Current trend

The quotes of the USD/CHF pair continue their upward trend, preparing to test the level of 0.9130.

Yesterday, US Federal Reserve Chairman Jerome Powell said that monetary authorities are ready to return to the “hawkish” course and tighten monetary parameters if economic conditions require it, and added that policymakers intend to ensure all conditions for inflation to reach the target of 2.0% as soon as possible quicker. In addition, he also noted tensions in the labor market but expressed hope that a further decline in demand due to slowing economic growth will contribute to its further stabilization. In turn, macroeconomic statistics published yesterday did not provide noticeable support for the American currency. Thus, initial jobless claims for the week of November 3 decreased from 220.0K to 217.0K, which was better than forecasts by only 1.0K. At the same time, continuous claims for the week of October 27 increased from 1.812M to 1.834M, while analysts were expecting 1.820M.

The October consumer price index in Switzerland remains at 1.7% YoY, and the unemployment rate is at 2.00%. Market participants will look to a survey from the Center for European Economic Research (ZEW) on Expectations and Real Retail Sales to gauge whether the Swiss National Bank will consider raising interest rates on December 14, with market participants favoring a 25 basis point increase in borrowing costs to end of the year.

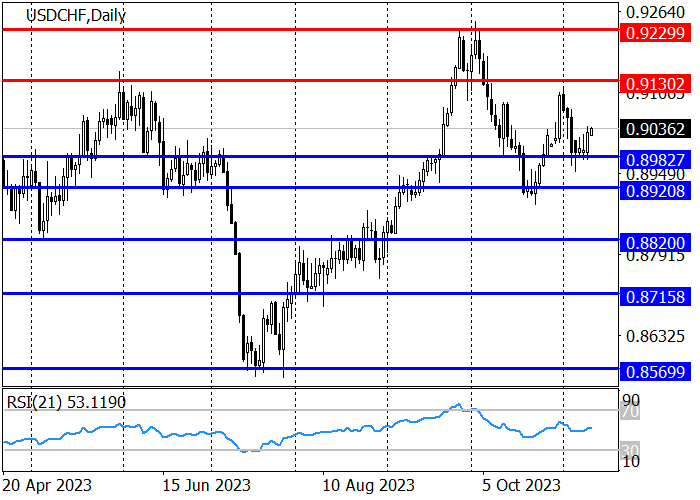

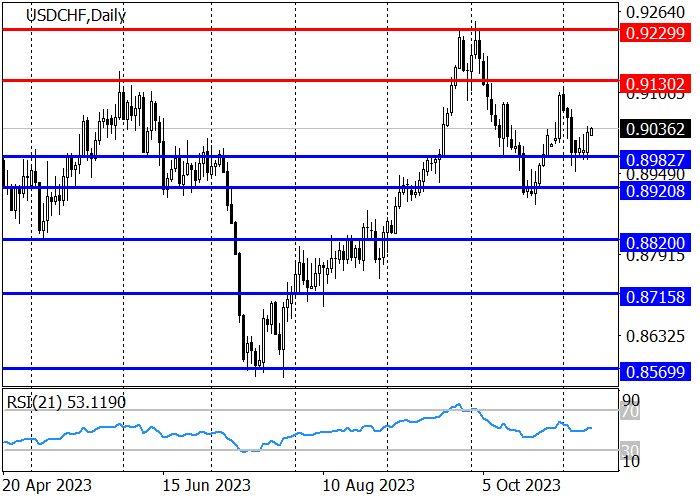

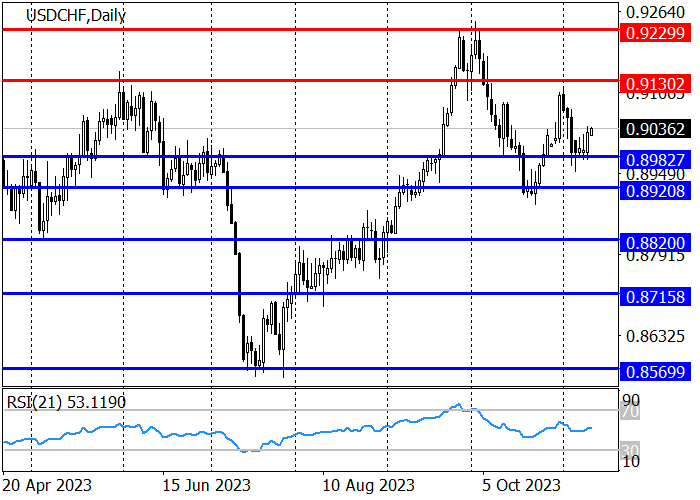

The long-term trend is upward to 0.9130, after the breakout of which the movement will continue to the October high of 0.9230. The nearest support level is at 0.8980, and the next target is 0.8920. The RSI indicator consolidates in the neutral zone, allowing traders to open both long and short positions.

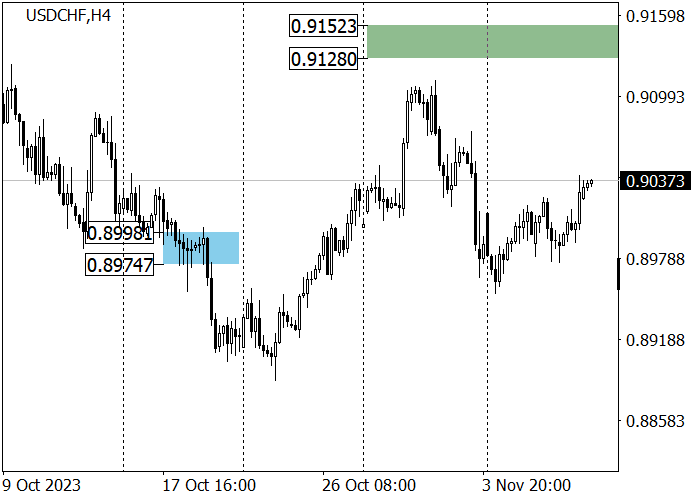

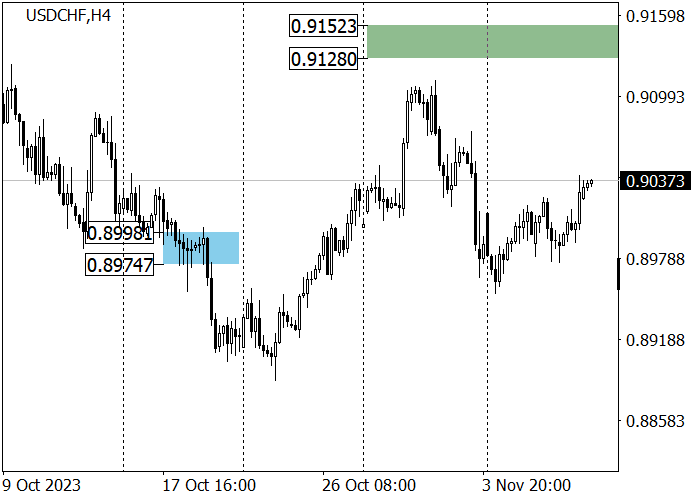

The medium-term trend is downward: last week, the pair approached the trend border 0.9152–0.9128 but was unable to reach it, reversed, and began growing towards the high of last week, after renewing which, the trend border will be tested: if it is held, then it will be possible to consider short positions with the target at the current week’s low of 0.8957, and otherwise, after the breakout of the area 0.9152–0.9128, the medium-term trend will reverse upwards, and long positions with the target in zone 2 (0.9384–0.9360) are relevant.

Support and resistance

Resistance levels: 0.9130, 0.9230.

Support levels: 0.8980, 0.8920, 0.8820.

Trading tips

Long positions may be opened from 0.8980 with the target at 0.9130 and stop loss around 0.8920. Implementation time: 9–12 days.

Short positions may be opened below 0.8920 with the target at 0.8820 and stop loss around 0.8966.

Hot

No comment on record. Start new comment.