Current trend

The GBP/USD pair is showing a moderate decline, developing a "bearish" impetus formed at the beginning of the week, when the instrument retreated from the local highs of September 15. At the moment, quotes are testing 1.2280 for a breakdown, while activity in morning trading today remains subdued due to the upcoming speeches of the Chairman of the US Federal Reserve Jerome Powell and the Governor of the Bank of England Andrew Bailey.

Both regulators decided to keep the monetary policy parameters unchanged at their last meetings. At the same time, officials note that they are ready for an additional increase in borrowing costs if the economic situation requires it. Analysts, however, are convinced that interest rates will remain at current levels until the middle of next year, and the British regulator may begin lowering the value a little later than the American one.

The day before, investors paid attention to the October data on the UK's Halifax House Prices, which on a monthly basis amounted to 1.1% against a forecast of 0.2%, and on an annual basis decreased by 3.2%. According to the company's experts, the six-month downward cycle has been completed, but the current correction was caused, rather, by a shortage of properties for sale, rather than by a market recovery. On Friday, statistics on the dynamics of Gross Domestic Product (GDP) and Industrial Production volumes for September will be published in the UK. Analysts expect the domestic economy to contract 0.1% in September after growing 0.2% in the previous month, and the figure could contract 0.1% in the third quarter after rising 0.2% in the previous period. In annual terms, GDP dynamics are expected to slow down from 0.6% to 0.5%. In turn, Industrial Production could add 0.1% after a sharp decline of 0.7% in August.

Support and resistance

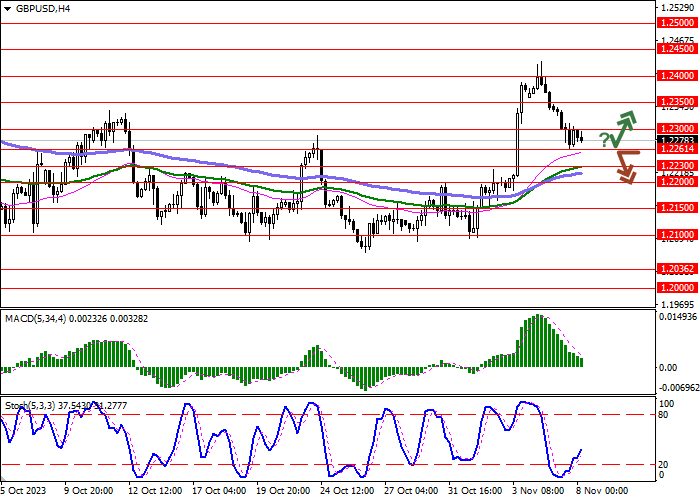

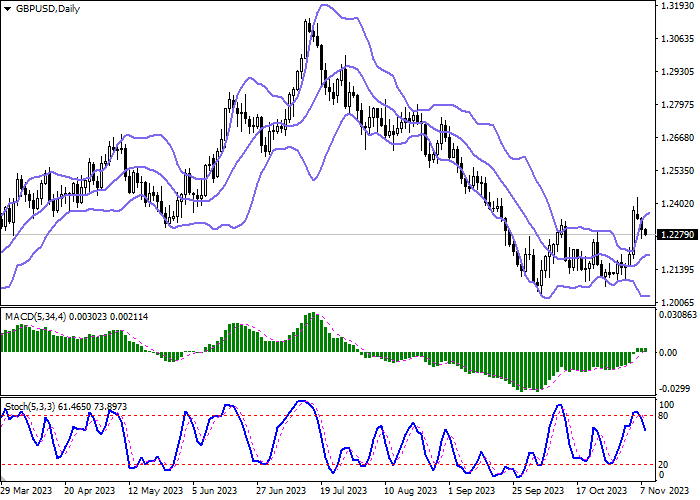

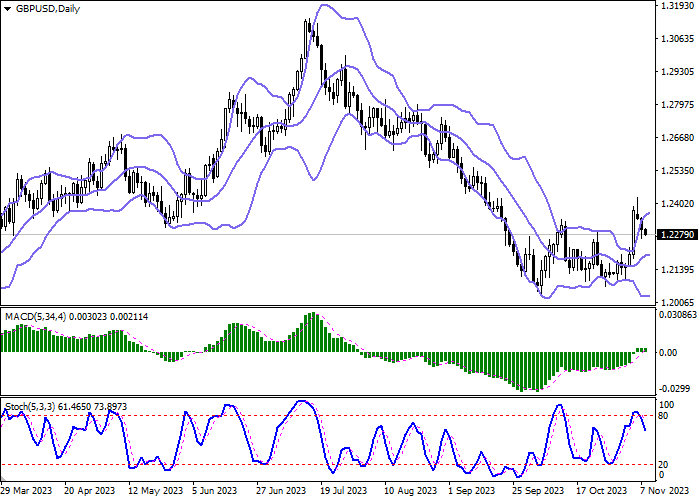

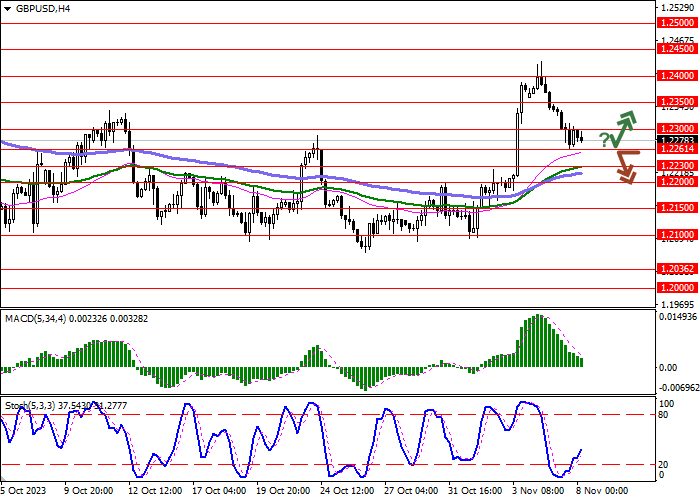

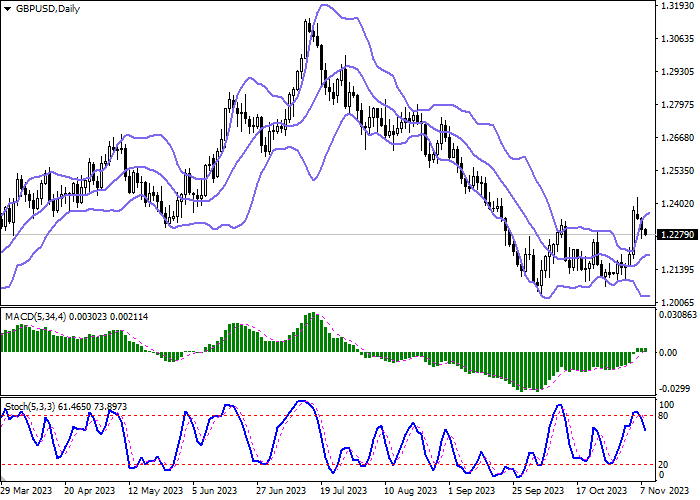

On the daily chart, Bollinger Bands are reversing horizontally. The price range is expanding from above, being spacious enough for the current activity level in the market. MACD indicator is trying to reverse into the descending plane, keeping the previous buy signal (located above the signal line). Stochastic reversed downwards, retreating from its highs indicating that the British currency is overbought in the ultra-short term.

Resistance levels: 1.2300, 1.2350, 1.2400, 1.2450.

Support levels: 1.2261, 1.2230, 1.2200, 1.2150.

Trading tips

Short positions may be opened after a breakdown of 1.2261 with the target at 1.2200. Stop-loss — 1.2300. Implementation time: 1-2 days.

A rebound from 1.2261 as from support followed by a breakout of 1.2300 may become a signal for opening new long positions with the target at 1.2400. Stop-loss — 1.2250.

Hot

No comment on record. Start new comment.