Current trend

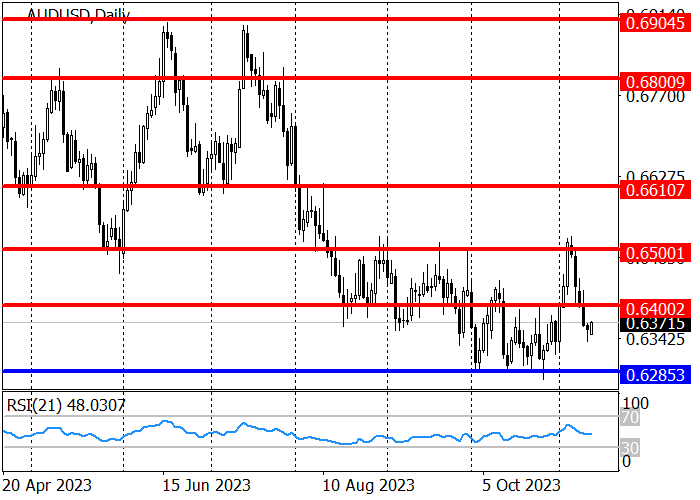

Last week, the AUD/USD pair consolidated below the support level of 0.6400, which suggests further movement towards 0.6285, the development of which primarily depends on the development of the conflict in the Middle East: while fighting is ongoing in the Gaza Strip, the situation will remain tense, increasing demand for shelter assets, which include the American dollar. In addition, the quotes were supported by comments from representatives of the US Federal Reserve, who noted the possibility of continuing to tighten monetary conditions, although the head of the regulator, Jerome Powell, emphasizes that a further increase in interest rates should be due to a noticeable increase in inflationary pressure within the country, which has not yet been observed.

The Australian currency remains under pressure as the Reserve Bank of Australia’s (RBA) increase in borrowing costs to 4.35% has so far failed to fight inflation. In a monetary policy report released on November 10, regulators noted that consumer price growth has peaked but is still high and more resilient than expected several months ago. According to forecasts, the indicator will not overcome 5.0% at the end of the year, remaining well above the target value of 2.0–3.0%.

The long-term trend is downwards: after testing the resistance level of 0.6500, the price reversed and broke through the support level of 0.6400, preparing to continue moving to 0.6285. Now, the instrument is correcting, and if 0.6400 holds, short positions with the target at 0.6285 are relevant. However, after its breakout, long positions with the target at 0.6500 are relevant. The RSI indicator is in the neutral zone, allowing opening both buy and sell trades.

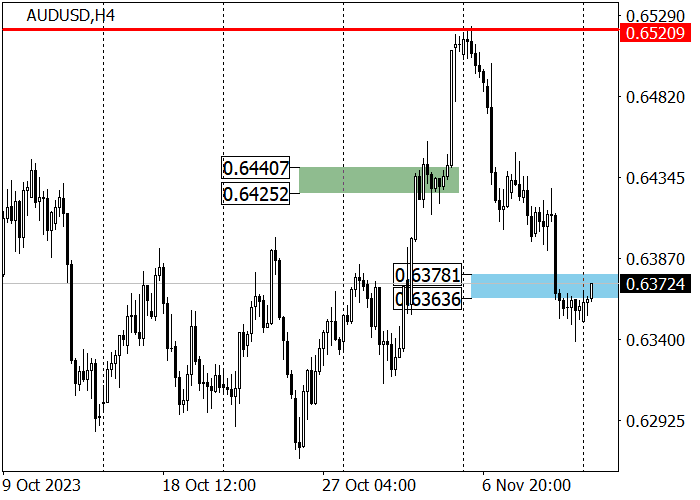

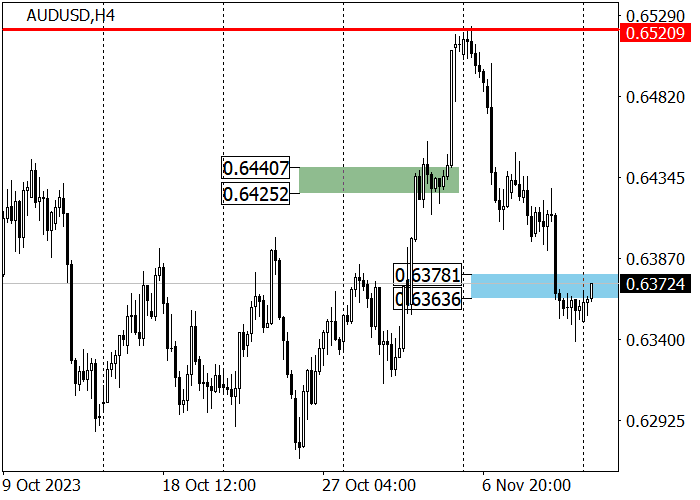

The medium-term trend remains upwards: last week, the trading instrument corrected to the key trend support of 0.6378–0.6363. The zone was held, which allows opening long positions with the first target at last week’s high of 0.6520, after which, the next target will be zone 2 (0.6595–0.6580). If the area 0.6378–0.6363 breaks down, the trend will reverse downwards.

Support and resistance

Resistance levels: 0.6400, 0.6500.

Support levels: 0.6285, 0.6185.

Trading tips

Short positions may be opened from 0.6400 with the target at 0.6285 and stop loss around 0.6430. Implementation time: 9–12 days.

Long positions may be opened above 0.6430 with the target at 0.6500 and stop loss around 0.6400.

Hot

No comment on record. Start new comment.