Current trend

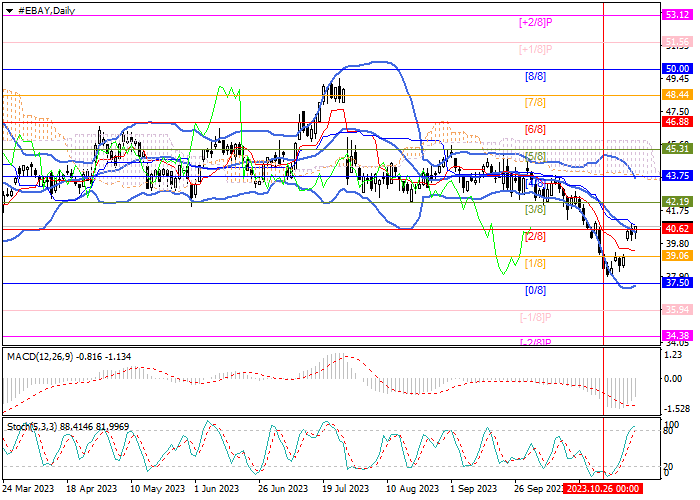

Shares of eBay Inc., an American online retail company, have been attempting an upward correction to a medium-term downward trend for the second week in a row.

Currently, the price has reached the reversal level of 40.62 (Murrey level [2/8]), supported by the central line of Bollinger Bands, but cannot consolidate above it yet. If successful, the growth of the instrument will continue to 42.19 (Murrey level [3/8]) and 43.75 (Murrey level [4/8]). The key for the bears is the level of 39.06 (Murrey level [1/8]), consolidating below which will allow the quotes to resume the decline to the lower border of the main Murrey trading range at 37.50 (Murrey level [0/8]) and further into the reversal zone to 35.94 (Murrey level [-1/8]) and 34.38 (Murrey level [-2/8]).

Technical indicators do not give a clear signal: Bollinger Bands are pointing downwards, MACD is decreasing in the negative zone, while Stochastic has entered the overbought zone, not excluding a rapid downward reversal.

Support and resistance

Resistance levels: 40.62, 42.19, 43.75.

Support levels: 39.06, 37.50, 35.94, 34.38.

Trading tips

Short positions should be opened below the level of 39.06 with targets at 37.50, 35.94, 34.38 and stop-loss at 40.10. Implementation period: 5-7 days.

Long positions can be opened from the 41.15 mark with targets at 42.19, 43.75 and stop-loss around 40.25.

Hot

No comment on record. Start new comment.