CAC 40: THE BOND MARKET CONTINUES TO GROWCAC 40: THE BOND MARKET CONTINUES TO GROW

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 6799.5 |

| Take Profit | 6600.0 |

| Stop Loss | 6900.0 |

| Key Levels | 6600.0, 6800.0, 6940.0, 7090.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 6940.5 |

| Take Profit | 7090.0 |

| Stop Loss | 6880.0 |

| Key Levels | 6600.0, 6800.0, 6940.0, 7090.0 |

Current trend

One of the leading indices of the European economy, CAC40, is correcting and is now trading at 6862.0.

The quarterly reporting period has started, and the results of French companies so far are quite weak. In particular, one of the market leaders, L'Oreal SA, reported revenue of 10.0B euros, which was lower than the forecast (10.04B) and the result a quarter earlier (10.19B). Another of the leaders in capitalization, EssilorLuxottica SA, reported revenue of 6.29B euros, also lower than the previous quarter (6.21B) and forecast (6.3B). Pernod Ricard SA recorded revenue of 3.04B euros, below the forecast of 3.06B, but above 2.63B a quarter earlier.

The situation on the domestic bond market is also playing against the stock market: popular 10-year bonds of France are trading at the highest rate of 3.553% this year, and conservative 20-year bonds are at 3.931% (slightly below the maximum 3.984%). Global 30-year bonds, which are least subject to local fluctuations, are trading at a rate of 3.983%, approaching the recent absolute maximum of 4.064%.

At the moment, the growth leaders in the index are: Pernod Ricard SA ( 4.76%), Alstom SA ( 1.34%) and Engie SA ( 1.05%).

Among the securities showing a decline, are: Renault SA (˗7.33%), Stellantis NV (˗3.60%), Edenred SA (˗2.88%), and Eurofins Scientific SE (˗2.88%).

Support and resistance

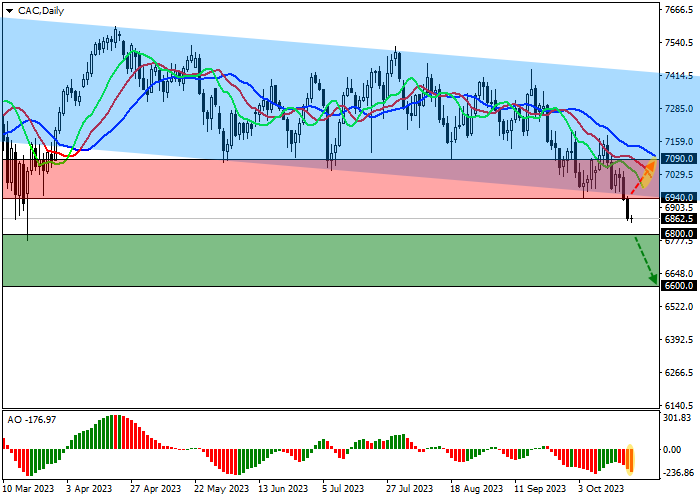

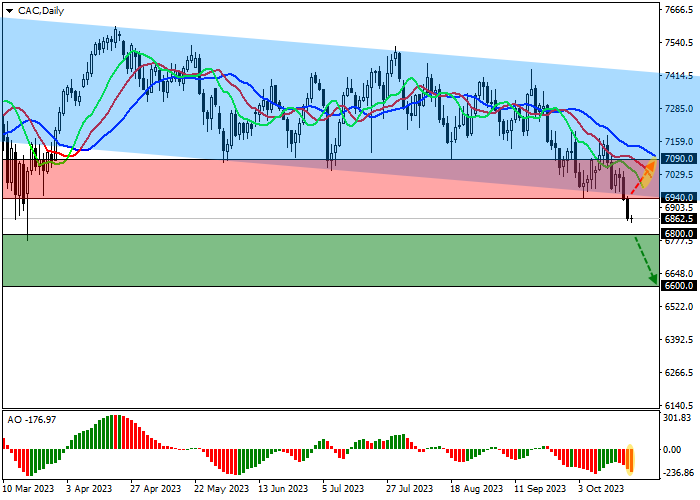

On the D1 chart, quotes continue to consolidate below the support line of the global descending channel with borders of 7415.0–6950.0 and are ready to continue the decline.

Technical indicators continue to actively strengthen the global sell signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram, being far from the transition level, continues to form correction bars.

Support levels: 6800.0, 6600.0.

Resistance levels: 6940.0, 7090.0.

Trading tips

In case of a reversal and continued decline of the asset, as well as price consolidation below the local support level, at 6800.0, short positions with the target at 6600.0 and stop-loss at 6900.0 may be opened. Implementation time: 7 days and more.

In case of the local growth of the asset continues and the price consolidation above the local resistance level, at 6940.0, long positions with the target at 7090.0 and stop-loss at 6880.0 can be opened.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.