Current trend

Today, the AUD/USD pair is actively correcting after a two-week growth against the background of the decision of the Reserve Bank of Australia (RBA) to raise the key rate from 4.10% to 4.35%.

In an accompanying statement, officials pointed to the risks of keeping inflation at peak levels for a long time, but did not confirm the need for further increases in the cost of borrowing. This decision caused the weakening of the AUD position as investors fear increased pressure on the economy: currently, its growth is at a two-year low (2.1%), and next year it may be only about 1.0%. The downward dynamics of the national currency accelerated after the publication of Chinese foreign trade data for October: the volume of imports increased by 3.0%, but the volume of exports immediately adjusted by -6.4%, surpassing the -3.3% predicted by analysts and confirming the weakness of the Chinese economy, which, in turn, may negatively affect the volume of Australian exports to this country.

Thus, the US dollar turned out to be more attractive for investment, primarily amid lower risks of a recession in the national economy.

Support and resistance

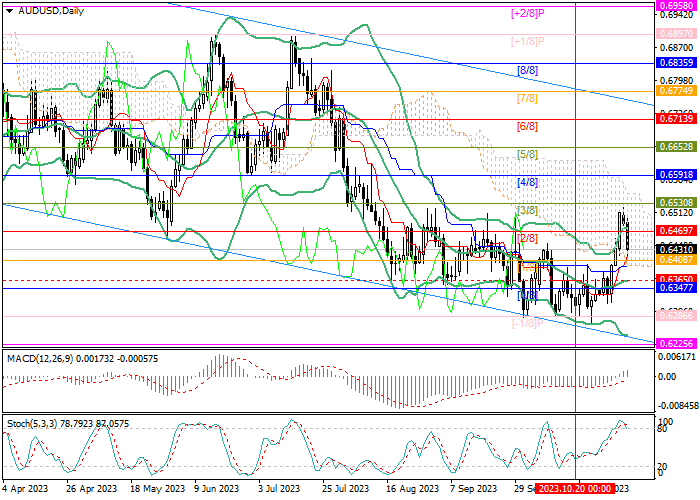

The instrument is trading within the long-term descending channel and is now close to 0.6408 (Murrey level [1/8]), however, the development of a serious correction will be possible after consolidation below the central line of Bollinger Bands near 0.6365. In this case, the decline will continue to the levels of 0.6286 (Murrey level [-1/8]) and 0.6225 (Murrey level [-2/8]). If the price is consolidated above 0.6469 (Murrey level [2/8]), the growth may resume to 0.6591 (Murrey level [4/8]) and 0.6652 (Murrey level [5/8]).

Technical indicators do not give a clear signal: Bollinger Bands are reversing up, MACD is stable in the positive zone, but Stochastic is preparing to leave the overbought zone and form a sell signal.

Resistance levels: 0.6469, 0.6591, 0.6652.

Support levels: 0.6365, 0.6286, 0.6225.

Trading tips

Short positions should be opened below the level of 0.6365 with targets at 0.6286, 0.6225 and stop-loss near 0.6410. Implementation period: 5-7 days.

Long positions can be opened above 0.6469 with targets at 0.6591, 0.6652 and stop-loss at 0.6425.

Hot

No comment on record. Start new comment.