FTSE 100: UK STOCK MARKET CONTINUES CORRECTION

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 7700.5 |

| Take Profit | 7900.0 |

| Stop Loss | 7600.0 |

| Key Levels | 7380.0, 7550.0, 7700.0, 7900.0 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 7549.5 |

| Take Profit | 7380.0 |

| Stop Loss | 7620.0 |

| Key Levels | 7380.0, 7550.0, 7700.0, 7900.0 |

Current trend

The leading index of the London Stock Exchange FTSE 100 is showing corrective dynamics and is currently at 7616.0.

The data from the end of last week turned out to be unexpected: the UK gross domestic product (GDP) grew by 0.2% in August after a July drop of -0.6%, which eventually led to an annual increase of 0.5% (0.3% earlier). In addition, the volume of industrial production decreased by -0.7% (-1.1% in the previous reporting period), which led to an annual increase of 1.3%, instead of 1.0% in July. If the labor market report, which will be published tomorrow, turns out to be positive, one can expect growth in the stock market.

However, this week bond yields started to rise again, which puts pressure on the stocks: popular 10-year UK bonds are trading at a rate of 4.435% ( 1.07%), conservative 20-year bonds are trading at a rate of 4.850% ( 1.26%). Global 30-year bonds are also rising, holding slightly below the key yield level of 4.879% ( 1.05% since the start of trading).

The growth leaders in the index at the moment are: Fresnillo PLC ( 4.39%), BP PLC ( 2.16%), United Utilities Group PLC ( 1.96%), National Grid PLC ( 1.53%).

Among the companies showing downward dynamics are: St.James's Place PLC (-21.79%), Ocado Group PLC (-7.24%) and Abrdn PLC (-5.09%).

Support and resistance

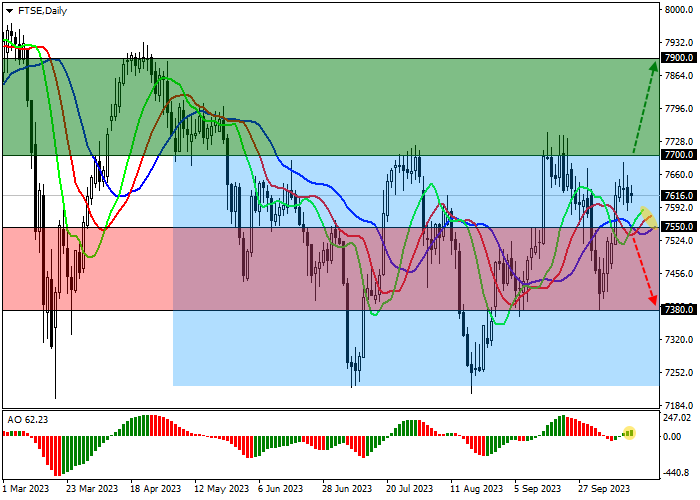

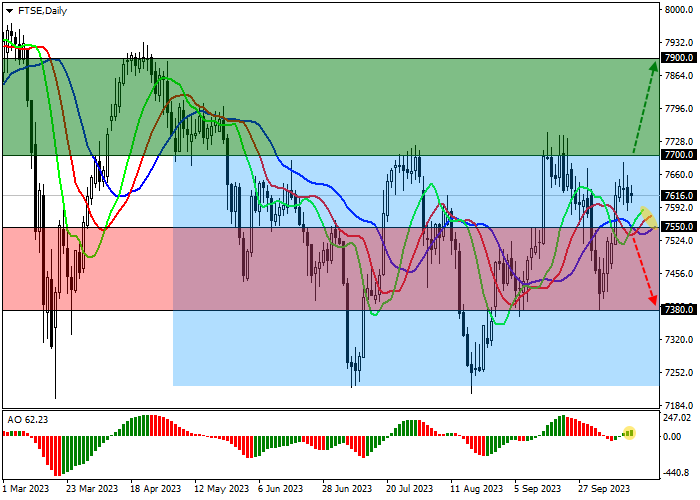

On the D1 chart, the index quotes continue the local upward correction and are approaching the resistance line of the lateral corridor with the borders of 7700.0–7220.0.

Technical indicators keep the buy signal, which was received last week: the range began to expand again in the direction of growth, and the AO histogram forms new correction bars, being in the buy zone.

Support levels: 7550.0, 7380.0.

Resistance levels: 7700.0, 7900.0.

Trading tips

If the global growth of the index continues and the price consolidates above the local resistance level, at around 7700.0, buy positions may be opened with a possible target at 7900.0 and stop-loss at 7600.0. Implementation time: 7 days and more.

In the event of a reversal and continuation of the global decline of the index, as well as the price consolidation below the local support, at around 7550.0, sell positions may be opened with the target at 7380.0 and stop-loss at 7620.0.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.