Current trend

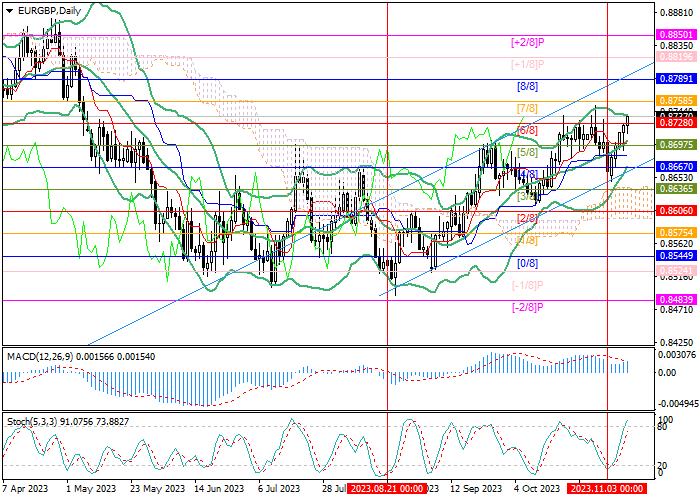

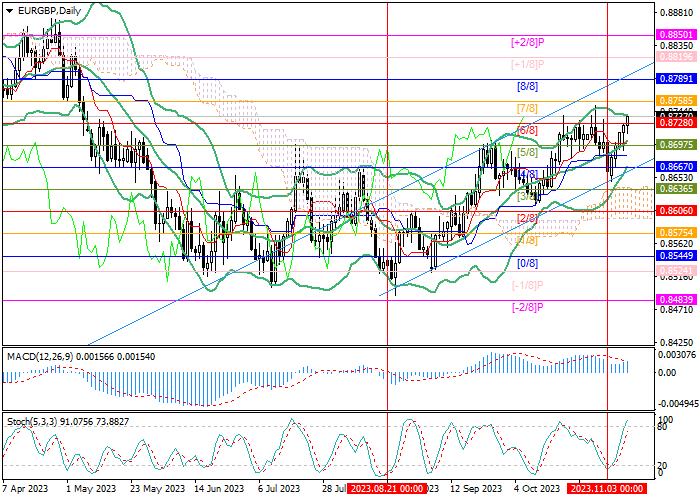

The EUR/GBP pair is trading within the medium-term ascending channel: this week the price reversed around at its lower border, resumed growth and is currently testing the 0.8728 mark (Murrey level [6/8]).

The British currency came under pressure after the publication of preliminary data on the UK gross domestic product (GDP) for Q3 2023 and comments by the chief economist of the Bank of England Huw Pill, who hinted at the possibility of starting a cycle of rate cuts in August 2024. The head of the regulator, Andrew Bailey, in response to this, said that he was not considering the scenario of switching to "dovish" rhetoric in the near future and added that inflation would reach the target level of 2.0% within two years, and until then rates would remain high. The official's comments did not help the British currency to regain its position, which weakened even more noticeably today after the publication of GDP data: QoQ, the UK economy showed zero dynamics, and YoY, it reached 0.6%, as in the previous quarter. Commenting on these data, Chancellor of the Exchequer Jeremy Hunt noted that the biggest obstacle to economic growth remains high inflation, which now stands at 6.7%.

Unlike their British counterparts, officials of the European Central Bank (ECB) have not yet discussed the timing of the start of rate cuts and do not even rule out the possibility of raising them, which further strengthens the euro and makes it more attractive for investment.

Support and resistance

The instrument is trying to consolidate above the 0.8728 mark (Murrey level [6/8]), after which further growth to 0.8789 (Murrey level [8/8]) and 0.8819 (Murrey level [8/8]) will be possible. The key for the "bears" is the level of 0.8697 (Murrey level [5/8]), supported by the central line of Bollinger Bands. Its breakdown will allow the quotes to develop a decline to 0.8667 (Murrey level [4/8]) and 0.8636 (Murrey level [3/8]), but this scenario seems less likely.

Technical indicators show the continuation of the uptrend: Bollinger Bands and Stochastic are directed upwards, MACD histogram is growing in the positive zone.

Resistance levels: 0.8789, 0.8819.

Support levels: 0.8697, 0.8667, 0.8636.

Trading tips

Long positions can be opened from the 0.8745 mark with targets at 0.8789, 0.8819 and stop-loss around 0.8710. Implementation period: 5-7 days.

Short positions may be opened below the level of 0.8697 with targets at 0.8667, 0.8636 and stop-loss at 0.8720.

Hot

No comment on record. Start new comment.