STARBUCKS CORP.: MURREY ANALYSIS

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 90.60 |

| Take Profit | 87.50, 84.38 |

| Stop Loss | 93.00 |

| Key Levels | 84.38, 87.50, 90.62, 96.88, 100.00, 106.25 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 96.90 |

| Take Profit | 100.00, 106.25 |

| Stop Loss | 94.60 |

| Key Levels | 84.38, 87.50, 90.62, 96.88, 100.00, 106.25 |

Current trend

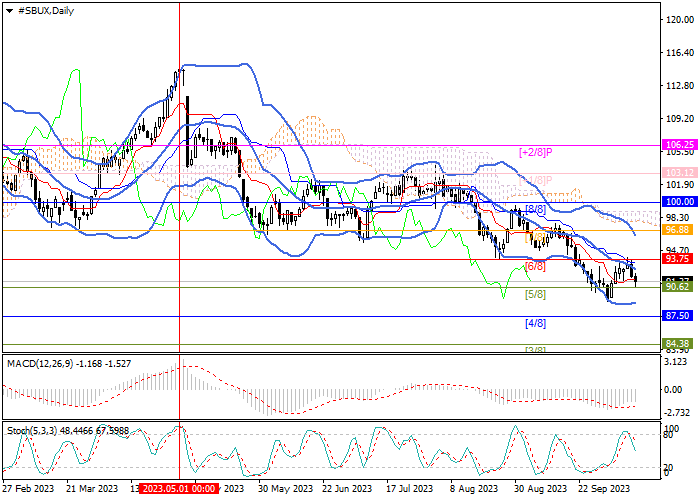

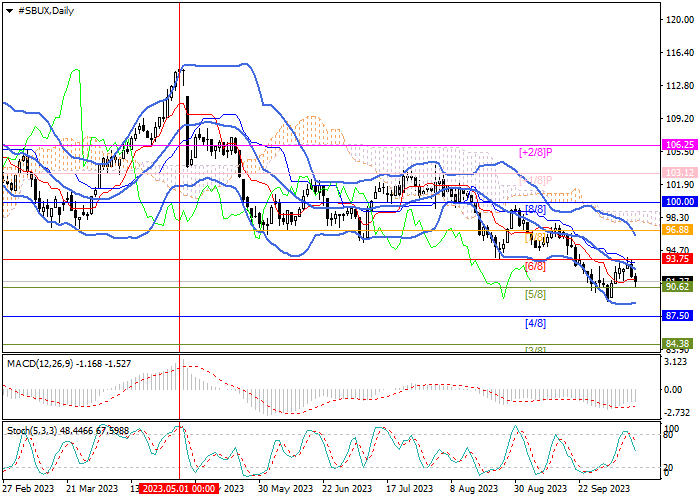

Securities of Starbucks Corp. are traded within a long-term downtrend.

Last week, the quotes attempted a correction, rising to the reversal level of 93.75 (Murrey level [6/8]), supported by the central line of Bollinger Bands, but they could not break above it and resumed the decline. The instrument is currently testing the mark of 90.62 (Murrey level [5/8]), the breakdown of which will allow a continued decline within the central Murrey channel to 87.50 (Murrey level [4/8]) and 84.38 (Murrey level [3/8]). The key for the "bulls" is the level of 96.88 (Murrey level [7/8], the upper line of Bollinger Bands), with the breakout of which an attempt to change the downward trend and continue growth to 100.00 (Murrey level [8/8]) and 106.25 (Murrey level [ 2/8]) is possible, but such a scenario seems less likely in the near future.

Technical indicators show the continuation of the downtrend: Bollinger Bands and Stochastic are directed downwards, MACD is stable in the negative zone.

Support and resistance

Resistance levels: 96.88, 100.00, 106.25.

Support levels: 90.62, 87.50, 84.38.

Trading tips

Short positions should be opened below the level of 90.62 with targets at 87.50, 84.38 and stop loss near 93.00. Implementation period: 5-7 days.

Long positions can be opened above 96.88 with targets at 100.00, 106.25 and stop loss at 94.60.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.