WTI CRUDE OIL: CHINESE “GOLDEN WEEK” WILL BECOME A CATALYST FOR GROWTH IN DOMESTIC OIL DEMAND

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 91.72 |

| Take Profit | 96.88, 100.00 |

| Stop Loss | 89.95 |

| Key Levels | 84.38, 87.50, 93.75, 96.88, 100.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 87.50 |

| Take Profit | 84.38 |

| Stop Loss | 89.70 |

| Key Levels | 84.38, 87.50, 93.75, 96.88, 100.00 |

Current trend

The price of WTI Crude Oil is moving within the framework of a medium-term upward trend: last week the quotes attempted to decline but are currently holding around 91.66.

In China, today, the Golden Week begins, associated with the anniversary of the country’s founding, during which the volume of domestic traffic increases significantly, which has a positive effect on the oil consumption within the second world economy: thus, experts note that the average number of flights only in the beginning of the holidays increased by 20.0%. At the same time, oil reserves in the United States, according to the Energy Information Administration of the US Department of Energy (EIA), decreased by 2.170M barrels, and the minimum since July 2022 was recorded in the Cushing storage facility.

The asset is further supported by the continued ban on the export of gasoline and diesel fuel from Russia, as well as the fall in inflation in the EU, which may allow the European Central Bank (ECB) to finally abandon the policy of increasing interest rates and not create additional pressure on the economy.

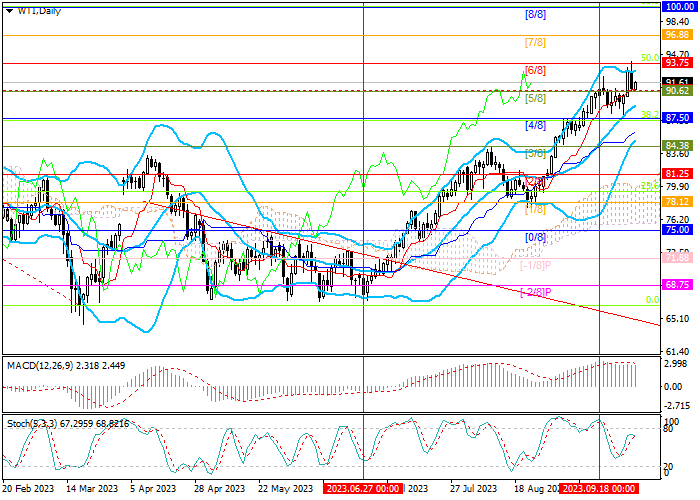

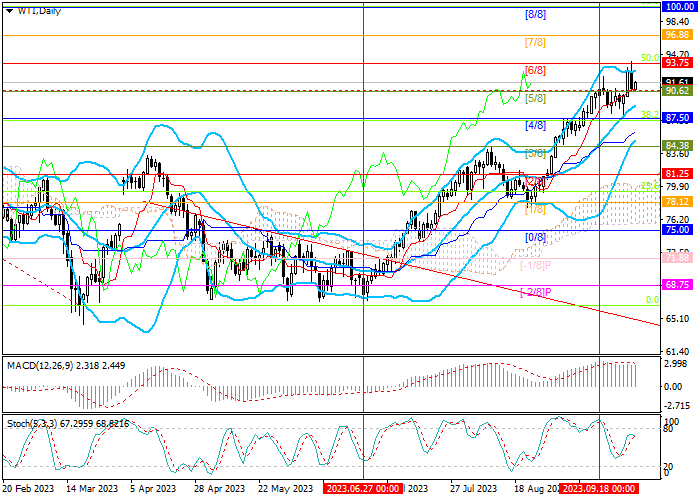

Support and resistance

The trading instrument is trying to resume growth from 90.62 (Murrey level [5/8]) to the area of 93.75 (Murrey level [6/8], Fibonacci correction 50.0%), 96.88 (Murrey level [7/8]) and 100.00 (Murrey level [8/8]). The key “bearish” level is 87.50 (Murrey level [4/8], Fibonacci correction 38.2%) below the middle line of Bollinger Bands, a breakdown of which will give the prospect of a decline to 84.38.

Technical indicators confirm the continuation of the upward trend: Bollinger Bands and Stochastic are directed upward, and the MACD histogram is stable in the positive zone.

Resistance levels: 93.75, 96.88, 100.00.

Support levels: 87.50, 84.38.

Trading tips

Long positions may be opened from the current level with the targets at 96.88, 100.00 and stop loss 89.95. Implementation time: 5–7 days.

Short positions should be opened below 87.50 with the target at 84.38 and stop loss 89.70.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.