Current trend

The NZD/USD pair is noticeably declining, developing downward dynamics in the ultra-short term and winning back the growth at the end of last week. The instrument is actively testing 0.5930 for a breakdown, reacting to the publication of statistics from China, as well as the results of the meeting of the Reserve Bank of Australia (RBA), which decided to increase the interest rate by 25 basis points to 4.35%, which may indirectly indicate a similar step to be announced by the Reserve Bank of New Zealand at its meeting on November 29.

Chinese data showed Exports fell 6.4% in October after -6.2% in the previous month, while analysts had expected -3.1%, while Imports, on the contrary, added 3.0% after -6.2% in September with expectations at -5.4%. The country's Trade Balance dropped from 77.71 billion dollars to 56.53 billion dollars, while experts expected an increase to 81.95 billion dollars.

On Wednesday at 16:15 (GMT 2), the US Federal Reserve Chairman Jerome Powell will speak, and investors expect to hear updated forecasts regarding the outlook for monetary policy. Analysts are confident that the current cycle of rising borrowing costs has come to an end and the uncertainty now lies in how soon officials will announce the start of interest rate cuts.

Support and resistance

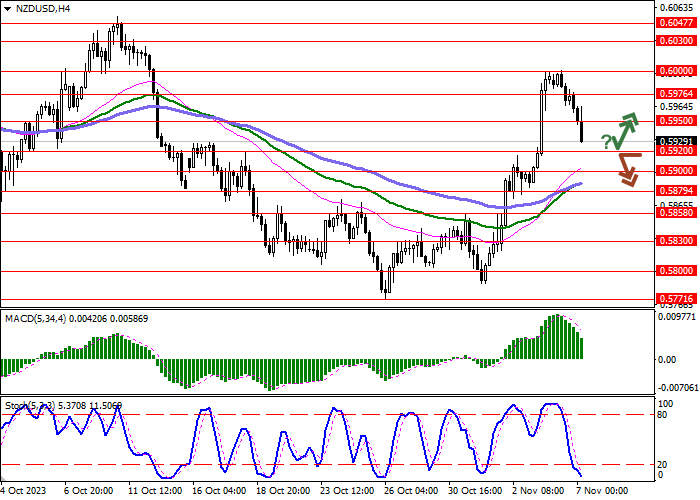

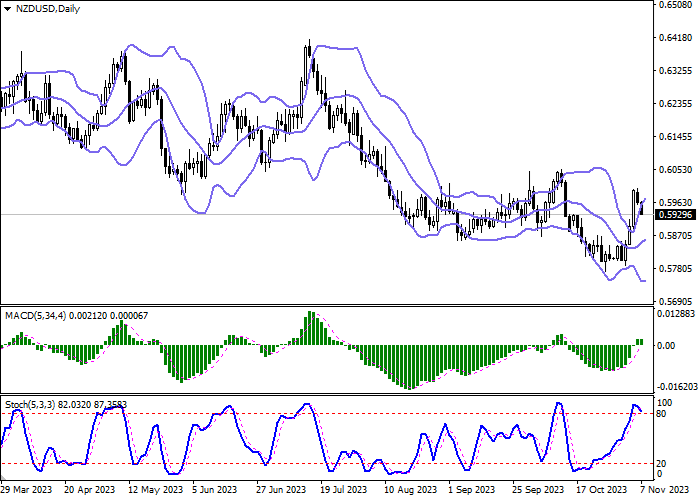

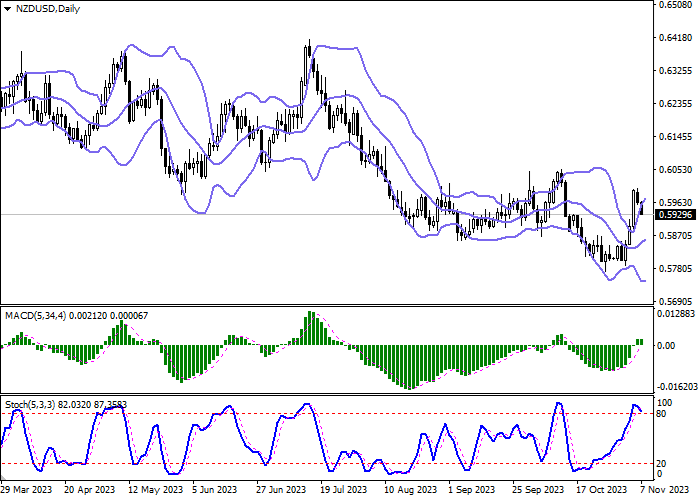

Bollinger Bands in D1 chart show moderate growth. The price range is widening from above, struggling to keep up with the surge in trading activity over the past few days. MACD is growing preserving a buy signal (located above the signal line). At the same time, against the background of the emergence of active "bearish" trend at the beginning of this week, the rate of growth of the indicator has slowed down significantly. Stochastic, having approached its highs, reversed into a downward plane, indicating the risks of overbought New Zealand dollar in the ultra-short term.

Resistance levels: 0.5950, 0.5976, 0.6000, 0.6030.

Support levels: 0.5920, 0.5900, 0.5879, 0.5858.

Trading tips

Short positions may be opened after a breakdown of 0.5920 with the target at 0.5858. Stop-loss — 0.5950. Implementation time: 2-3 days.

A rebound from 0.5920 as from support followed by a breakout of 0.5950 may become a signal for opening new long positions with the target at 0.6000. Stop-loss — 0.5920.

Hot

No comment on record. Start new comment.