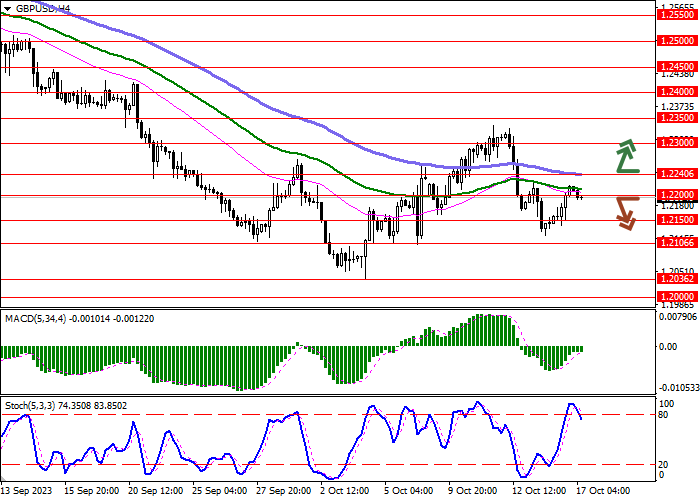

GBP/USD: THE POUND IS CONSOLIDATING NEAR 1.2200

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.2195 |

| Take Profit | 1.2106 |

| Stop Loss | 1.2250 |

| Key Levels | 1.2036, 1.2106, 1.2150, 1.2200, 1.2240, 1.2300, 1.2350, 1.2400 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2245 |

| Take Profit | 1.2350 |

| Stop Loss | 1.2190 |

| Key Levels | 1.2036, 1.2106, 1.2150, 1.2200, 1.2240, 1.2300, 1.2350, 1.2400 |

Current trend

The GBP/USD pair is trading with downward dynamics, again trying to consolidate below 1.2200. Investors are in no hurry to open new trading positions ahead of tomorrow's publication of a block of macroeconomic statistics on inflation in the UK. Forecasts suggest a slowdown in the annual Consumer Price Index from 6.7% to 6.5%, and the monthly indicator could adjust from 0.3% to 0.4%, while Core CPI may fall from 6.2% to 6.0%. Also tomorrow, data on the Retail Price Index will be presented: analysts expect a reduction in the September indicator from 0.6% to 0.5% on a monthly basis and from 9.1% to 8.9% on an annual basis.

Today, the market is focusing on statistics on the UK labor market, in particular, data on the dynamics of Average Earnings: the figure Excluding Bonus in July was revised from 7.8% to 7.9% and then decreased to 7.8% in August, and the indicator Including Bonus dropped from 8.5% to 8.1% with a forecast of 8.3%.

In turn, the position of the American currency remains quite strong due to the expectation of a longer period of high interest rates, as well as against the background of the worsening conflict in the Middle East, which has led to an increase in demand for safe assets. At the same time, the data published the day before reflected a decrease in the NY Empire State Manufacturing Index in October from 1.9 points to -4.6 points, while analysts expected -7.0 points.

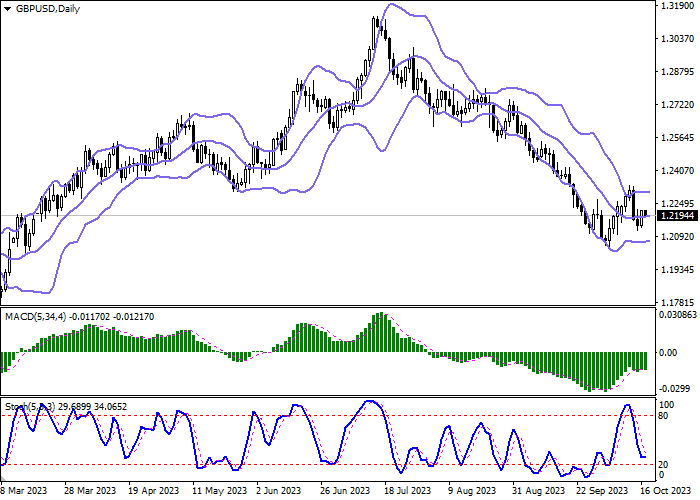

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowed from below, being spacious enough for the current activity level in the market. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic, reacting to the appearance of an attempt at corrective growth on Monday, reversed horizontally, indicating the risks of the pound being oversold in the near future.

Resistance levels: 1.2240, 1.2300, 1.2350, 1.2400.

Support levels: 1.2200, 1.2150, 1.2106, 1.2036.

Trading tips

Short positions may be opened after a breakdown of 1.2200 with the target at 1.2106. Stop-loss — 1.2250. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 1.2240 may become a signal for new purchases with the target of 1.2350. Stop-loss — 1.2190.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.