of a reduction in selling positions: according to the report on positions with swap dealers, their balance is 35.759 thousand versus 35.684 thousand for the "bears". Last week, buyers increased the number of contracts by 1.606 thousand, and sellers decreased it by 0.393 thousand, which signals the return of investor interest in the asset and the end of the profit-taking phase.

Support and resistance

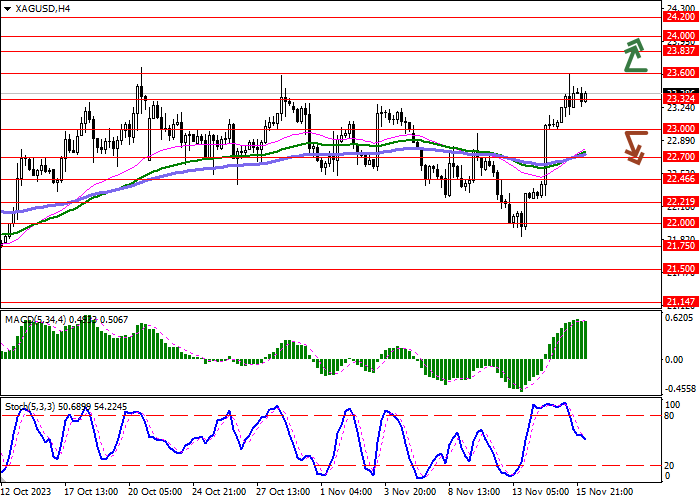

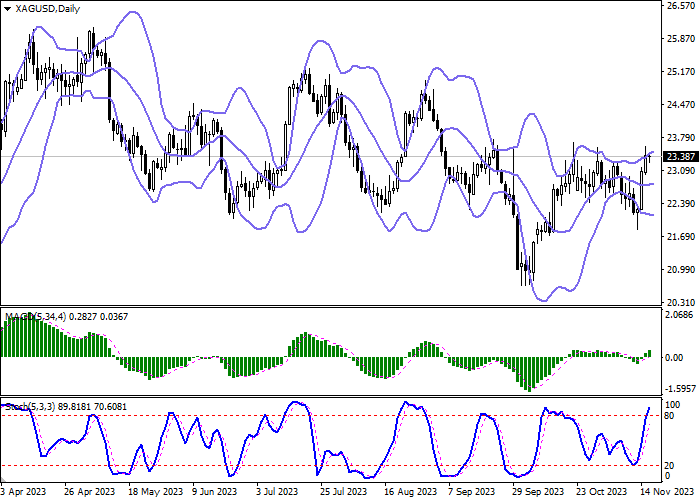

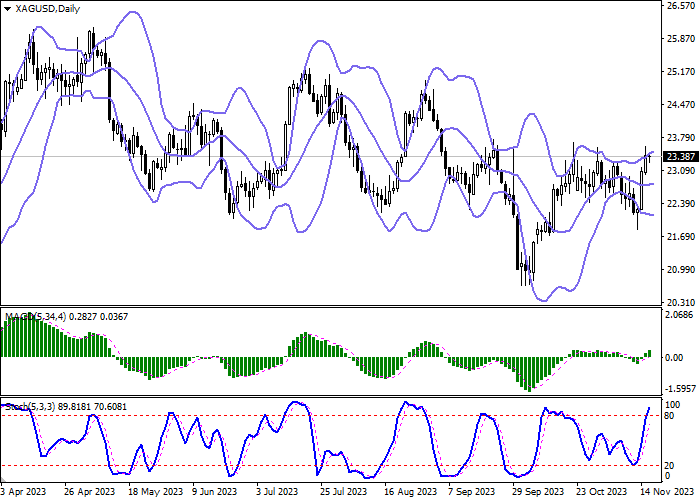

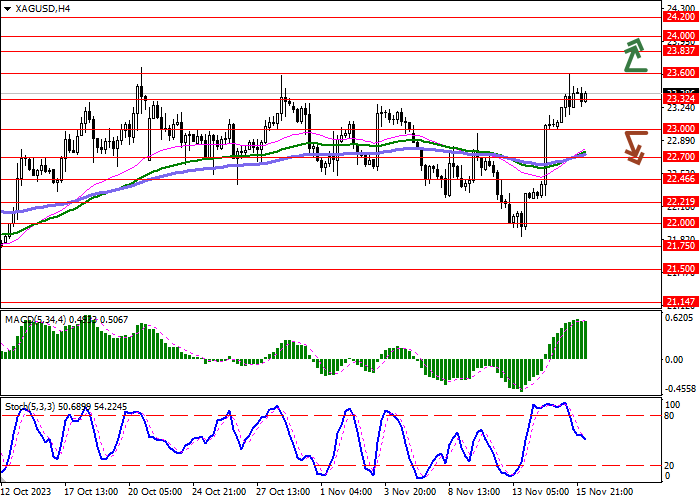

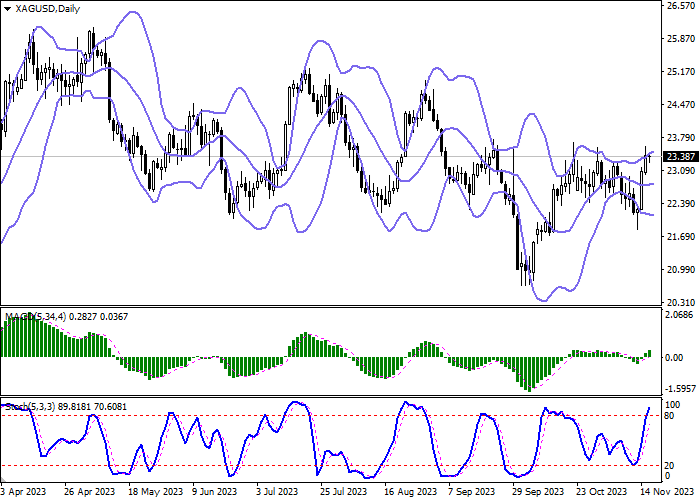

Bollinger Bands in D1 chart show weak growth. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic retains an uptrend, but is located in close proximity to its highs, which points to the risk of overbought silver in the ultra-short term.

Resistance levels: 23.60, 23.83, 24.00, 24.20.

Support levels: 23.32, 23.00, 22.70, 22.46.

Trading tips

Long positions can be opened after a breakout of 23.60 with the target of 24.00. Stop-loss — 23.40. Implementation time: 1-2 days.

The return of "bearish" trend with the breakdown of 23.00 may become a signal for new sales with the target at 22.46. Stop-loss — 23.32.

Hot

No comment on record. Start new comment.