EUR/USD: AWAITING US CONSUMER INFLATION DATA

Scenario Timeframe Weekly Recommendation BUY STOP Entry Point 1.0655 Take Profit 1.0742, 1.0864 Stop Loss 1.0575 Key Levels 1.0260, 1.0376, 1.0498, 1.0650, 1.0742, 1.0864

Alternative scenario Recommendation SELL STOP Entry Point 1.0495 Take Profit 1.0376, 1.0260 Stop Loss 1.0590 Key Levels 1.0260, 1.0376, 1.0498, 1.0650, 1.0742, 1.0864

Current trend

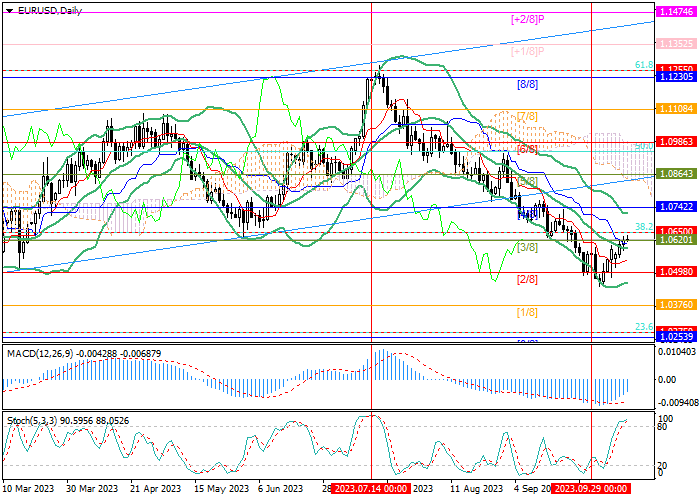

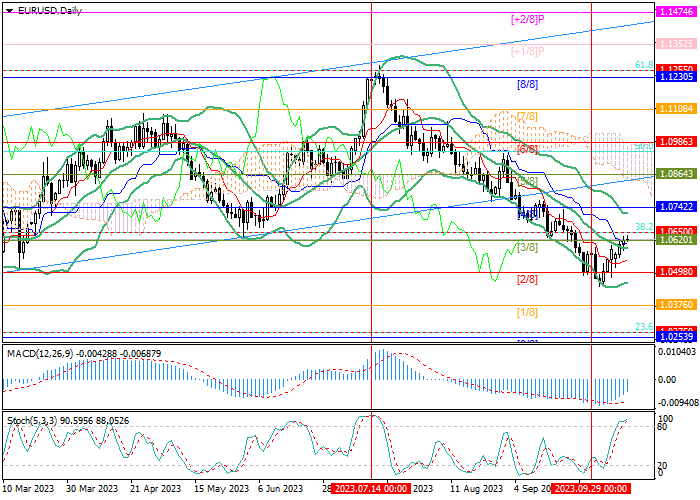

This week, the EUR/USD pair continued to grow, correcting to the medium-term downward trend, and is now trading around 1.0620 (Murrey level [3/8]).

The dollar is under pressure amid uncertainty about the future actions of the US Federal Reserve: on the one hand, inflation is showing clear signs of decline, as evidenced by the reduction in the August private consumption expenditure index from 4.3% to 3.9% but the labor market remains strong, and employment growth in September amounted to 336.0K, which may accelerate the growth of consumer prices. In these conditions, there is no unanimity of opinion among the representatives of the regulator: thus, the President of the Federal Reserve Bank (FRB) of Minneapolis Neel Kashkari and the head of the Atlanta Fed Raphael Bostic call for stopping the cycle of tightening monetary policy, while, for example, Fed Governor Michelle Bowman believes that inflation has not decreased sufficiently, and a new increase in interest rates is quite possible.

Today, September data on the consumer price index will be published, which can significantly affect the mood of the officials: if the indicator meets forecasts and decreases again, the position of the “doves” will strengthen, and the dollar may come under new pressure. In general, investors are counting on this scenario and abandoning the US currency in favor of alternative assets, including the euro.

Support and resistance

The trading instrument is trying to break the resistance zone 1.0620–1.0650 (Murrey level [3/8], Fibonacci retracement 38.2%) to continue growing to the area of 1.0742 (Murrey level [4/8]) and 1.0864 (Murrey level [5/8]). The key “bearish” level is 1.0498 (Murrey level [2/8]), which breakdown will allow the price to fall to the area of 1.0376 (Murrey level [1/8]) and 1.0260 (Murrey level [0/8], Fibonacci correction 23, 6%).

Technical indicators do not give a single signal: Bollinger bands reverse horizontally after a decline, the MACD histogram is increasing in the negative zone, and Stochastic has entered the overbought zone but is directed upwards.

Resistance levels: 1.0650, 1.0742, 1.0864.

Support levels: 1.0498, 1.0376, 1.0260.

Trading tips

Long positions may be opened above 1.0650 with the targets at 1.0742, 1.0864 and stop loss around 1.0575. Implementation time: 5–7 days.

Short positions may be opened below 1.0498 with the targets at 1.0376, 1.0260 and stop loss around 1.0590.

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.0655 |

| Take Profit | 1.0742, 1.0864 |

| Stop Loss | 1.0575 |

| Key Levels | 1.0260, 1.0376, 1.0498, 1.0650, 1.0742, 1.0864 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.0495 |

| Take Profit | 1.0376, 1.0260 |

| Stop Loss | 1.0590 |

| Key Levels | 1.0260, 1.0376, 1.0498, 1.0650, 1.0742, 1.0864 |

Current trend

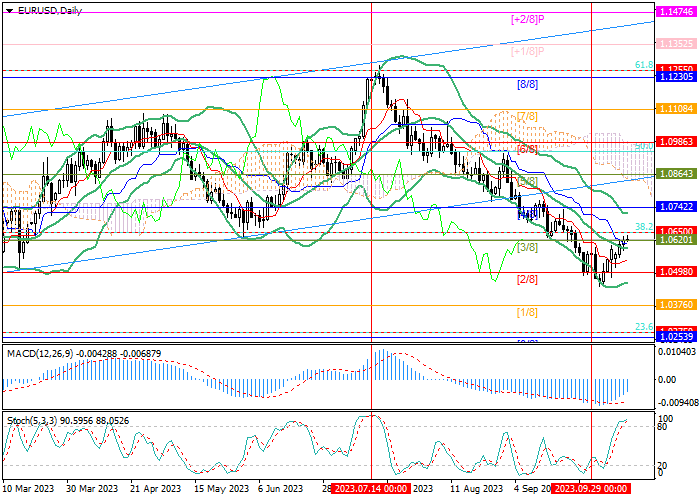

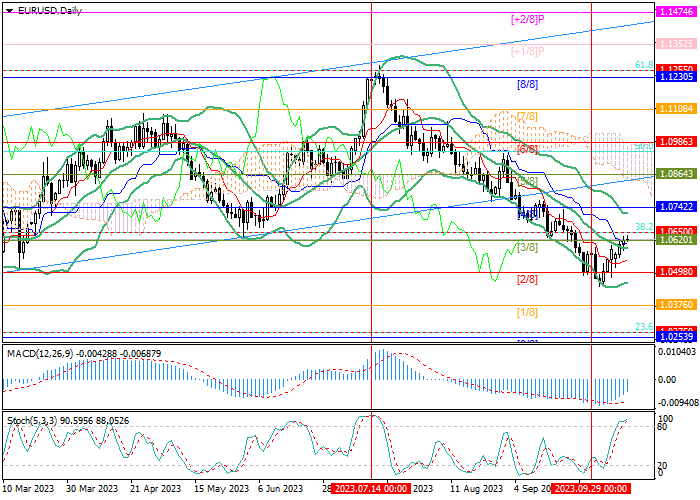

This week, the EUR/USD pair continued to grow, correcting to the medium-term downward trend, and is now trading around 1.0620 (Murrey level [3/8]).

The dollar is under pressure amid uncertainty about the future actions of the US Federal Reserve: on the one hand, inflation is showing clear signs of decline, as evidenced by the reduction in the August private consumption expenditure index from 4.3% to 3.9% but the labor market remains strong, and employment growth in September amounted to 336.0K, which may accelerate the growth of consumer prices. In these conditions, there is no unanimity of opinion among the representatives of the regulator: thus, the President of the Federal Reserve Bank (FRB) of Minneapolis Neel Kashkari and the head of the Atlanta Fed Raphael Bostic call for stopping the cycle of tightening monetary policy, while, for example, Fed Governor Michelle Bowman believes that inflation has not decreased sufficiently, and a new increase in interest rates is quite possible.

Today, September data on the consumer price index will be published, which can significantly affect the mood of the officials: if the indicator meets forecasts and decreases again, the position of the “doves” will strengthen, and the dollar may come under new pressure. In general, investors are counting on this scenario and abandoning the US currency in favor of alternative assets, including the euro.

Support and resistance

The trading instrument is trying to break the resistance zone 1.0620–1.0650 (Murrey level [3/8], Fibonacci retracement 38.2%) to continue growing to the area of 1.0742 (Murrey level [4/8]) and 1.0864 (Murrey level [5/8]). The key “bearish” level is 1.0498 (Murrey level [2/8]), which breakdown will allow the price to fall to the area of 1.0376 (Murrey level [1/8]) and 1.0260 (Murrey level [0/8], Fibonacci correction 23, 6%).

Technical indicators do not give a single signal: Bollinger bands reverse horizontally after a decline, the MACD histogram is increasing in the negative zone, and Stochastic has entered the overbought zone but is directed upwards.

Resistance levels: 1.0650, 1.0742, 1.0864.

Support levels: 1.0498, 1.0376, 1.0260.

Trading tips

Long positions may be opened above 1.0650 with the targets at 1.0742, 1.0864 and stop loss around 1.0575. Implementation time: 5–7 days.

Short positions may be opened below 1.0498 with the targets at 1.0376, 1.0260 and stop loss around 1.0590.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.