XAG/USD: SILVER IS RECOVERING AFTER UPDATING ITS MARCH LOWS

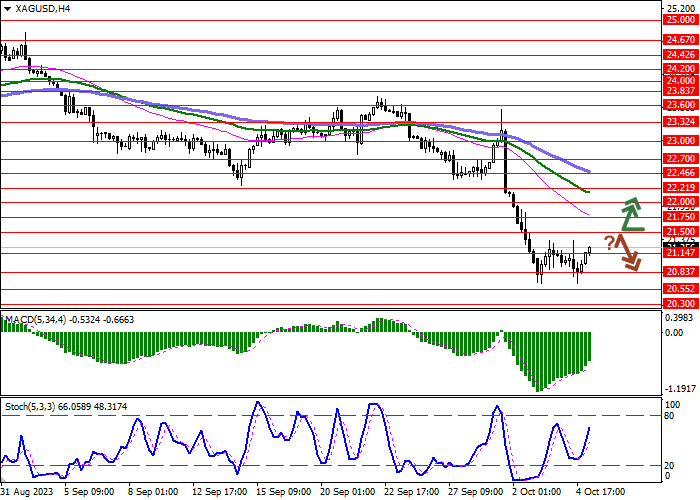

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 21.50 |

| Take Profit | 22.00 |

| Stop Loss | 21.20 |

| Key Levels | 20.30, 20.55, 20.83, 21.14, 21.50, 21.75, 22.00, 22.21 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 21.10 |

| Take Profit | 20.55 |

| Stop Loss | 21.50 |

| Key Levels | 20.30, 20.55, 20.83, 21.14, 21.50, 21.75, 22.00, 22.21 |

Current trend

The XAG/USD pair is showing moderate gains, recovering from its mid-March record lows earlier in the week. The instrument is testing 21.25, reacting to technical factors that are contributing to the weakening of the US currency. A report from Automatic Data Processing (ADP) on employment in the private sector, which was published yesterday, reflected a slowdown in dynamics from 180.0 thousand to 89.0 thousand, while analysts expected 153.0 thousand. The Services PMI from the Institute for Supply Management (ISM) in September fell from 54.5 points to 53.6 points, and the same indicator from S&P Global went down from 50.2 points to 50.1 points. However, silver remains under pressure from weak demand, especially amid a slower-than-expected economic recovery in one of the precious metal's biggest consumers, China, where electronics and renewable energy production are trending downward.

In turn, a strong increase in US Treasury yields puts additional pressure on the instrument's quotes. The day before, the rate on 10-year bonds rose to 4.850%, updating record highs from 2007 and approaching the psychological level of 5.000%, while the rate on 30-year bonds had already exceeded this level. The rise in yields can also be seen in the EU, where German 10-year bonds are trading at 3.000% for the first time since 2011. This suggests that markets expect interest rates to remain at high levels for a longer period.

Support and resistance

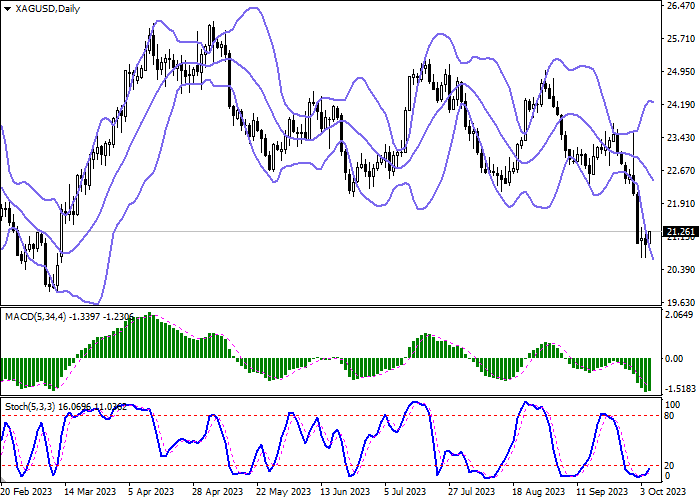

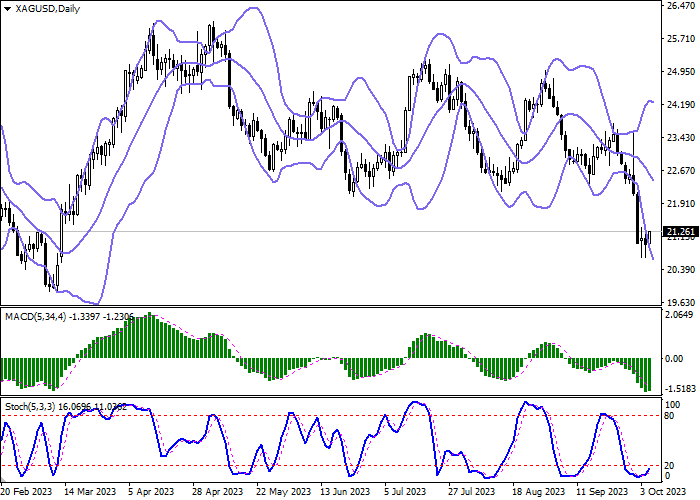

Bollinger Bands on the daily chart show a steady decline. The price range expands from below, making way for new local lows for the "bears". MACD is trying to reverse upwards but preserves its previous sell signal (located below the signal line). Stochastic shows similar dynamics, reversing upwards near its lows, indicating the risks of the instrument being oversold in the near future.

Resistance levels: 21.50, 21.75, 22.00, 22.21.

Support levels: 21.14, 20.83, 20.55, 20.30.

Trading tips

Long positions can be opened after a breakout of 21.50 with the target of 22.00. Stop-loss — 21.20. Implementation time: 1-2 days.

A rebound from 21.50 as from resistance, followed by a breakdown of 21.14 may become a signal for opening of new short positions with the target at 20.55. Stop-loss — 21.50.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.