Current trend

Shares of Walmart Inc., an American company that operates the world’s largest wholesale and retail chain, are at 166.20.

Ahead of the release of its Q3 financial report, the company announced that it intends to invest more than 9.0B dollars over the next two years to modernize certain stores. Last week, 117 facilities were restarted in thirty states, bringing the total to a 500.0M dollars turnaround program. As part of the new project, the corporation is transforming up to 1,400 establishments out of 4,717 throughout the country, expecting to receive part of the funds to implement the plan during the Christmas sales period since in recent years there has been an increase in demand even despite high inflation.

The financial report, due on November 16, could be slightly worse than last year’s data, with revenue expected to be 159.3B dollars, down from 161.6B dollars in the second quarter, and earnings per share of 1.51 dollars relative to 1.84 dollars. The new dividend payment is scheduled for January 2, when shareholders will receive 0.57 dollars per share or 1.57% of earnings QoQ.

Support and resistance

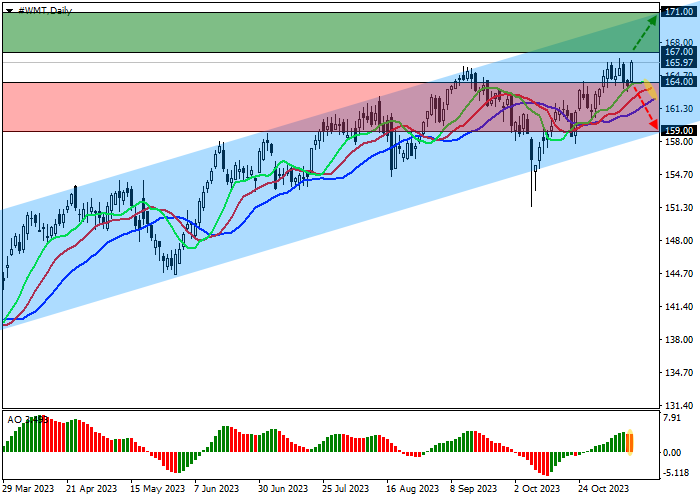

On the daily chart, the trading instrument is moving within the global corridor, approaching the channel resistance line at 171.00.

Technical indicators maintain a buy signal: the AO histogram remains high in the buy zone, and fast EMAs on the Alligator indicator are trading above the signal line, maintaining a stable wide range of fluctuations.

Resistance levels: 167.00, 171.00.

Support levels: 164.00, 159.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 167.00 with the target at 171.00 and stop loss 165.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 164.00 with the target at 159.00. Stop loss – 167.00.

Hot

No comment on record. Start new comment.