Current trend

Last week, the S&P 500 added 5.95%, reaching its highest since November 2022, as the US Federal Reserve kept interest rates at 5.50%. Currently, the instrument is holding at 4362.00.

The head of the department, Jerome Powell, does not deny the possibility of tightening monetary policy in December or early next year but investors are preparing for a gradual softening of the rhetoric. In an accompanying statement, officials noted that inflation risks in the country remain elevated, while job growth has not yet slowed down. In this regard, the Federal Open Market Committee of the US Federal Reserve will continue to evaluate the effectiveness of measures already taken by analyzing macroeconomic statistics. After Powell’s speech, the 10-year yield began to decline sharply and set a record since the 2008 financial crisis, losing 31.7 basis points.

A decrease in securities yields contributes to the growth of the stock market, as investors are always looking for more profitable investment options: after the decision on the interest rate, futures for US Federal Reserve funds began to include a probability of 85.0% that the regulator finished increasing the rate and 80.0% that that the reduction in borrowing costs will begin in June. Yesterday, the President of the Federal Reserve Bank (FRB) of Atlanta, Raphael Bostic, said during an interview that there is no longer a need to increase it, and it can be assumed that other speakers will join this opinion.

Economic labor market data released last week weighed on the dollar, with October nonfarm payrolls coming in at 150.0K, below expectations of 180.0K, and unemployment adjusting 0.1% to 3.9%. against forecasts of 3.8%. As a result, the decline in the dollar again supported the stock market, and the S&P 500 index was able to strengthen to 4360.00.

Support and resistance

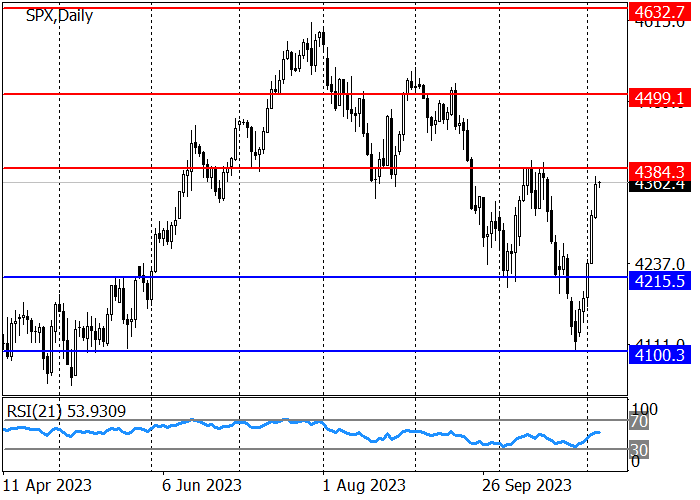

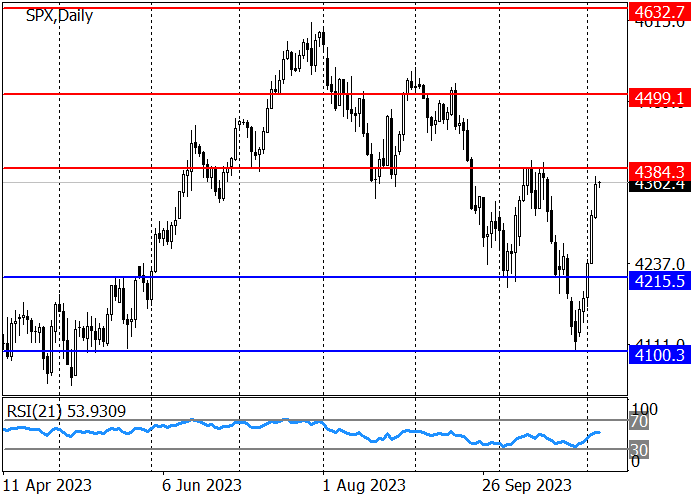

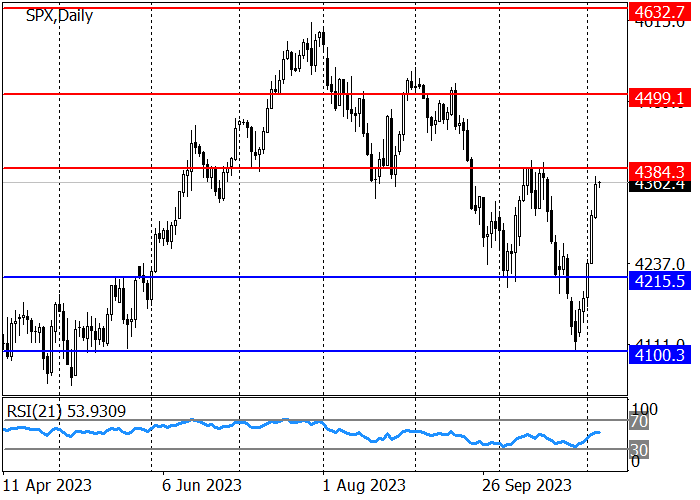

The long-term trend is upward, and the decline from July to October can be called a correction: after reaching a strong support level of 4100.00, the price began to rise again, approaching 4385.00, after breaking through which the positive dynamics will continue to 4500.00.

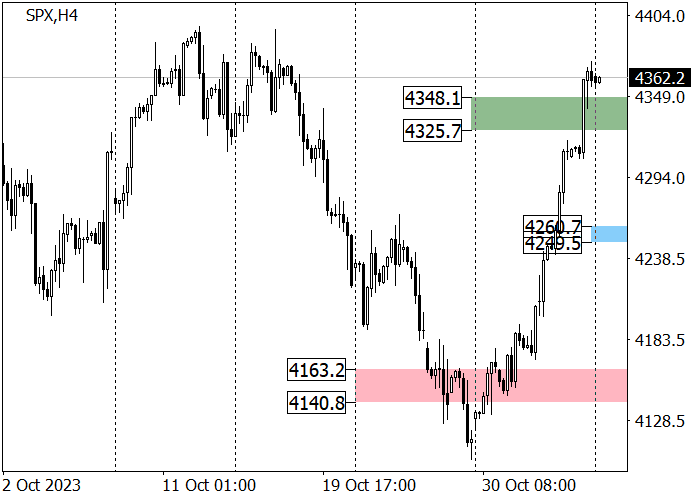

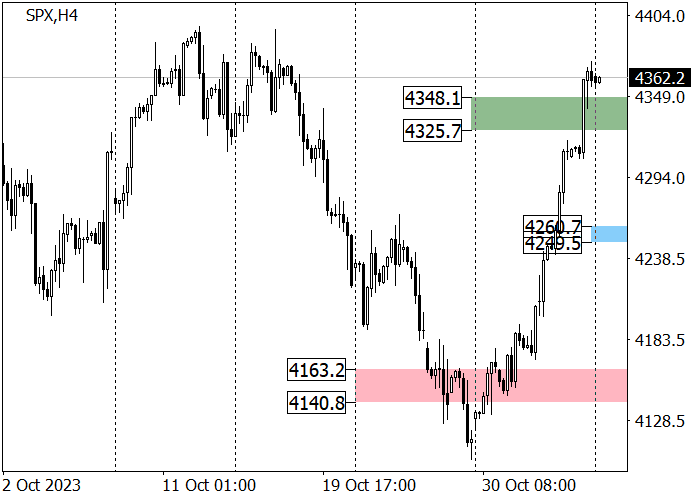

The medium-term trend remains downward: last week the trading instrument reached the trend line 4348.00–4325.00 and is trying to consolidate above this resistance level and change the medium-term trend, after which it will be possible to open long positions with the target in the zone 2 (4572.00–4549.00). If the quotes return below 4325.00, then a decline to the 4163.00–4140.00 zone is possible.

Resistance levels: 4384.00, 4500.00, 4632.00.

Support levels: 4215.00, 4100.00.

Trading tips

Long positions may be opened from 4260.00 with the target at 4400.00 and stop loss around 4220.00. Implementation time: 9–12 days.

Short positions may be opened below 4220.00 with the target at 4100.00 and stop loss around 4260.00.

Hot

No comment on record. Start new comment.