Today, we present you a mid-term investment overview of Altria Group Inc. shares.

The corporation's position in the global tobacco market has recently been under pressure due to falling demand for traditional cigarettes and the popularity of alternatives such as vapes. The negative dynamics has been developing since 2020 and was associated with the coronavirus pandemic, but the subsequent increase in product prices allowed Altria Group to maintain high dividends, and the recent purchase of NJOY Holdings for 2.75 billion dollars to take a share of the e-cigarette market.

The financial report for Q3 2023 showed that sales volumes decreased by -11.6% QoQ and by -10.5% YoY. Revenue fell to 5.28 billion dollars compared to 5.44 billion dollars a quarter earlier, and earnings per share (EPS) – 1.28 dollar (also down from 1.31 dollar in the previous quarter). In the forecast for the end of the year, management expects earnings in the range of 4.91–4.98 dollar per share, above the consensus forecast of analysts of 4.70 dollar. Dividends remain among the highest on the American market: the last payment (0.98 dollar per share) took place on October 10, bringing 8.76% of quarterly income. The date of the new payment has not yet been determined, but it will happen towards the end of the year.

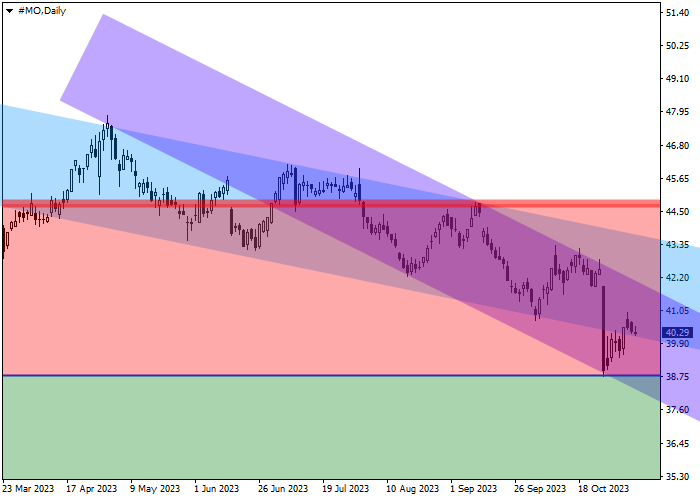

In addition to the underlying fundamental factors, technical indicators also signal the strengthening of the downward dynamics in the asset: the price is held within the descending corridor with the borders of 49.00–21.00, and after bouncing from the resistance line at 56.00, a new downward wave is formed.

Within this wave, the previous minimum of 42.00 has already been overcome, and the nearest support is the minimum of March 22, 2020 in the area of 30.80.

The key levels are shown on the D1 chart.

As can be seen on the chart, the price is falling within the local corridor with the borders of 42.20–39.00 and is already close to the yearly minimum of 38.80, consolidating below which will strengthen the downward movement.

At the 44.80 mark (the maximum from September 15, 2023), there is a zone of cancellation of the sell signal. In the event of price growth and reaching this level, the downward scenario will either be canceled or significantly delayed in time, and open positions should be liquidated.

Near the level of 30.80 (the minimum of March 22, 2020), there is a target zone; in case of reaching it, one should fix profits on open positions.

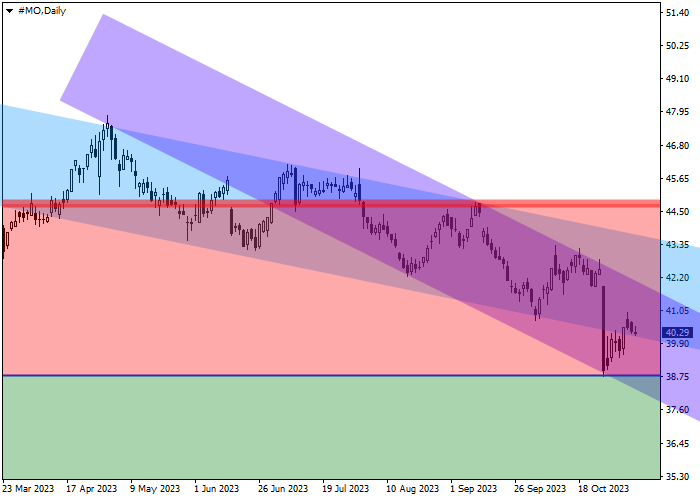

In more detail, trade entry levels can be evaluated on the H4 chart.

The entry level for a sell position is at the current year's minimum at around 38.80, and a local signal can be received in the coming days. Technically, a local "flag" pattern will be implemented, and after it – a breakdown of the minimum of the year, after which there will be no obstacles on the way of the price to the target level of 30.80, and the position can be implemented.

Considering the average daily volatility of a trading instrument for the last month, which is 56.0 points, the price movement to the target zone of 30.80 may take about 47 trading sessions.

Hot

No comment on record. Start new comment.