Current trend

Shares of RTX Corp., an American aerospace and defense conglomerate, have been adding value since the beginning of last month and are now trading around 83.60, supported by strong financial statements of the company and fundamental factors.

The emitter's revenue was fixed at 18.95 billion dollars (11.8% more than in the same period last year), and earnings per share amounted to 1.25 dollar, exceeding the previous figure of 1.21 dollar. Management has adjusted the sales forecast for the current year: they should amount to 74.0 billion dollars compared to early estimates of 73.0–$74.0 billion dollars. In addition, RTX Corp. announced a repurchase of shares in the amount of 10.0 billion dollars. The financial position of the company looks generally stable, despite the serious costs of checking the safety of Pratt & Whitney engines, which will be carried out from 2023 to 2026.

Speaking of the fundamental factors supporting the price, it is worth highlighting the escalation of the military conflict between Israel and the Palestinian Hamas movement, which could potentially increase the volume of orders of the defense units of RTX Corp. and significantly increase the company's profit.

Support and resistance

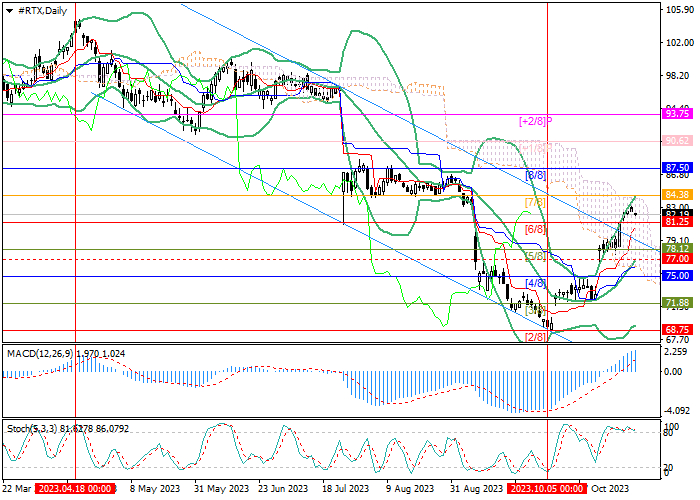

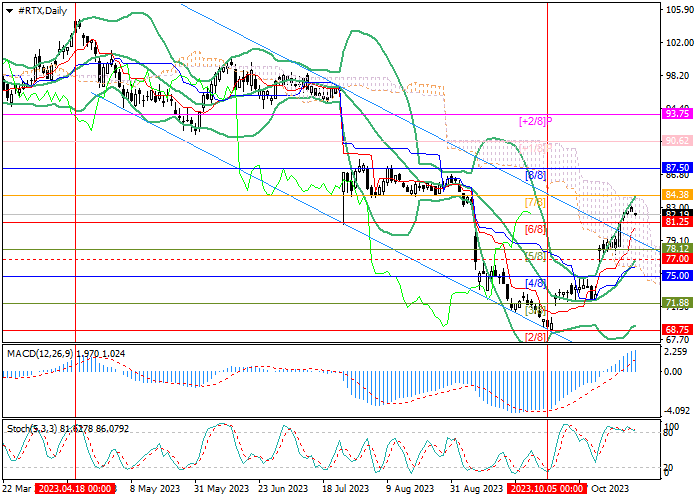

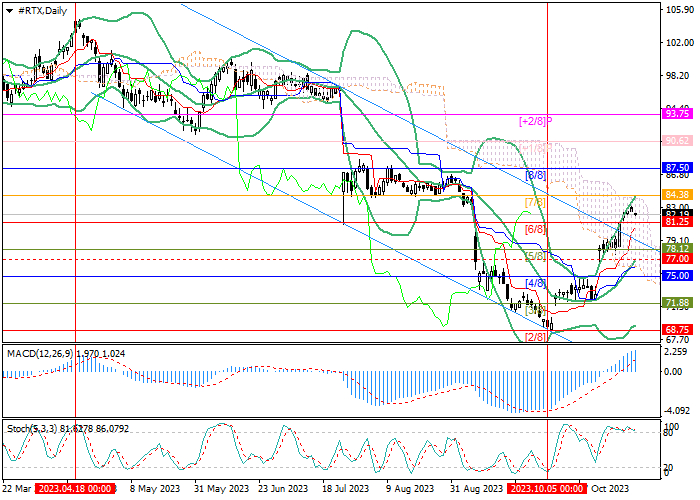

The instrument left the long-term descending channel and consolidated above 81.25 (Murrey level [6/8]). Further growth of quotes is possible to the levels of 84.38 (Murrey level [7/8]) and 87.50 (Murrey level [8/8]). The key for the "bears" is the central line of Bollinger Bands near 77.00, the breakdown of which can cause the development of a decline to 71.88 (Murrey level [3/8]) and 68.75 (Murrey level [2/8]).

Technical indicators confirm the continued growth: Bollinger Bands are directed upwards, MACD is increasing in the positive zone, and Stochastic is horizontal in the overbought zone.

Resistance levels: 84.38, 87.50.

Support levels: 77.00, 71.88, 68.75.

Trading tips

Long positions can be opened from the 82.20 mark with targets at 84.38, 87.50 and stop-loss around 81.00. Implementation period: 5-7 days.

Short positions should be opened below the level of 77.00 with targets at 71.88, 68.75 and stop-loss at 79.50.

Hot

No comment on record. Start new comment.