Current trend

Shares of Starbucks Corp., one of the largest companies in the world, which owns the coffee shop chain of the same name, are trading in a corrective trend at 104.00.

Against the positive Q3 report, the company decided to continue expanding the business: by 2030, the number of stores will increase from 38.0K to 55.0K, and next year, employees with 2 to 5 years of experience can apply for a salary increase by 4.0%, and with experience of more than 5 years – up to 5.0%.

Meanwhile, quarterly statistics reflected an increase in revenue to 9.4B dollars, which was a new record and exceeded analysts’ forecast of 9.29B dollars. Earnings per share were also among the highest in history, 1.06 dollars per share, above preliminary estimates of 0.97 dollars per share.

The day after tomorrow, there will be a register cut-off for dividends raised from 0.53 dollars per share to 0.57 dollars per share. The quarterly yield is expected to be 2.22%, and the payment is scheduled for November 24.

Support and resistance

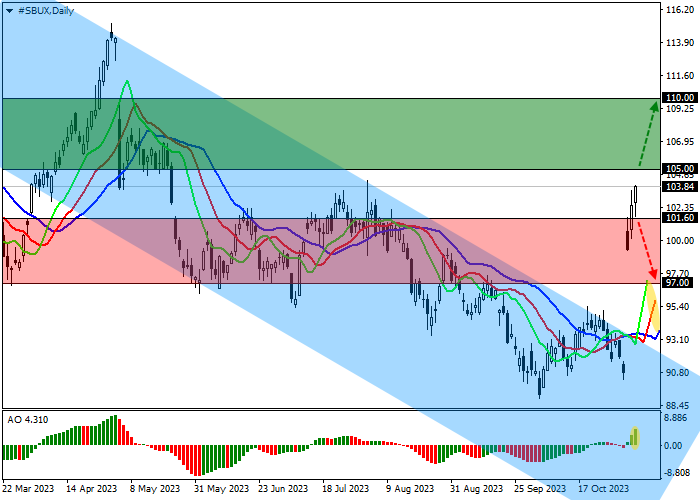

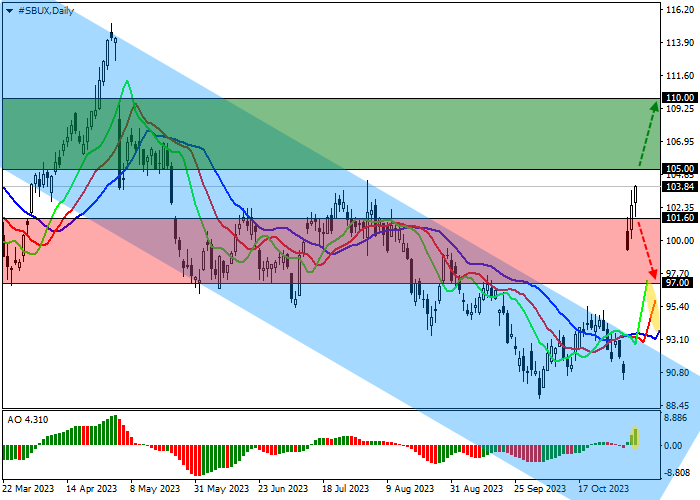

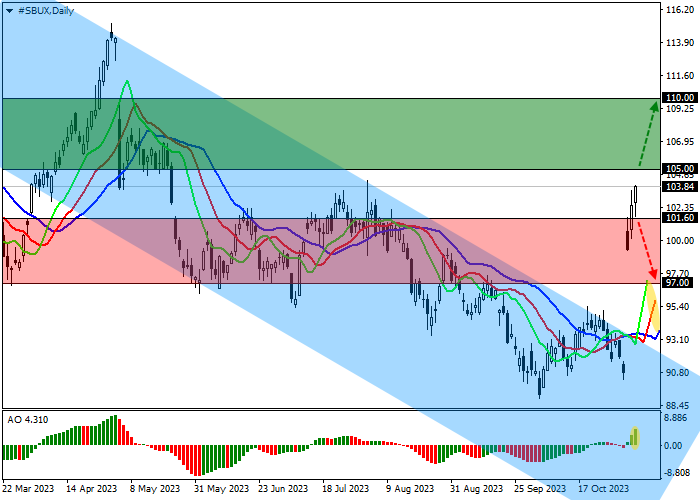

On the daily chart, the trading instrument is above the resistance line of the global downward corridor with dynamic boundaries of 97.00–85.00.

Technical indicators have issued a buy signal: the EMA fluctuation range on the Alligator indicator is expanding upward, and the histogram on the AO oscillator is forming ascending bars in the buy zone.

Resistance levels: 105.00, 110.00.

Support levels: 101.60, 97.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 105.00 with the target at 110.00. Stop loss – 103.00. Implementation period: 7 days or more.

Short positions may be opened after a reversal, decline, and consolidation of the price below 101.60 with the target at 97.00. Stop loss – 103.00.

Hot

No comment on record. Start new comment.