EUR/USD: EURO UNDER PRESSURE FROM POOR GERMAN FOREIGN TRADE DATA

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.0495 |

| Take Profit | 1.0376, 1.0253 |

| Stop Loss | 1.0580 |

| Key Levels | 1.0253, 1.0376, 1.0498, 1.0650, 1.0742, 1.0864 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.0650 |

| Take Profit | 1.0742, 1.0864 |

| Stop Loss | 1.0580 |

| Key Levels | 1.0253, 1.0376, 1.0498, 1.0650, 1.0742, 1.0864 |

Current trend

The EUR/USD pair is declining as part of the medium-term downward trend but yesterday, the quotes attempted a correction, rising to the area of 1.0530.

The American currency is under pressure after the publication of September employment data from Automatic Data Processing (ADP): the figure increased by 89.0K, significantly less than both the forecast of 153.0K and the August figure of 180.0K. The statistics caused investors to hope that a new tightening of the US Federal Reserve’s monetary policy this year will be avoided, given that among the regulator’s officials there are supporters of this approach: thus, yesterday, the chairman of the Federal Reserve Bank (FRB) of Atlanta, Raphael Bostic, said that it was necessary to increase the cost of borrowing no more but there were no reasons to start reducing it yet.

The negative trend resumed today as the euro came under pressure from poor German August statistics: exports adjusted by –1.2%, beating expectations of –0.4%, and imports changed by –0.4%, compared to a forecast increase of 0.5%. The trade surplus amounted to 16.6B euros, less than the July's 17.7B euros. Experts note that due to the reduction in global demand, foreign trade, which was the driver of growth in the German economy, is now impeding its recovery, which could negatively affect the entire region.

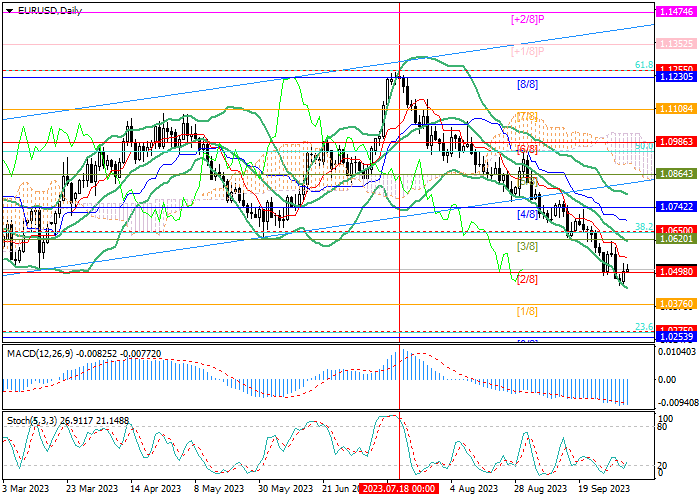

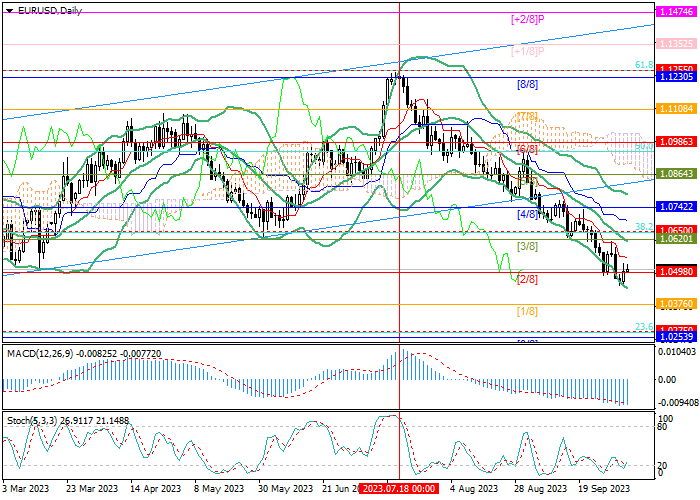

Support and resistance

The trading instrument is testing 1.0498 (Murrey level [2/8]), consolidation below which will allow the quotes to decline to the area of 1.0376 (Murrey level [1/8]) and 1.0253 (Murrey level [0/8], Fibonacci correction 23.6%). The key “bullish” level is 1.0650 (Fibonacci retracement 38.2%, middle line of Bollinger Bands), after breaking through which growth can resume to the area of 1.0742 (Murrey level [4/8]) and 1.0864 (Murrey level [5/8]).

Technical indicators confirm the continuation of the downward trend: Bollinger bands are declining, and the MACD histogram is stabilizing in the negative zone.

Resistance levels: 1.0650, 1.0742, 1.0864.

Support levels: 1.0498, 1.0376, 1.0253.

Trading tips

Short positions should be opened below 1.0498 with the targets at 1.0376, 1.0253, and stop loss 1.0580. Implementation time: 5–7 days.

Long positions may be opened above 1.0650 with the targets at 1.0742, 1.0864 and stop loss 1.0580.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.