Current trend

The USD/CAD pair is declining, trading at 1.3795, despite positive macroeconomic statistics from Canada.

Thus, the total cost of construction permits in the third quarter increased by 4.9% to 34.6B dollars, of which the increase for the residential sector was 3.4% (21.2B dollars), and for the non-residential sector – 7.3 % (13.5B dollars). In total, the construction of 64.4K houses began in the residential sector, of which 13.6K were small private buildings, which is 12.1% more than the same indicator in the second quarter and is the first period of upward dynamics after negative dynamics for almost two years. Of course, the recovery of the real estate market will have a positive impact on the national economy in the long term.

The American dollar is at 105.700 in the USD Index, supported by labor market reports, where the number of initial claims for unemployment benefits decreased from 220.0K to 217.0K but the total number of claims adjusted from 1.812M to 1.834M, and the average number over the past four weeks is from 210.75K to 212.25K.

Support and resistance

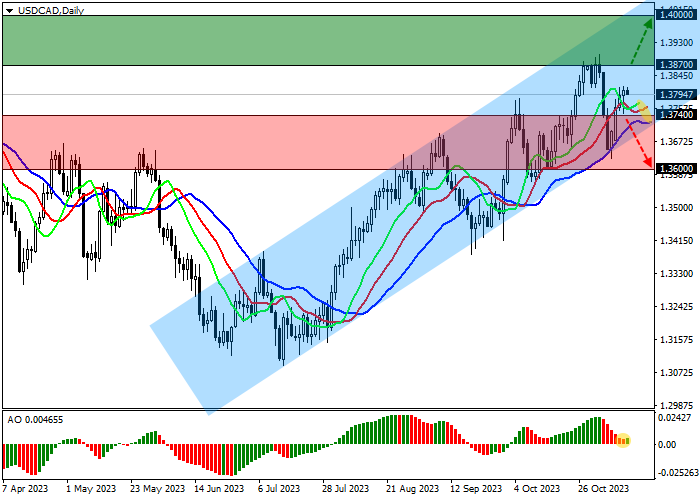

On the daily chart, the price is correcting within a local ascending corridor with dynamic boundaries of 1.3930–1.3740, moving towards the resistance line.

Technical indicators maintain a buy signal: the EMA fluctuation range on the Alligator indicator is expanding, and the AO histogram is forming corrective bars above the transition level.

Resistance levels: 1.3870, 1.4000.

Support levels: 1.3740, 1.3600.

Trading tips

Long positions may be opened after the price rises and consolidates above 1.3870 with the target at 1.4000. Stop loss – 1.3800. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 1.3740 with the target at 1.3600. Stop loss – 1.3800.

Hot

No comment on record. Start new comment.