USD/TRY: AMERICAN DOLLAR IN ANTICIPATION OF NEW GROWTH DRIVERS

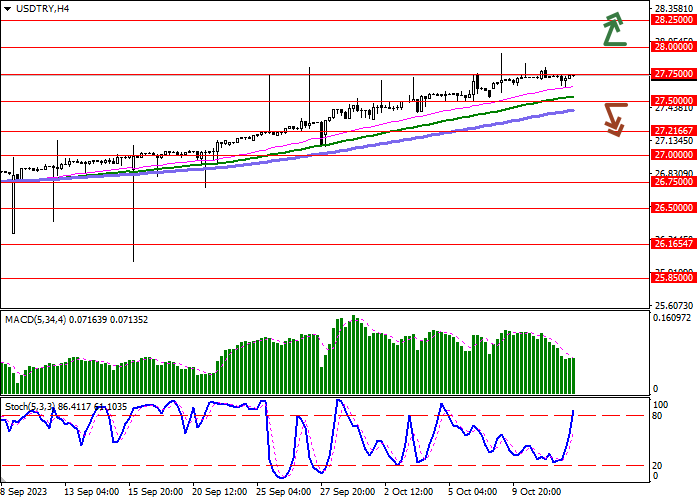

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 27.4995 |

| Take Profit | 27.0000 |

| Stop Loss | 27.7500 |

| Key Levels | 26.7500, 27.0000, 27.2166, 27.5000, 27.7500, 28.0000, 28.2500, 28.5000 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 28.0005 |

| Take Profit | 28.5000 |

| Stop Loss | 27.7500 |

| Key Levels | 26.7500, 27.0000, 27.2166, 27.5000, 27.7500, 28.0000, 28.2500, 28.5000 |

Current trend

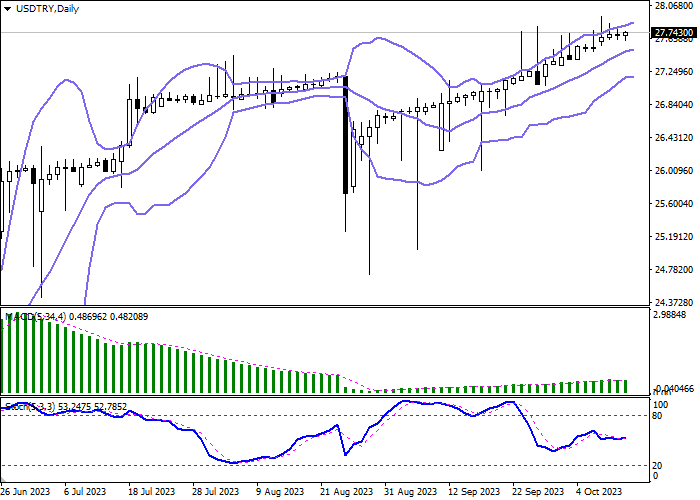

During the Asian session, the USD/TRY pair is growing slightly, developing a strong “bullish” trend since the end of August. At the beginning of the week, the price approached the psychological resistance level of 28.0000 but could not consolidate above it.

Investors are focusing on US inflation data: The September producer price index accelerated from 2.0% to 2.2% against forecasts of a decline to 1.6%, and the indicator slowed from 0.7% to 0.5% MoM, while the market expected it to reach 0.4%. Core indicators for the same period increased from 0.2% to 0.3% and from 2.5% to 2.7%, respectively, but have not yet been able to support the American dollar. Investors prefer to wait for the publication of statistics on consumer inflation; in addition, the rhetoric of representatives of the US Federal Reserve has a more significant impact on the national currency: yesterday, the President of the Federal Reserve Bank (FRB) of Minneapolis Neel Kashkari and the head of the Atlanta Fed noted that at the moment there is a need for further increase in interest rates.

The lira is under pressure amid further strengthening of inflation risks in the country, despite the actions of the Central Bank of the Republic of Turkey: September price growth increased from 58.94% to 61.53% YoY, significantly exceeding the regulator’s target levels. The regulator raised its forecasts for this indicator at the end of the year to 58.0%, while a more optimistic target of 22.3% was previously set.

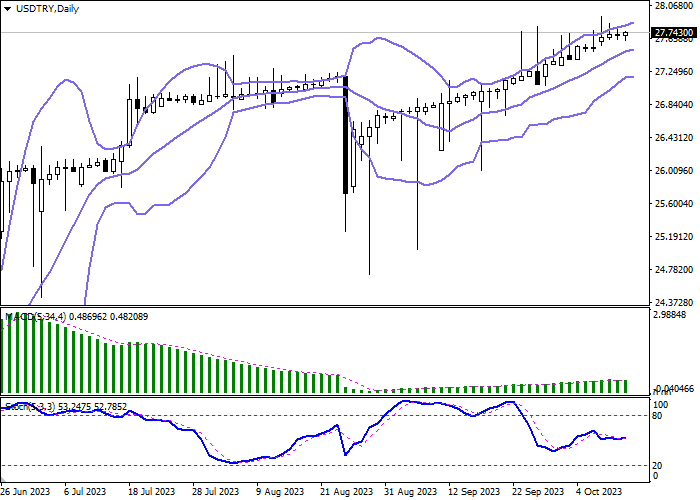

Support and resistance

On the daily chart, Bollinger Bands are growing uncertainly: the price range is expanding from above, letting the bulls renew local highs. The MACD indicator is growing, maintaining a poor buy signal (the histogram is above the signal line). Stochastic has been located in the center of the working area for a long time, indicating the approximate balance of forces in the ultra-short term.

Resistance levels: 27.7500, 28.0000, 28.2500, 28.5000.

Support levels: 27.5000, 27.2166, 27.0000, 26.7500.

Trading tips

Short positions may be opened after 27.5000 is broken with the target at 27.0000. Stop loss – 27.7500. Implementation time: 2–3 days.

Long positions may be opened after growth and breakout of 28.0000 with the target at 28.5000. Stop loss – 27.7500.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.