USD/CHF: THE INSTRUMENT DEVELOPS CORRECTIVE DECLINE

| Scenario | |

|---|---|

| Timeframe | Intraday |

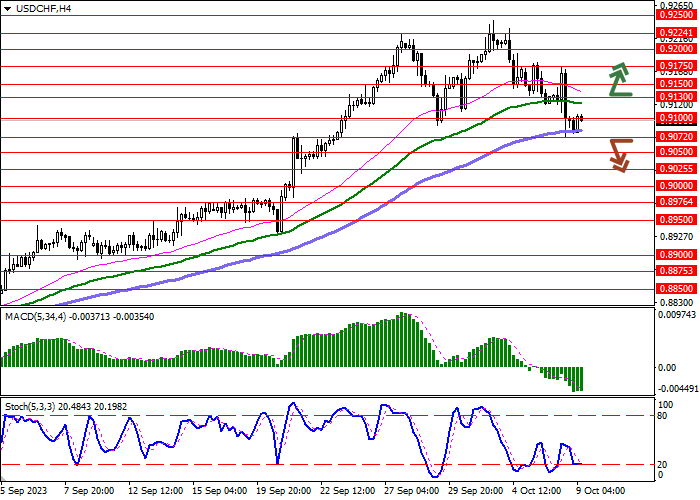

| Recommendation | SELL STOP |

| Entry Point | 0.9070 |

| Take Profit | 0.9025 |

| Stop Loss | 0.9100 |

| Key Levels | 0.9000, 0.9025, 0.9050, 0.9072, 0.9100, 0.9130, 0.9150, 0.9175 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9135 |

| Take Profit | 0.9200 |

| Stop Loss | 0.9100 |

| Key Levels | 0.9000, 0.9025, 0.9050, 0.9072, 0.9100, 0.9130, 0.9150, 0.9175 |

Current trend

The USD/CHF pair shows multidirectional dynamics, remaining close to 0.9100. Activity in the market remains quite low against the backdrop of closed markets in the United States on the occasion of Columbus Day.

At the same time, the position of the American currency remains under pressure after the publication of the September report on the US labor market last Friday, which reflected a sharp increase in the Nonfarm Payrolls from 227.0 thousand to 336.0 thousand, exceeding forecasts at 170.0 thousand. At the same time, the Unemployment Rate remained at 3.8%, and the Average Hourly Earnings adjusted from 4.3% to 4.2%. The presented data led to a slight revision of forecasts regarding a further increase in the cost of borrowing by the US Federal Reserve until the end of this year. In turn, the Unemployment Rate in Switzerland remained at 2.1% in September.

The focus of investors' attention this week will be macroeconomic statistics from the EU and the US on the dynamics of consumer and producer inflation for September. Forecasts for the US data on a monthly basis suggest a slowdown in price growth from 0.6% to 0.3%, while the annual rate is expected to be 3.7%, the same as the previous month. In Germany, the Producer Price Index may remain at 0.3% on a monthly basis and 4.5% on an annual basis.

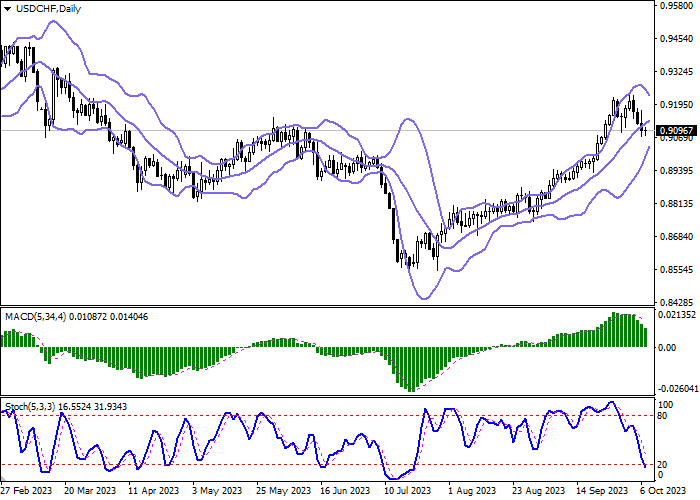

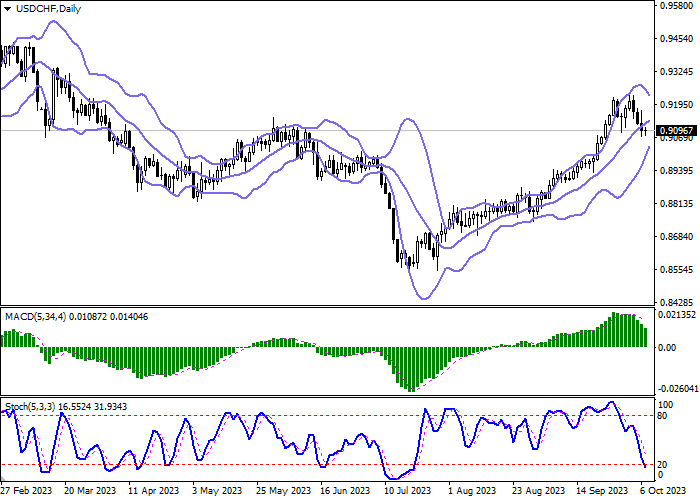

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic is showing similar dynamics, quickly approaching its lows and pointing to the risks of oversold American dollar in the ultra-short term.

Resistance levels: 0.9100, 0.9130, 0.9150, 0.9175.

Support levels: 0.9072, 0.9050, 0.9025, 0.9000.

Trading tips

Short positions may be opened after a breakdown of 0.9072 with the target at 0.9025. Stop-loss — 0.9100. Implementation time: 1-2 days.

The return of the "bullish" trend with the breakout of 0.9130 may become a signal for new purchases with the target of 0.9200. Stop-loss — 0.9100.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.