Current trend

The NZD/USD pair shows a slight decline, testing 0.5890 for a breakdown and updating the local lows of November 3. The instrument is correcting after a sharp rise in the middle of last week. The position of the New Zealand dollar is being pressured by the moderate growth of the American currency throughout the week. Investors focused on the rhetoric of US Federal Reserve Chairman Jerome Powell, who again noted his readiness to increase borrowing costs if the rate of inflation slows down. The official also expressed hope that a further drop in demand due to weakening economic growth will contribute to stabilization in the labor market.

In turn, macroeconomic statistics published the day before did not provide noticeable support to the American currency. Initial Jobless Claims for the week ended November 3 decreased from 220.0 thousand to 217.0 thousand, which turned out only 1.0 thousand better than the projected value. At the same time, Continuing Jobless Claims for the week ended October 27 increased from 1.812 million to 1.834 million, while analysts expected 1.820 million. Pressure on the position of the New Zealand dollar is exerted by data on the New Zealand Manufacturing PMI, which in October dropped from 45.3 points to 42.5 points.

Support and resistance

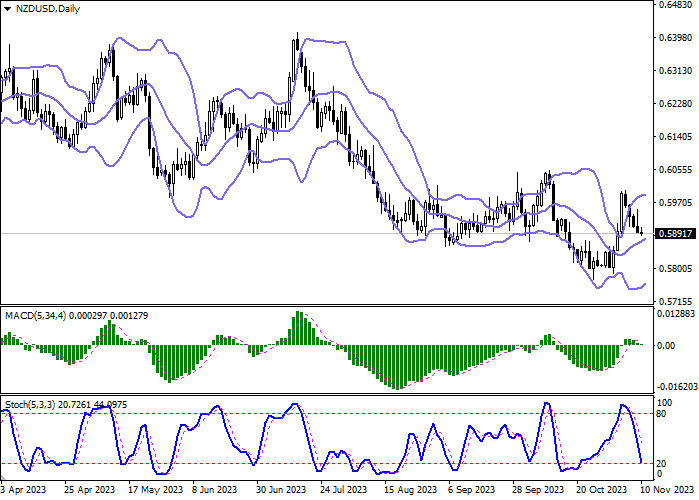

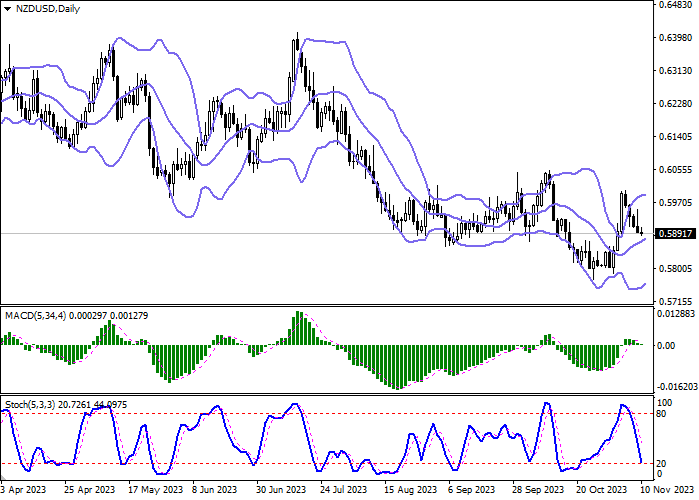

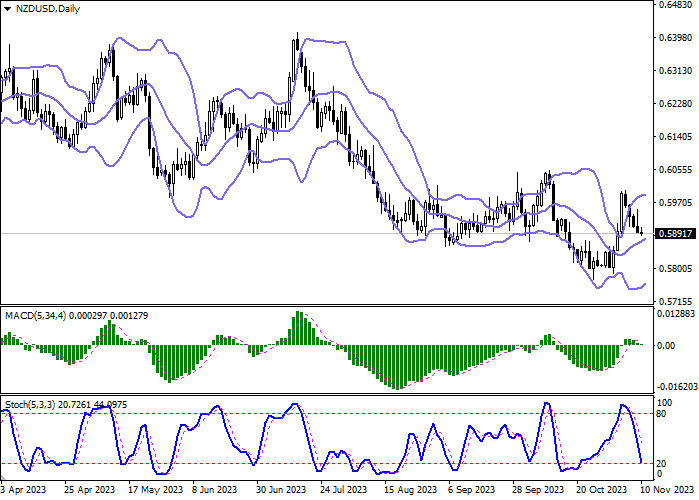

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting a sharp change of trend in the short term. MACD reversed into a descending plane, having formed new sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic shows a more confident decline, but is currently quickly approaching the level of "20", indicating risks of the New Zealand dollar being oversold in the ultra-short term.

Resistance levels: 0.5900, 0.5920, 0.5950, 0.5976.

Support levels: 0.5879, 0.5858, 0.5830, 0.5800.

Trading tips

Short positions may be opened after a breakdown of 0.5879 with the target at 0.5830. Stop-loss — 0.5900. Implementation time: 1-2 days.

A rebound from 0.5879 as from support followed by a breakout of 0.5900 may become a signal for opening new long positions with the target at 0.5950. Stop-loss — 0.5879.

Hot

No comment on record. Start new comment.