Current trend

Against the stabilization of the American dollar, the NZD/USD pair is correcting near the level of 0.5893.

The negative dynamics are developing against a lack of key macroeconomic publications but from the latest reports, it is worth noting the October index of business activity in the manufacturing sector, which decreased from 45.3 points to 42.5 points, the minimum indicator since August 2021. The service PMI adjusted from 50.6 points to 48.9 points compared to 47.0 points in August and September.

The American dollar is held at 105.600 in the USD Index and cannot continue to rise amid negative forecasts for November from the University of Michigan, according to which inflation will rise from 4.2% to 4.4%, as a result of which US Federal Reserve officials may postpone consideration of the issue lowering interest rates. The consumer expectations index fell from 59.3 points to 56.9 points, and the consumer sentiment indicator fell from 63.8 points to 60.4 points, bringing the current conditions indicator to 65.7 points, down from 70.6 points previously.

Support and resistance

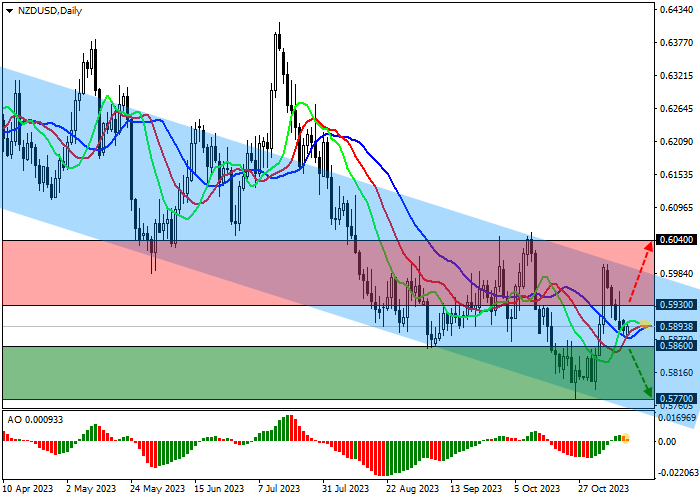

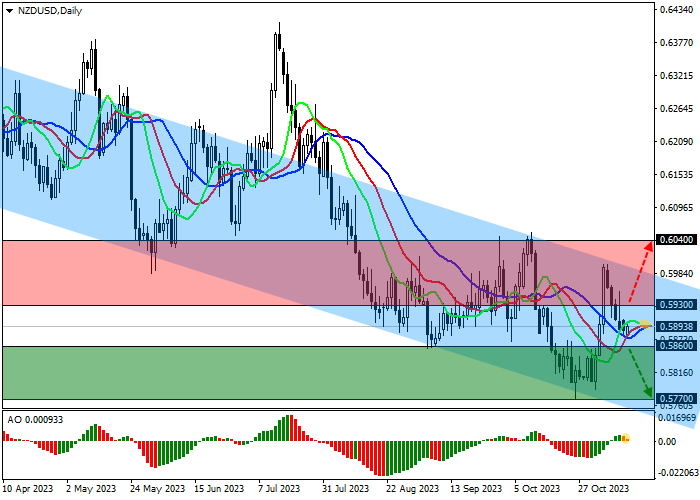

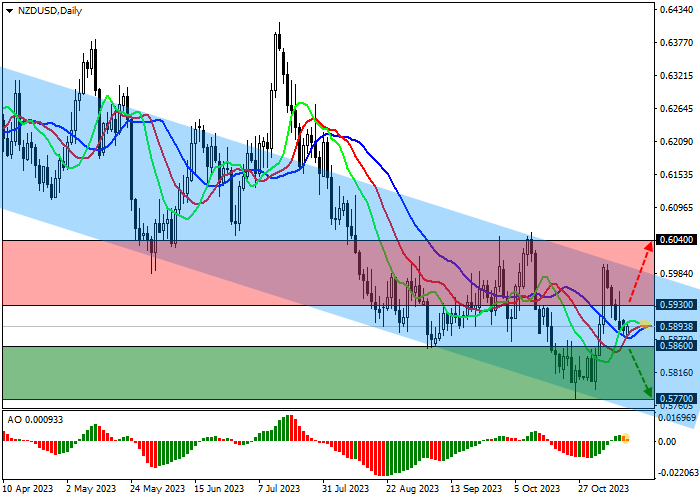

The trading instrument is correcting, remaining within the global downward corridor with dynamic boundaries of 0.5980–0.5750.

Technical indicators are in uncertainty after the correction, preparing to renew the sell signal: fast EMA on the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars close to the transition level.

Resistance levels: 0.5930, 0.6040.

Support levels: 0.5860, 0.5770.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.5860 with the target at 0.5770. Stop loss – 0.5920. Implementation period: 7 days or more.

Long positions may be opened in case of price growth and price consolidation above 0.5930 with the target at 0.6040. Stop loss – 0.5860.

Hot

No comment on record. Start new comment.