Current trend

The AUD/USD pair is developing a confident downward trend, holding in the area of 0.6361. The instrument is preparing to end the week with the strongest decline in the last few years, updating local lows from November 1.

Pressure on quotes increased after the "hawkish" speech of US Federal Reserve Chairman Jerome Powell, who indicated the likelihood of another increase in borrowing costs the day before if the rate of decline in inflation pressure slows down. The official commented on the strong growth of Gross Domestic Product (GDP) in the third quarter, noting that this could negatively affect the unstable dynamics in the overheated labor market. At the same time, the regulator expects a further slowdown in the growth rate of the national economy in the coming quarters, so the situation should stabilize.

In turn, the Australian currency was supported by signals that the price of iron ore, which remains one of Australia's main exports, reached 16-month highs amid expectations of a recovery in demand among major importers, primarily from China. The macroeconomic statistics published the day before reflected a decrease in the Chinese Consumer Price Index in October by 0.1% after an increase of 0.2% in the previous month, while analysts expected zero dynamics to appear, and in annual terms the indicator slowed down by 0.2% with a forecast of –0.1%.

Investors today took notice of the monetary policy report from the Reserve Bank of Australia (RBA), in which officials projected that inflation would remain at 4.5% until the end of December and would not fall below 3.0% in 2025, and consumption households, despite record annual growth in the working-age population, might fall by 2.8%. Last Tuesday, the RBA decided to interrupt a four-month pause in tightening monetary policy and increase the interest rate from 4.10% to 4.35%, and in the follow-up statement, officials pointed out the risks of maintaining the Consumer Price Index at peak values for a long time but they did not confirm the need to further increase the cost of borrowing.

Support and resistance

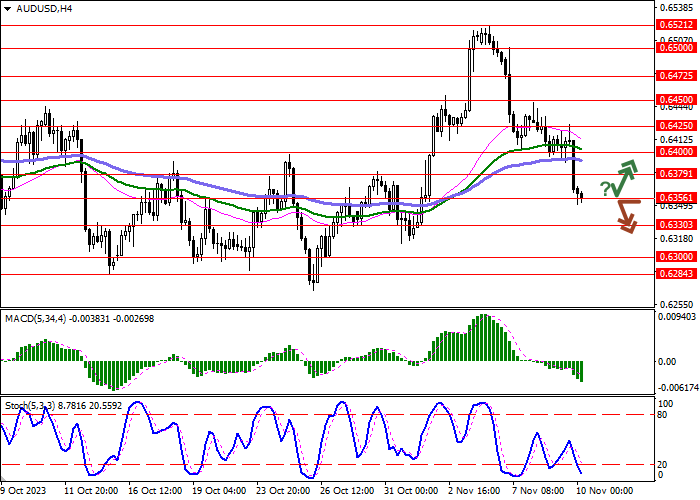

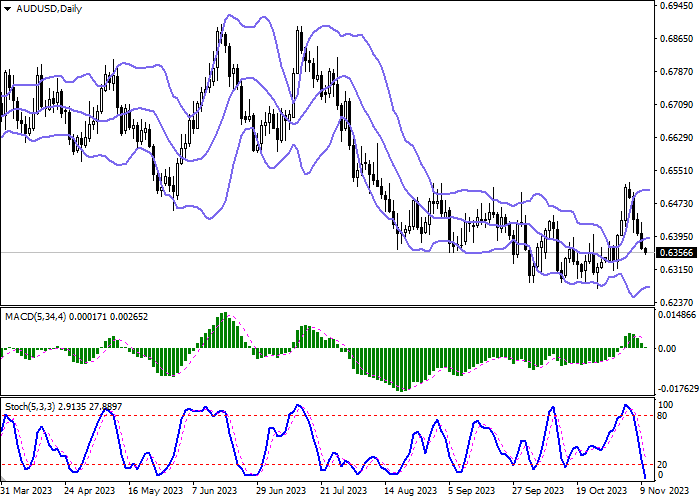

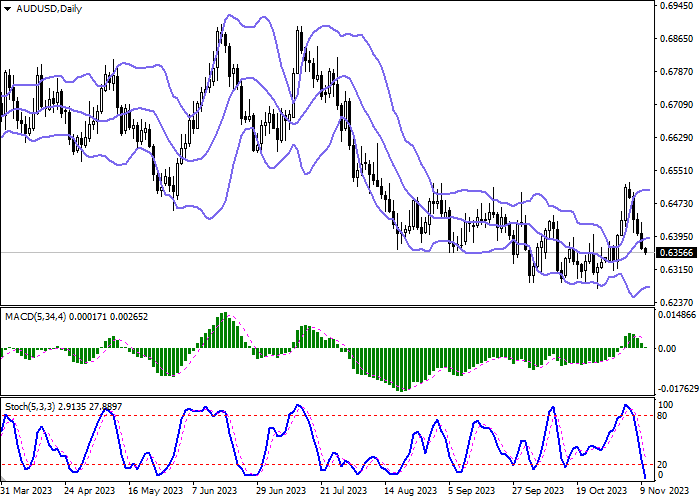

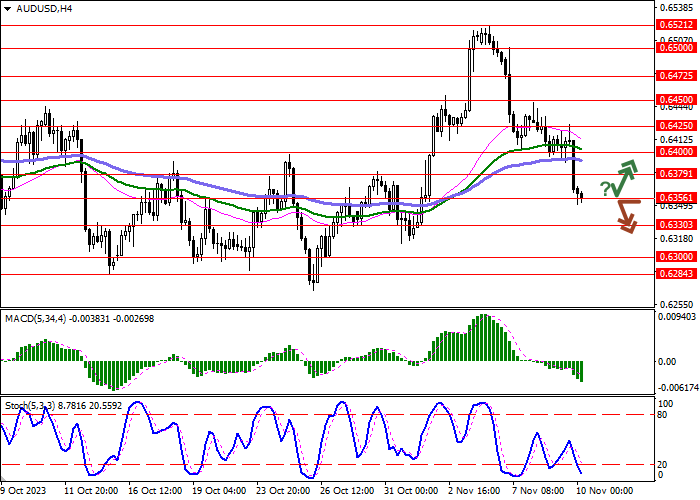

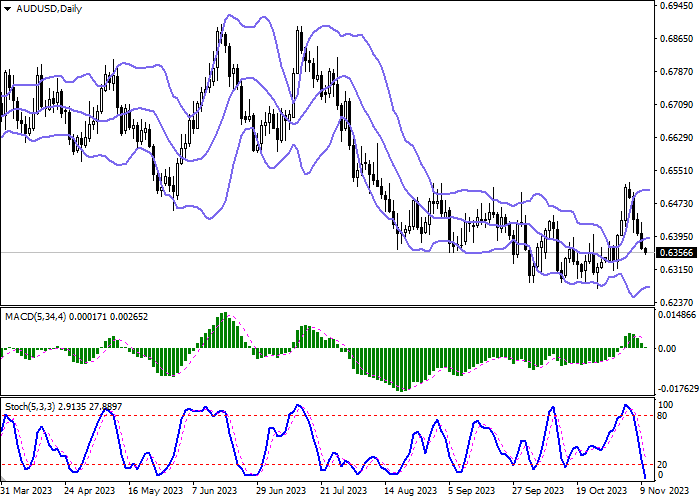

On the daily chart, Bollinger Bands are reversing horizontally. The price range is narrowing from below, reflecting the emergence of ambiguous dynamics of trading in the short term. MACD is going down preserving a stable sell signal (located below the signal line). The indicator is about to test the zero level for a breakdown. Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold Australian dollar in the ultra-short term.

Resistance levels: 0.6379, 0.6400, 0.6425, 0.6450.

Support levels: 0.6356, 0.6330, 0.6300, 0.6284.

Trading tips

Short positions may be opened after a breakdown of 0.6356 with the target at 0.6300. Stop-loss — 0.6379. Implementation time: 1-2 days.

A rebound from 0.6356 as from support followed by a breakout of 0.6379 may become a signal for opening new long positions with the target at 0.6425. Stop-loss — 0.6356.

Hot

No comment on record. Start new comment.