NZD/USD: PRICE GROWTH MAY CONTINUE

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.6045 |

| Take Profit | 0.6103, 0.6164 |

| Stop Loss | 0.6005 |

| Key Levels | 0.5798, 0.5859, 0.5955, 0.6042, 0.6103, 0.6164 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.5950 |

| Take Profit | 0.5859, 0.5798 |

| Stop Loss | 0.6020 |

| Key Levels | 0.5798, 0.5859, 0.5955, 0.6042, 0.6103, 0.6164 |

Current trend

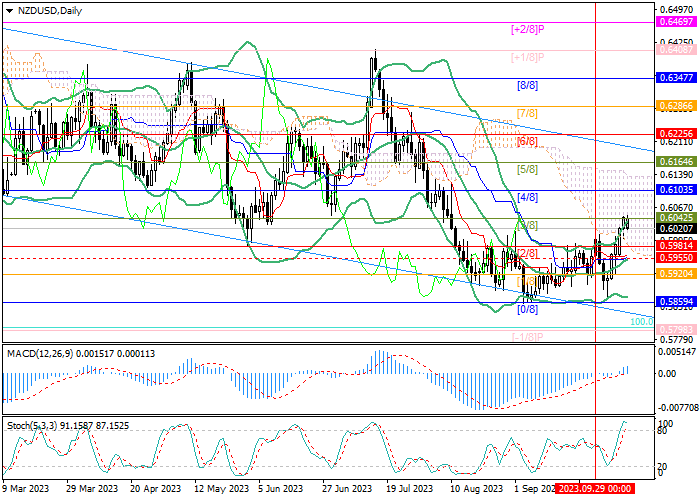

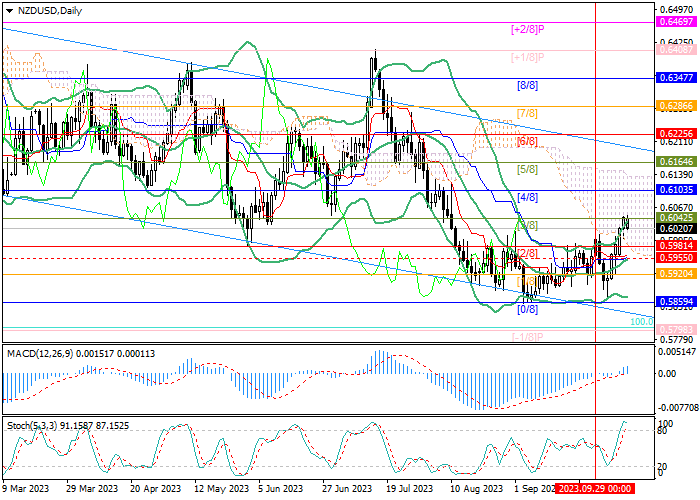

Last week, the NZD/USD pair had an ambigous dynamics: at first the price dropped to the area of 0.5870, but later the quotes resumed growth amid the decision of the Reserve Bank of New Zealand (RBNZ) to keep the interest rate at 5.50%, and now they are testing the 0.6042 mark (Murrey level [3/8]).

Additional support for NZD is provided by increased instability in the Middle East, which forces investors to turn to it as a safe haven asset. The US dollar, on the contrary, is losing ground amid uncertainty about the further actions of the US Federal Reserve. The situation in the US economy remains difficult for the regulator: on the one hand, inflation is showing clear signs of decline, but on the other hand, the labor market remains strong and consumption is stable, which can lead to a new acceleration in price growth. In these circumstances, many officials of the US Federal Reserve have changed their rhetoric from "hawkish" to "dovish" and are calling for greater caution: yesterday, the president of the Atlanta Federal Reserve Bank (FRB), Raphael Bostic, and the head of the Minneapolis FRB, Neel Kashkari, said that the regulator shouldn't raise rates again. The final certainty in the actions of the Fed may be made by the publication of September data on the consumer price index on Thursday. If the indicators continue to decline, the probability of stopping interest rate growth will increase, and USD will be under pressure.

Support and resistance

The price is testing the 0.6042 mark (Murrey level [3/8]), consolidation above which will allow continued growth to 0.6103 (Murrey level [4/8]) and 0.6164 (Murrey level [5/8]). The key for the "bears" is the central line of Bollinger Bands near 0.5955, the breakdown of which will allow the instrument to return to the levels of 0.5859 (Murrey level [0/8]) and 0.5798 (Murrey level [-1/8]).

Technical indicators do not give a clear signal: Bollinger Bands are reversing upwards, MACD is growing in the positive zone, but Stochastic is reversing downwards in the overbought zone.

Resistance levels: 0.6042, 0.6103, 0.6164.

Support levels: 0.5955, 0.5859, 0.5798.

Trading tips

Long positions may be opened above the level of 0.6042 with targets at 0.6103, 0.6164 and stop loss at 0.6005. Implementation period: 5-7 days.

Short positions may be opened below the level of 0.5955 with targets at 0.5859, 0.5798 and stop loss at 0.6020.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.