Current trend

Against the stabilization of the American dollar, the AUD/USD pair is trading at 0.6438 after an unexpected tightening of monetary policy by the Reserve Bank of Australia (RBA).

The regulator increased the target interest rate by 25 basis points from 4.10% to 4.35%, and the rate on foreign currency balances to 4.25%. Officials explained their decision by more stable inflation than previously expected, which, according to the renewed forecast, will be about 3.5% by the end of 2024, which is unacceptable in the context of unprecedented price pressure on households. Commodity costs are rising, making shipping more expensive, causing prices for food and essential goods to rise, which the RBA has not ruled out another rise in borrowing costs at its next meeting to prevent.

The American dollar fell to 105.600 in the USD Index amid the lack of key macroeconomic reports. Today, a series of speeches by US Federal Reserve officials will continue, and markets are awaiting statements from the head of the regulator, Jerome Powell. At the beginning of the month, he did not rule out a return to higher interest rates, and recent reports on non-farm payrolls, which showed significant job losses, may influence the rhetoric of financial authorities.

Support and resistance

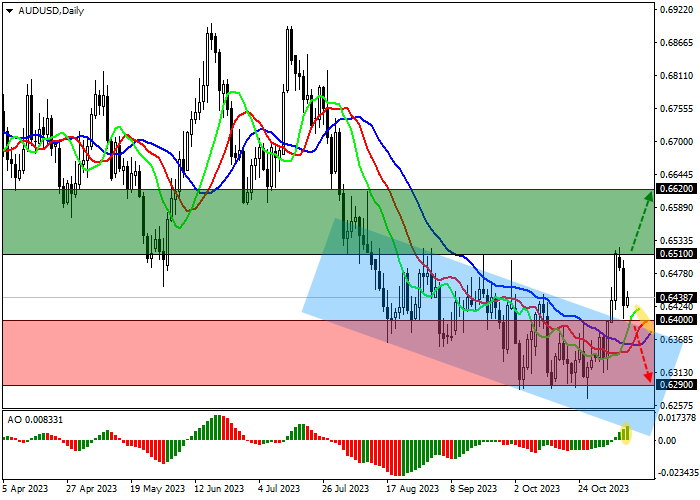

On the daily chart, the price is above the resistance line of the local downward corridor with dynamic boundaries of 0.6400–0.6220.

Technical indicators maintain a buy signal: fast EMAs on the Alligator indicator are above the signal line, maintaining a fluctuating range, and the AO histogram forms ascending bars in the buy zone.

Resistance levels: 0.6510, 0.6620.

Support levels: 0.6400, 0.6290.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.6510 with the target at 0.6620. Stop loss – 0.6450. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.6400 with the target at 0.6290. Stop loss – 0.6460.

Hot

No comment on record. Start new comment.