ASX 200: AUSTRALIAN BOND YIELDS REMAIN AT PEAK LEVELS

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 6770.0 |

| Take Profit | 6560.0 |

| Stop Loss | 6850.0 |

| Key Levels | 6560.0, 6760.0, 6920.0, 7070.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 6920.0 |

| Take Profit | 7070.0 |

| Stop Loss | 6850.0 |

| Key Levels | 6560.0, 6760.0, 6920.0, 7070.0 |

Current trend

The leading index of the Australian economy, the ASX 200, is showing corrective dynamics at 6837.0.

Macroeconomic statistics from Australia remain one of the main factors of pressure on the stock market. Thus, the Unemployment Rate in September adjusted from 3.7% to 3.6%, but Employment Change amounted to only 6.7 thousand jobs against the backdrop of an increase of 63.3 thousand in August. The Participation Rate also decreased significantly to 66.7% compared to 67.0% in the previous month.

The main factor of the downward dynamics for the index now is the correction in the bond market: 10-year bonds are trading at a rate of 4.792%, exceeding the previous high in early October at 4.651%, the yield on 20-year bonds is 5.157%, increasing from 4.902% recorded at the beginning of the month, and 30-year bonds are trading at an absolute high since their release on the market at 5.215%.

The growth leaders in the index are Zip Co. Ltd. ( 4.39%), ARB Corp. Ltd. ( 5.75%), Resmed Inc. DRC ( 3.14%), Sky City Entertainment Group ( 2.84%).

Among the leaders of the decline are Pilbara Minerals Ltd. (-7.25%), Mineral Resources Ltd. (-3.54%), IGO Ltd (-5.20%), Alumina Ltd. (-3.70%).

Support and resistance

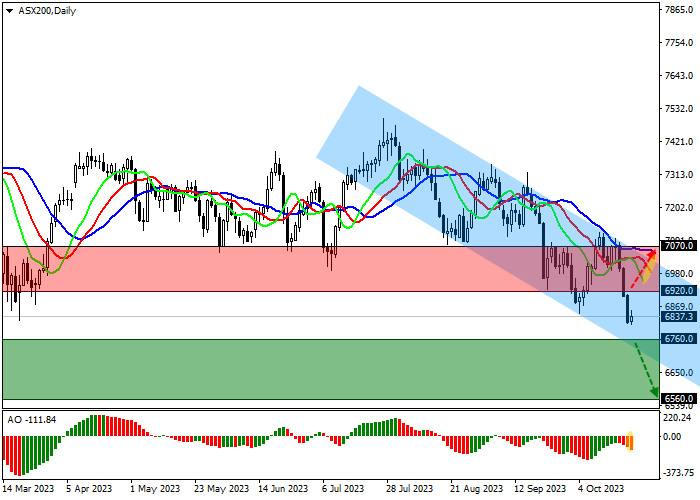

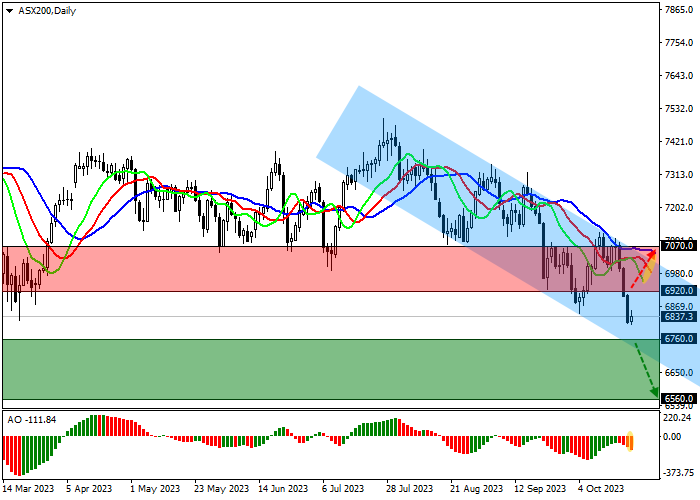

On the daily chart, the price is held within the global downward corridor with dynamic boundaries of 6670.0–7070.0, continuing to fall within the next wave.

Technical indicators maintain a stable sell signal: fast EMAs of the Alligator indicator are kept below the signal line and expand the range of fluctuations, and the AO histogram forms corrective bars, while being in the sell zone.

Support levels: 6760.0, 6560.0.

Resistance levels: 6920.0, 7070.0.

Trading tips

If the asset continues to decline and consolidates below 6770.0, sell positions with a target of 6560.0 will be relevant. Stop-loss – 6850.0. Implementation time: 7 days or more.

In the event of a reversal and continued global growth of the asset, as well as price consolidation above the local resistance level of 6920.0, buy positions with a target of 7070.0 and stop-loss of 6850.0 will be relevant.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.