Current trend

The AUD/USD pair is showing mixed dynamics, correcting after last week's "bullish" rally, which resulted in an update of local highs from September 1. The instrument is testing 0.6500 for a breakout, waiting for new drivers to appear on the market and winning back Friday’s publications.

At the end of last week, the October labor market report was presented in the United States, which disappointed many traders. Nonfarm Payrolls decreased from 297.0 thousand to 150.0 thousand, which turned out to be worse than the forecast of 180.0 thousand. At the same time, the Unemployment Rate adjusted from 3.8% to 3.9%. Another negative aspect was the decline in the Services PMI from the Institute for Supply Management (ISM) from 53.6 points to 51.8 points, with expectations at 53.0 points. In turn, the Australian Services PMI from the Commonwealth Bank in October strengthened from 47.6 points to 47.9 points, and the Composite PMI went up from 47.3 points to 47.6 points. In addition, the position of the Australian currency was supported by an increase in Retail Sales in the third quarter by 0.2% after -0.6% in the previous period.

Activity on the market at the beginning of the week remains low, as trading participants expect the emergence of new drivers. In particular, tomorrow there will be a meeting of the Reserve Bank of Australia (RBA), at which it is predicted that the interest rate will increase by 25 basis points to 4.35% against the backdrop of negative statistics: the Consumer Price Index in the third quarter increased by 5.4% in annual terms, which was higher than expected 5.3%, and amounted to 1.2% compared to 1.1% in quarterly terms, and Producer inflation reached 3.8% in annual terms in quarterly terms and rose from 0.5% to 1.8% in quarterly terms, exceeding the forecast of 0.7%.

Support and resistance

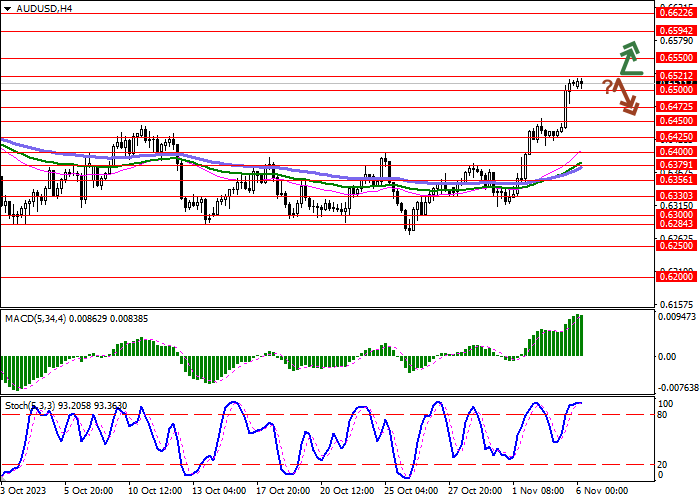

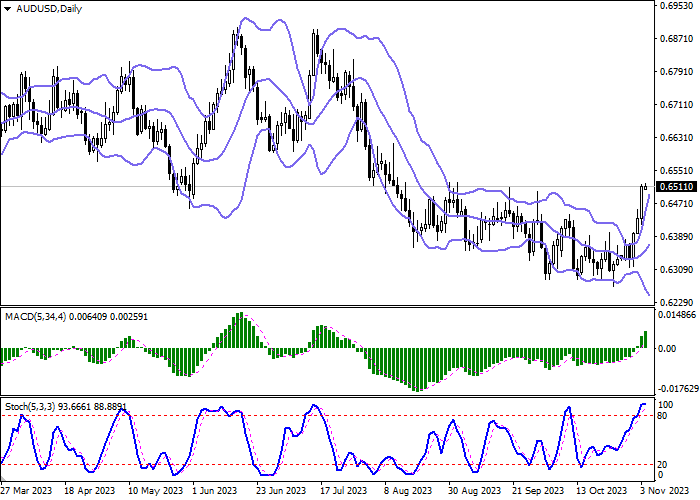

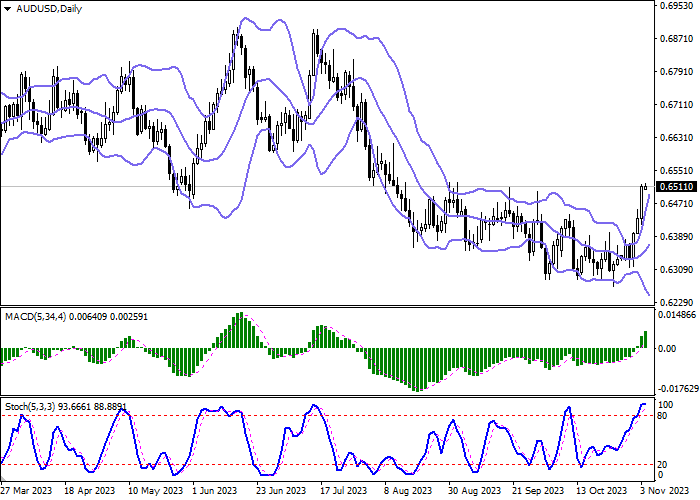

Bollinger Bands on the daily chart show a steady increase. The price range is expanding but it fails to conform to the surge of "bullish" activity at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic approached its highs and reversed into a horizontal plane, indicating the risks of the Australian currency being overbought in the ultra-short term.

Resistance levels: 0.6521, 0.6550, 0.6594, 0.6622.

Support levels: 0.6500, 0.6472, 0.6450, 0.6425.

Trading tips

Long positions can be opened after a breakout of 0.6521 with the target of 0.6594. Stop-loss — 0.6480. Implementation time: 2-3 days.

A rebound from 0.6521 as from resistance, followed by a breakdown of 0.6500 may become a signal for opening of new short positions with the target at 0.6450. Stop-loss — 0.6521.

Hot

No comment on record. Start new comment.