Current trend

The leading index of the Frankfurt Stock Exchange DAX 40 remains at 15241.0, developing a corrective decline against the backdrop of the publication of financial statements of components and dynamics in the bond market.

The day before, the operator Deutsche Telekom AG recorded revenue of 27.56 billion euros, which was below the forecast of 27.62 billion euros, and earnings per share amounted to 0.460 euros, also losing the 0.466 euros that analysts had expected.

The science and technology company Merck KGaA also reported a decrease in revenue to 5.17 billion euros, while experts expected 5.24 billion euros, and in the previous quarter the figure was 5.30 billion euros. However, earnings per share reached 2.07 euros, exceeding the 1.98 euros forecast.

Chemicals group Henkel & Co KGaA posted revenue of 5.40 billion euros, below the 5.42 billion euros analysts had expected, but earnings per share beat the 1.08 euros forecast at 1.10 euros.

The growth leaders in the index are Siemens Energy AG ( 6.30%), Merck KGaA ( 3.92%), Henkel & Co KGaA ( 3.53%), Sartorius AG ( 3.11%).

Among the leaders of the decline are Hannover Rückversicherung AG (-2.33%), Airbus Group (-1.96%), Munchener Rück (-0.94%).

Support and resistance

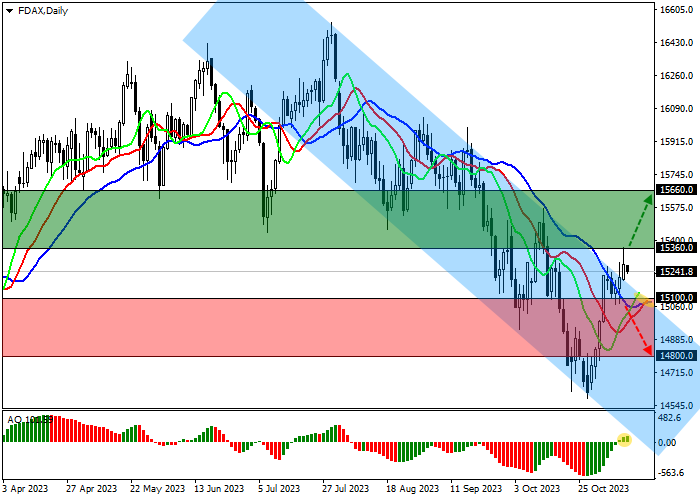

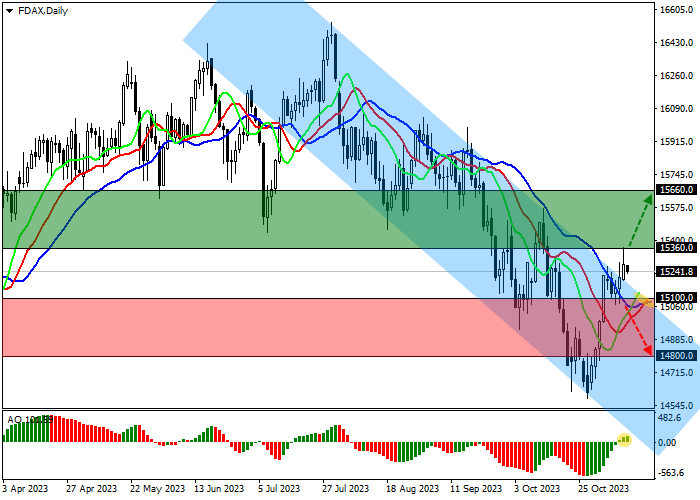

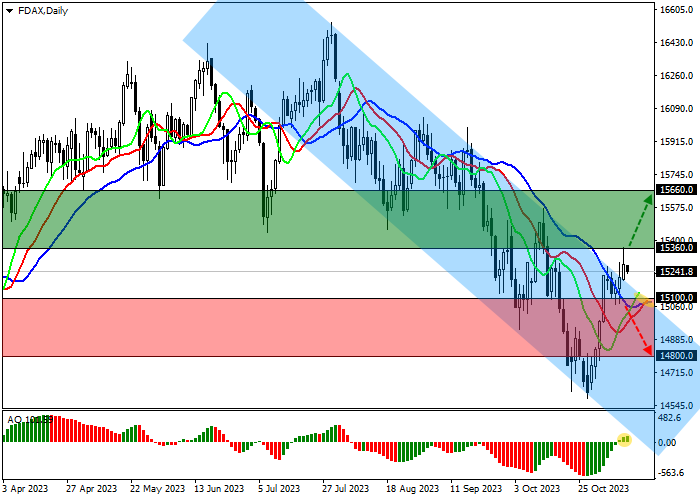

On the daily chart, the price is trading in a corrective trend, trying to leave the downward channel with boundaries of 15200.0–14800.0.

Technical indicators have already reversed and issued a buy signal, supporting local growth: fast EMAs on the Alligator indicator crossed the signal line from below, and the AO histogram, being in the buy zone, continues to form corrective bars.

Support levels: 15100.0, 14800.0.

Resistance levels: 15360.0, 15660.0.

Trading tips

If the asset continues growing locally and the price consolidates above the local resistance level of 15360.0, long positions will be relevant with target at 15660.0. Stop-loss — 15100.0. Implementation time: 7 days and more.

If the asset continues declining and the price consolidates below 15100.0, short positions can be opened with the target at 14800.0. Stop-loss — 15200.0.

Hot

No comment on record. Start new comment.