Current trend

The XAU/USD pair remains virtually unchanged, remaining near the level of 1965.00 and local lows of October 24. Last week, gold failed to consolidate above the psychological level of 2000.00, after which a massive fixation of long positions followed on the market.

Today, trading participants are expecting speeches from the Governor of the Bank of England, Andrew Bailey, and the Chair of the US Federal Reserve, Jerome Powell. Officials may clarify the prospects for raising interest rates, which, according to some analysts, have already reached their highs. Following the November meetings, both regulators left the monetary policy parameters unchanged, although they allowed for the possibility of tightening them in the event of renewed inflationary pressure. The President of the European Central Bank (ECB), Christine Lagarde, is also expected to speak tomorrow.

In turn, macroeconomic statistics on the dynamics of jobless claims will be published in the United States on Thursday. It is expected that Initial Jobless Claims for the week ended November 3 will be adjusted from 217.0 thousand to 218.0 thousand, and Continuing Jobless Claims for the week ended October 27 may remain unchanged at 1.818 million.

According to the latest report from the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in gold increased from 149.4 thousand to 163.4 thousand. Demand is generated by sellers, who most likely open new transactions, while at the same time fixing profits on purchases: the balance of swap dealers is 78.167 thousand for the "bulls" versus 224.670 thousand for the "bears". Last week, buyers reduced the number of contracts by 3.799 thousand, and sellers increased it by 13.175 thousand.

Support and resistance

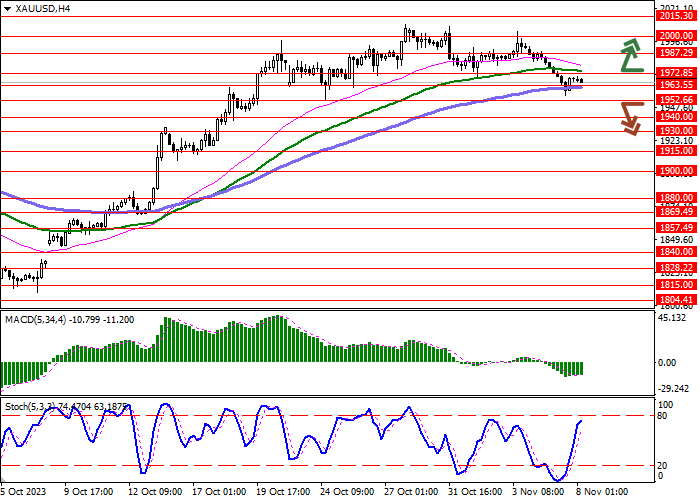

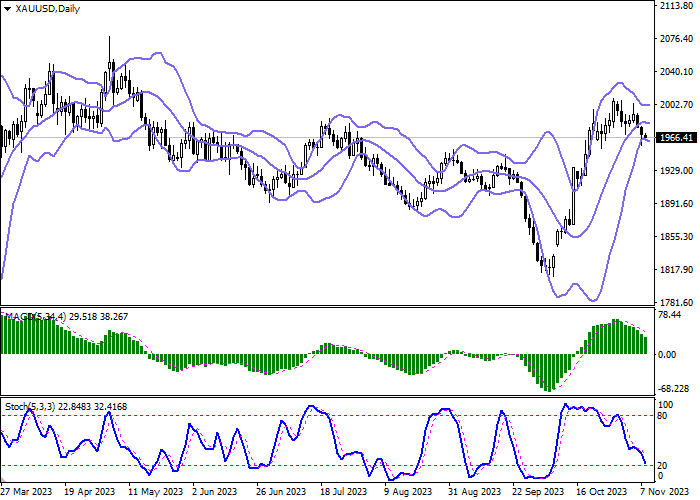

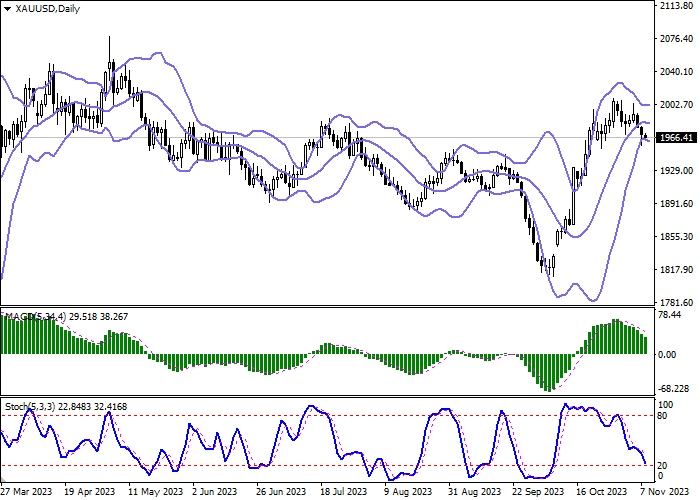

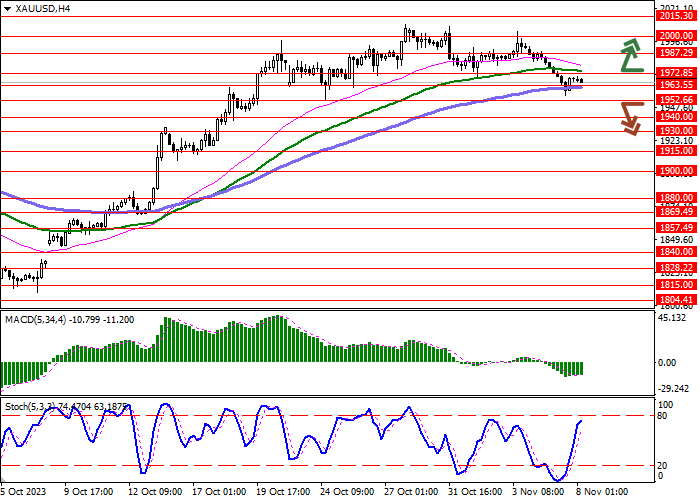

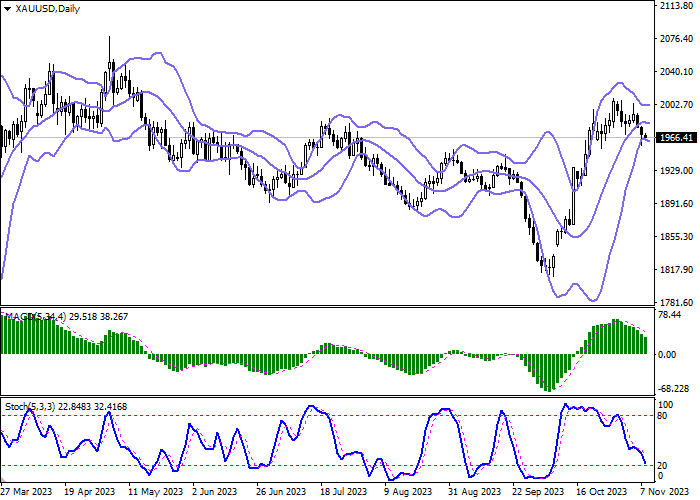

On the D1 chart Bollinger Bands are trying to reverse horizontally. The price range expands from below, making way for new local lows for the "bears". MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its lows, indicating the risks of oversold gold in the ultra-short term.

Resistance levels: 1972.85, 1987.29, 2000.00, 2015.30.

Support levels: 1963.55, 1952.66, 1940.00, 1930.00.

Trading tips

Short positions may be opened after a breakdown of 1952.66 with the target at 1930.00. Stop-loss — 1963.55. Implementation time: 2-3 days.

The development of the corrective trend with the breakout of 1972.85 may become a signal for opening new long positions with the target of 2000.00. Stop-loss — 1960.00.

Hot

No comment on record. Start new comment.