USD/CAD: THE QUOTES ARE TARGETING THE SEPTEMBER HIGH OF 1.3690

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 1.3510 |

| Take Profit | 1.3690 |

| Stop Loss | 1.3450 |

| Key Levels | 1.3140, 1.3385, 1.3510, 1.3690, 1.3830, 1.3960 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3380 |

| Take Profit | 1.3140 |

| Stop Loss | 1.3455 |

| Key Levels | 1.3140, 1.3385, 1.3510, 1.3690, 1.3830, 1.3960 |

Current trend

A record strengthening of the American dollar and a decline in oil prices are pushing the USD/CAD pair to September highs: the American currency has been growing for eleven weeks, reaching 106.00 in the USD Index.

Positive dynamics are developing against strong US macroeconomic statistics: Q2 gross domestic product (GDP) amounted to 2.1%, meeting the forecast, and initial jobless claims reached 204.0K compared to expectations of 215.0K. Price personal consumption expenditure index for August increased from 3.4% to 3.5% YoY, as analysts expected but the price of WTI Crude Oil over the past week first increased to 95.30, and then adjusted to 91.15, putting pressure on the Canadian dollar.

Data on the Canadian economy disappointed investors: gross domestic product (GDP) for July was 0.0%, worse than the 0.1% forecast but better than the –0.2% previously forecast. The CFIB Business Barometer for September is at 48.7 points, well below expectations of 54.0 points and the previous reading of 54.7 points but preliminary industrial sales for August corrected 1.0%, exceeding the 0.7% estimate.

As long as US GDP continues to grow and the labor market remains strong the American dollar may grow. Lower oil prices will put pressure on the Canadian currency, and if national macroeconomic data does not improve, the USD/CAD pair will continue to rise and regain its long-term upward trend after consolidating above 1.3830.

Support and resistance

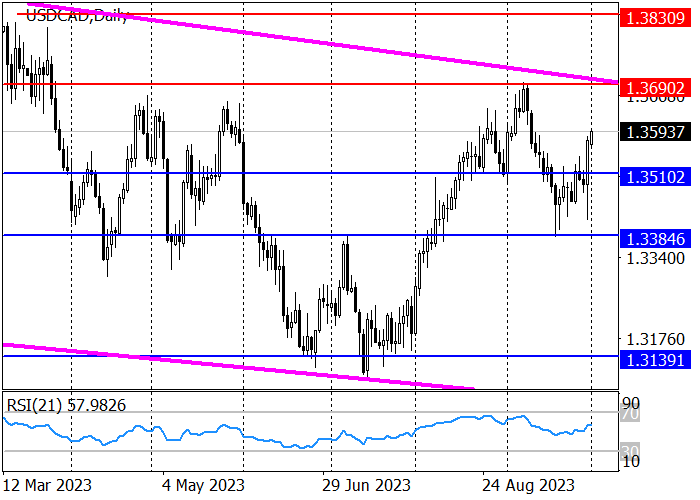

The long-term downward trend continues: the price is trading in the channel, marked on the chart with sloping lines. This week, it may reach the upper border of the channel around resistance level 1.3690, after breaking through which, growth may continue to 1.3830.

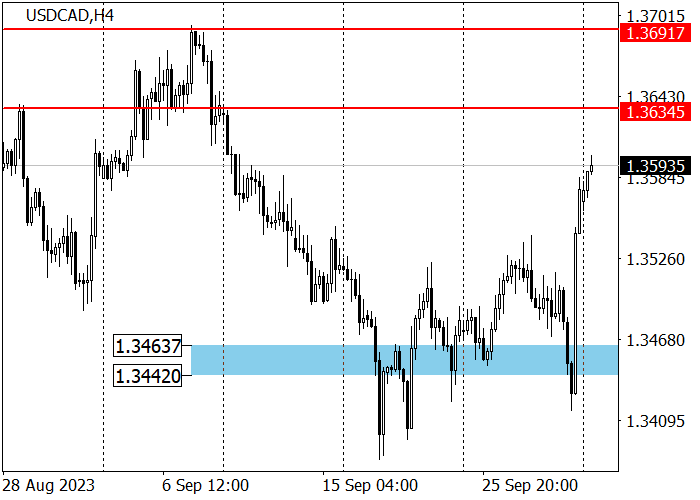

The medium-term trend, despite testing the key support area of 1.3463–1.3442 during September, remained upward and the positive trend continued last week. Now, the quotes are approaching the local resistance level of 1.3635, if it is overcome, the next target will be 1.3690, and then zone 3 (1.3791–1.3768). To reverse the medium-term trend downwards, sellers need to renew the September low of 1.3380 and consolidate below it.

Resistance levels: 1.3690, 1.3830, 1.3960.

Support levels: 1.3510, 1.3385, 1.3140.

Trading tips

Long positions may be opened from 1.3510 with the target at 1.3690 and stop loss around 1.3450. Implementation time: 9–12 days.

Short positions may be opened below 1.3385 with the target at 1.3140 and stop loss around 1.3455.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.