Current trend

The USD/CHF pair shows slight growth, consolidating near 0.9020. Last Friday, the instrument showed restrained upward dynamics, updating local highs from November 3.

The buying sentiment for the American currency strengthened on the back of the statements by representatives of the US Federal Reserve regarding the prospects for the regulator's monetary policy. Officials supported the idea of a possible tightening of monetary conditions if the rate of decline in inflation lags behind expectations. At the same time, the Fed is aware of the additional risks that a further increase in borrowing costs brings with it, but considers the American economy to be quite stable. Last Thursday, US Federal Reserve Chairman Jerome Powell said he was not confident yet that the regulator had done enough to bring consumer price growth to its 2.0% target on time, although progress was being made in slowing it down. In addition, on Friday, investors were disappointed by the data published in the US on the Consumer Confidence Index from the University of Michigan: in November, the indicator fell sharply from 63.8 points to 60.4 points, while the forecast was 63.7 points.

Today at 21:00 (GMT 2) the October Budget Statement will be presented in the United States: the deficit is expected to slow down from -171.0 billion dollars to -30.0 billion dollars. Tomorrow investors will evaluate data on inflation dynamics: the Consumer Price Index in October may decrease from 0.4% to 0.1%. In addition, on Tuesday, the Chairman of the Governing Board of the Swiss National Bank (SNB) Thomas Jordan will give a speech, and October statistics on the dynamics of the Swiss Producer Price Index, which in September decreased by 0.1% in monthly terms and by 1.0% in annual terms, will also be published.

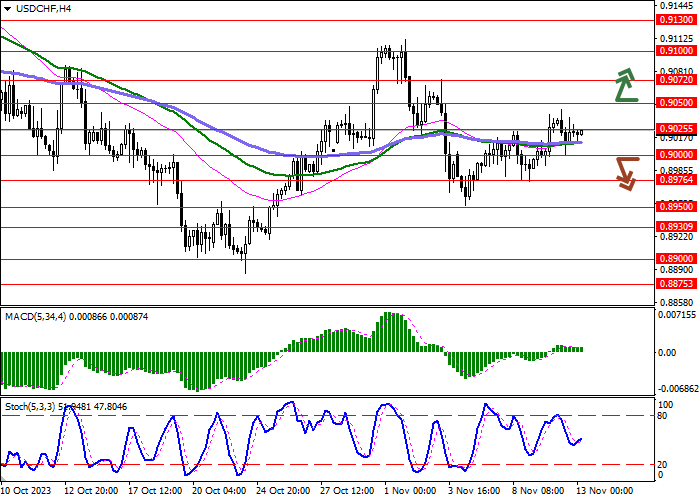

Support and resistance

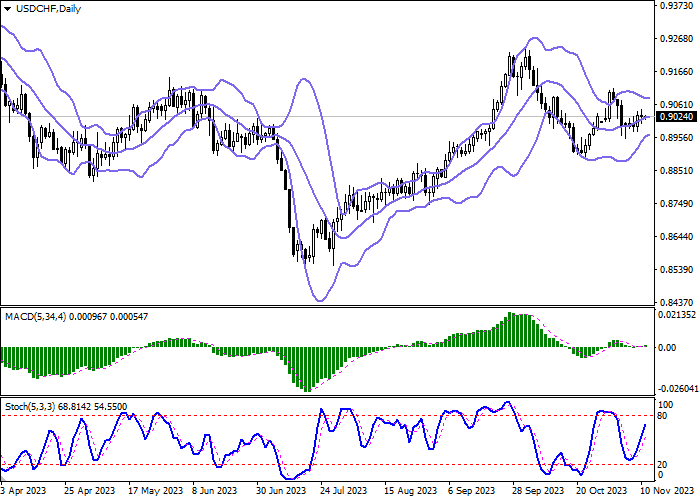

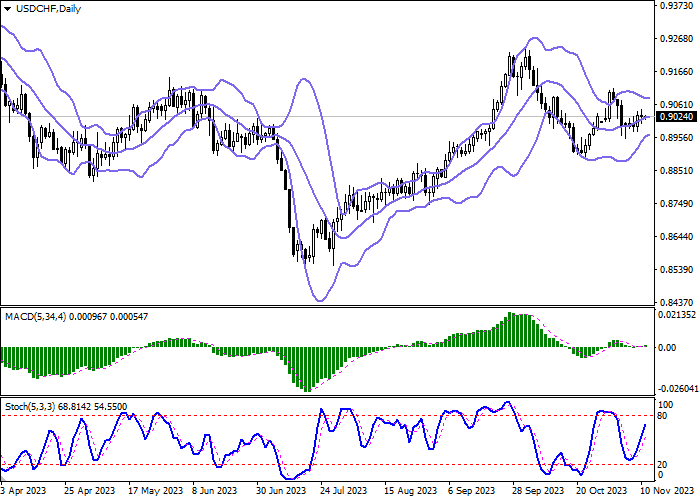

In the D1 chart Bollinger Bands are reversing horizontally. The price range is narrowing, reflecting the emergence of ambiguous dynamics of trading in the short term. The MACD is stretched into a line along the zero level, reflecting low activity and the approximate balance of sentiment in recent days. Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought American dollar in the ultra-short term.

Resistance levels: 0.9025, 0.9050, 0.9072, 0.9100.

Support levels: 0.9000, 0.8976, 0.8950, 0.8930.

Trading tips

Short positions may be opened after a breakdown of 0.9000 with the target at 0.8950. Stop-loss — 0.9025. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 0.9050 may become a signal for new purchases with the target of 0.9100. Stop-loss — 0.9025.

Hot

No comment on record. Start new comment.