Current trend

Yesterday, the NZD/USD pair tested the resistance level of 0.6045, failed to overcome it, and began to decline against negative macroeconomic data from New Zealand.

Thus, the October service efficiency index amounted to 48.9 points, lower than the previous value of 50.6 points, and the composite income per capita was 46.1 points compared to 48.6 points earlier. Food inflation fell sharply, reaching 6.3% in October, below the 7.4% forecast and the previous 8.0%. Given these statistics, officials of the Reserve Bank of New Zealand (RBNZ) may refuse to raise interest rates at its meeting on November 29, which puts pressure on the national currency.

The American dollar is strengthening against risk assets amid the adoption of a bill on temporary measures to finance the US Government to avoid a suspension of its work. On November 14, the US House of Representatives approved the bill, yesterday it was supported in the Senate, and the next step will be the signature of President Joe Biden. In addition, October core retail sales reached 0.1%, better than the –0.2% forecast, while the previous figure was corrected from 0.6% to 0.8%. Retail sales fell by 0.1% compared to preliminary estimates of a decline of 0.3%, and the previous indicator was revised from 0.7% to 0.9%.

If the New Zealand economy continues its negative trend and the US indicators continue to grow in the medium term, the NZD/USD pair is expected to decline towards 0.5865.

Support and resistance

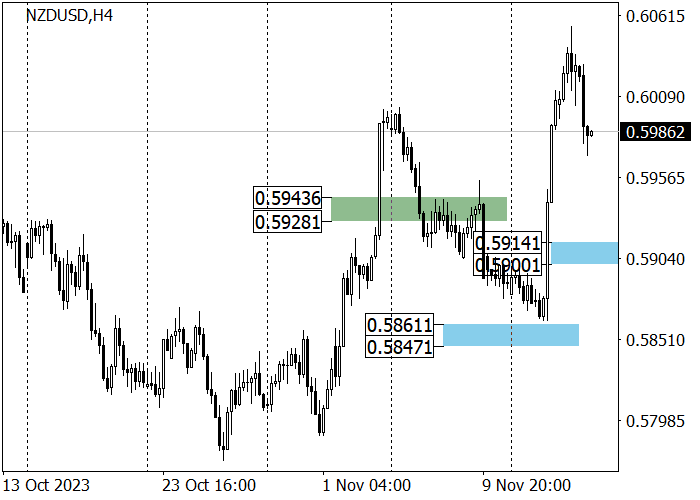

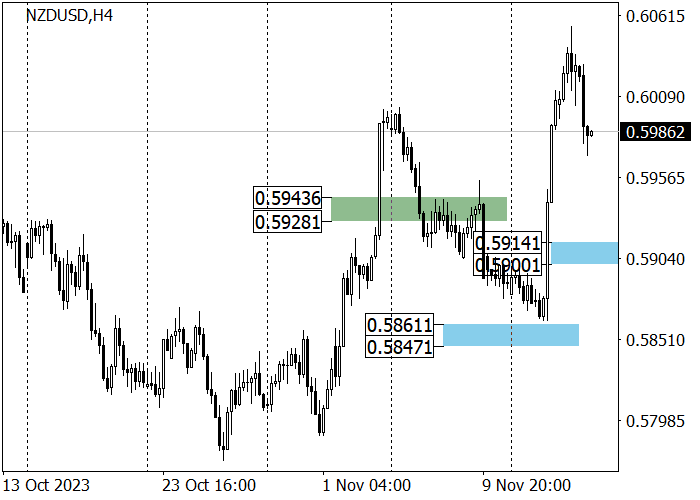

The long-term trend remains downward: yesterday, the quotes tested the key trend resistance around 0.6045 and began to decline to 0.5865, after which the next target will be the area of 0.5790–0.5750.

The medium-term trend is upward: this week, the price renewed its high from November 6 around 0.6000 and headed towards zone 2 (0.6098–0.6083). The key support for the trend is shifting to the area of 0.5961–0.5900, after a correction to which long positions with the first target at 0.6050 are relevant.

Resistance levels: 0.6045, 0.6245.

Support levels: 0.5865, 0.5790, 0.5750.

Trading tips

Short positions may be opened from 0.5995 with the target at 0.5865 and stop loss around 0.6045. Implementation time: 9–12 days.

Long positions may be opened above 0.6045 with the target at 0.6245 and stop loss around 0.5980.

Hot

No comment on record. Start new comment.