JOHNSON & JOHNSON: Q3 REPORT OUTPERFORMED ANALYSTS' FORECASTS

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 153.95 |

| Take Profit | 150.00 |

| Stop Loss | 156.00 |

| Key Levels | 150.00, 154.00,158.70, 164.80 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 158.75 |

| Take Profit | 164.80 |

| Stop Loss | 156.00 |

| Key Levels | 150.00, 154.00,158.70, 164.80 |

Current trend

The securities of one of the world's leading retail holdings Johnson & Johnson continue to adjust and are currently trading at around 155.00.

The company quickly responded to the data of the report for Q3 2023, which showed a decline in orthopedic products sales, announcing a two-year program of the orthopedic business restructuring. In addition, the corporation plans to withdraw from some markets, focusing on the areas that brought it the greatest profit: the pharmaceutical business brought USD 13.89B in sales, in which more than 20% was the share of the Stelara drug. Total revenue amounted to USD 21.4B, exceeding analysts' forecast of USD 21.04B, and earnings per share amounted to USD 2.66, also above the forecast (USD 2.51).

Johnson & Johnson expects adjusted earnings per share to be between USD 10.07 and USD 10.13 by the end of the year, which exceeds the previous forecast in the range of USD 10.00–10.10. The forecast for operating sales assumes 7.2%–7.7%, higher than the previous forecast (6.2%–7.2%).

On September 7, the payment of dividends was completed: shareholders received USD 1.19 per share, which amounted to 2.88% for the quarter. The new payment will amount to the same USD 1.19, and will approximately occur in early December.

Support and resistance

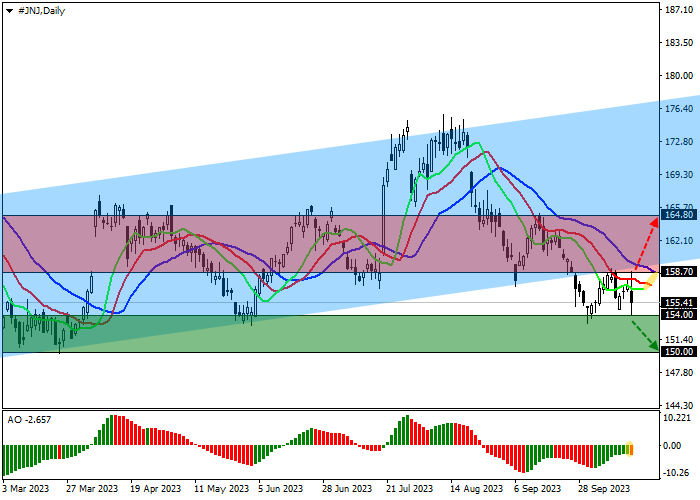

On the D1 chart, the company's securities continue to adjust, holding below the support line of the ascending corridor at 159.00.

Technical indicators continue to show a sufficiently strong sell signal: fast EMAs on the Alligator indicator continue to be held below the signal line, and the AO histogram continues to form descending bars.

Support levels: 154.00, 150.00.

Resistance levels: 158.70, 164.80.

Trading tips

In the event of a reversal and continued decline of the asset, as well as consolidation of the price below the support level at 154.00,one can open short positions with the target at 150.00 and stop-loss at 156.00. Implementation time: 7 days and more.

If the asset continues growing globally and the price consolidates above the resistance level at 158.70, long positions will be relevant with the target of 164.80. Stop-loss may be set below the support level, at 156.00.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.