Current trend

Shares of ExxonMobil Corp., an American oil company, have been actively declining for the second month, testing 103.12 (Murrey level [1/8]), amid poor financial reporting and fears of declining oil demand.

Thus, in the third quarter, profit amounted to 9.07B dollars, 54.0% less than in the same period last year, while earnings per share of 2.27 dollars did not meet experts’ expectations, and revenue decreased by 19.0% to 90.76B dollars. The world’s leading economies are showing signs of slowing down, as a result of which consumption of petroleum products may decline: thus, EU PMI is seriously slowing down, and gross domestic product (GDP) is on the verge of recession. The economy of China, the world’s leading energy consumer, remains unstable: business activity is growing slightly, export volumes are falling, the consumer price index decreases, indicating poor external and domestic demand for Chinese products. Meanwhile, experts from the Energy Information Administration of the US Department of Energy (EIA) predict an annual reduction in oil consumption by 300.0K barrels per day. All these factors increase the risks of a decline in oil prices and a further reduction in corporate income.

The corporation’s management hopes for an improvement in the situation in the long term, as evidenced by the recent acquisition of mining company Pioneer Natural Resources Co. for almost 60.0B dollars, which should strengthen ExxonMobil Corp.’s position in US shale fields, including the resource-rich Permian Basin.

Support and resistance

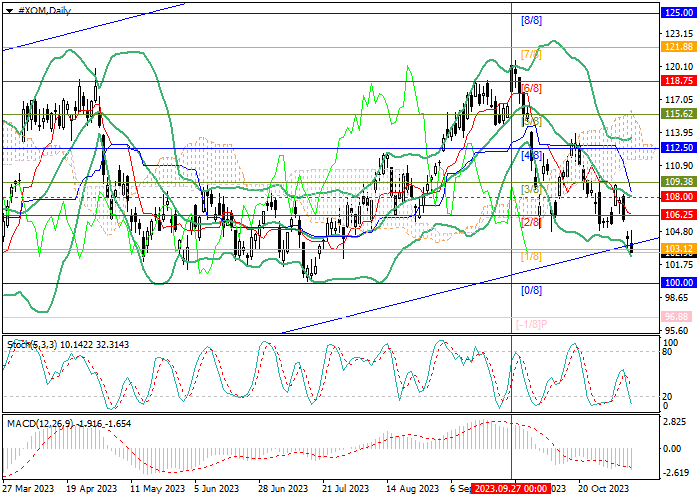

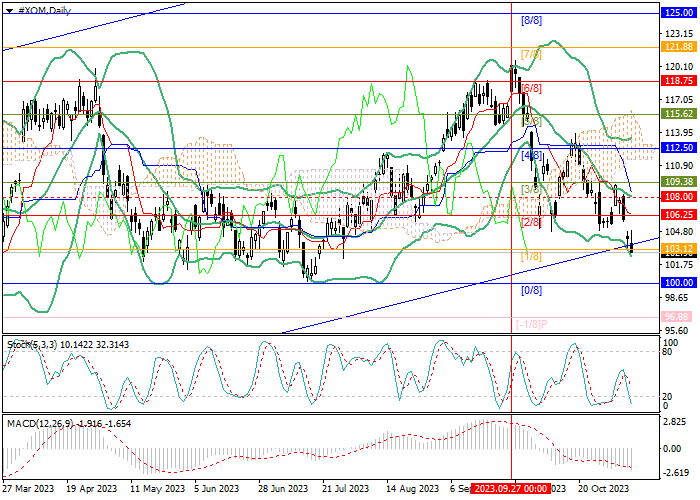

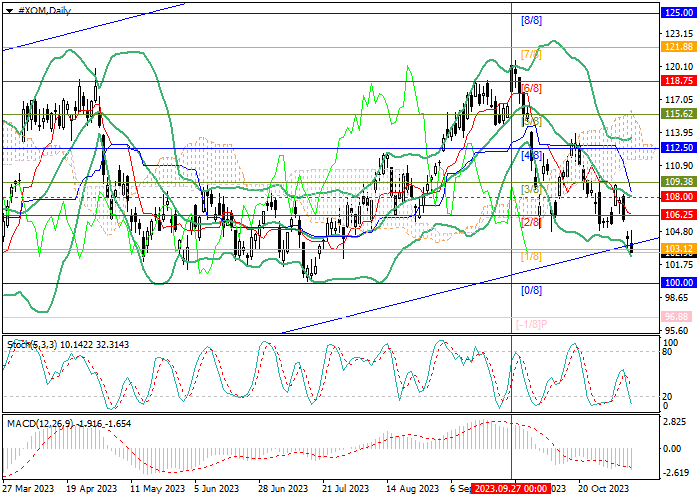

The trading instrument is trying to leave the long-term ascending channel downwards: consolidation the price below its lower border of 103.12 (Murrey level [1/8]) allows it reaching 100.00 (Murrey level [0/8]) and 96.88 (Murrey level [–1/8]). The key “bullish” level is the middle line of Bollinger Bands 108.00, after which breakout, upward dynamics may develop to the area of 112.50 (Murrey level [4/8]) and 115.62 (Murrey level [5/8]).

Technical indicators are signaling that the downward trend in the market will continue: Bollinger Bands and Stochastic are directed downwards, and the MACD histogram is increasing in the negative zone.

Resistance levels: 108.00, 112.50, 115.62.

Support levels: 103.12, 100.00, 96.88.

Trading tips

Short positions may be opened below 103.12 with the targets at 100.00 96.88 and stop loss around 105.00. Implementation time: 5–7 days.

Long positions may be opened from 108.00 with the targets at 112.50 115.62 and stop loss around 105.10.

Hot

No comment on record. Start new comment.