USD/JPY:

THE DIFFERENCE IN THE MONETARY APPROACHES OF THE US FEDERAL RESERVE AND THE BANK OF JAPAN PUTS PRESSURE ON THE YEN

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 149.10 |

| Take Profit | 150.00, 151.56 |

| Stop Loss | 148.50 |

| Key Levels | 143.75, 145.31, 146.87, 150.00, 151.56 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 146.85 |

| Take Profit | 145.31, 143.75 |

| Stop Loss | 147.80 |

| Key Levels | 143.75, 145.31, 146.87, 150.00, 151.56 |

Current trend

The USD/JPY pair is moving within a long-term uptrend, trading at 149.00 and under pressure from the different monetary approaches of the US Federal Reserve and the Bank of Japan.

The yen is under pressure due to the difference in monetary approaches between the US Federal Reserve and the Bank of Japan. As the American regulator carried out a cycle of serious rate increases and may increase it again before the end of this year, despite the September pause, the Japanese officials maintain economic incentives, despite the rapid pace of inflation in the country. Yesterday, the position was confirmed by the head of the department, Kazuo Ueda, who said that there was great uncertainty as to whether companies would continue to raise prices and wages, which is a hint of maintaining ultra-loose monetary policy. In addition, officials note the possibility of currency interventions in the market in the event of further weakening of the national currency since, in their opinion, it is caused by speculative actions and not by natural fundamental factors. Previously, such statements led to a course correction but now investors have lost sensitivity to them. Experts believed that the government would act after quotes exceeded 145.00 but more than a month has passed since then, and Japanese officials have still not taken any steps. The new key level may be 150.00, however, in this case, experts expect only temporary support for the yen’s positions but not a change in the current upward trend.

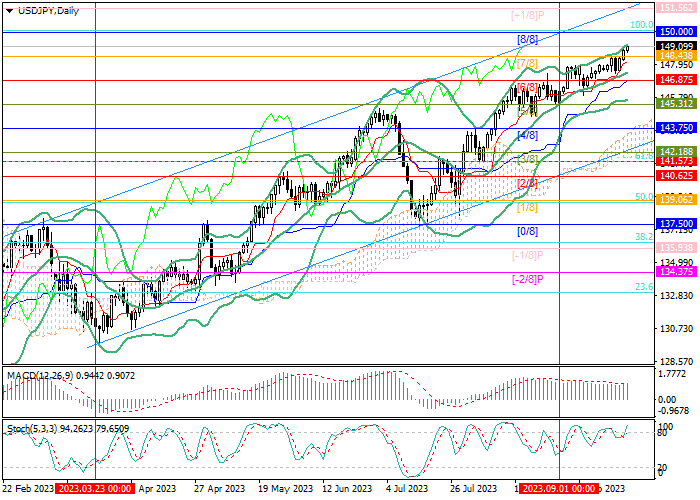

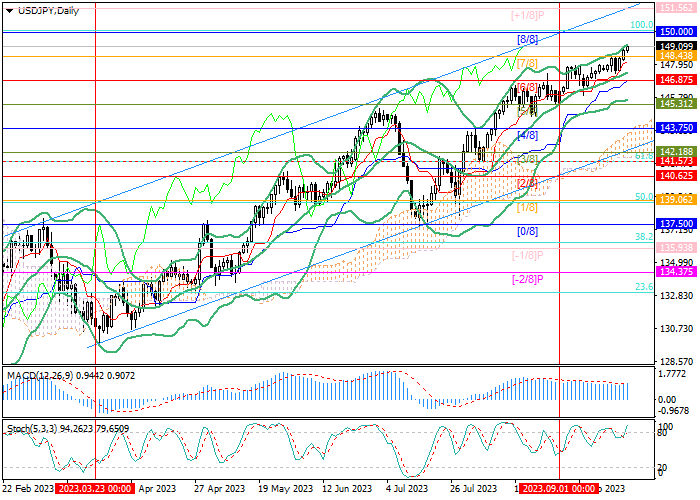

Support and resistance

The trading instrument is moving in a long-term upward corridor: the price has risen above 149.00 and may continue to rise to the area of 150.00 (Murrey level [8/8]) and 151.56 (Murrey level [ 1/8]). If the price breaks below 146.87 (Murrey level [6/8]) under the middle line of Bollinger Bands, it may reach the area of 145.31 (Murrey level [5/8]) and 143.75 (Murrey level [4/8]).

Technical indicators reflect the continuation of the upward trend: Bollinger Bands and Stochastic are reversing upwards, and the MACD histogram is stabilizing in the negative zone.

Resistance levels: 150.00, 151.56.

Support levels: 146.87, 145.31, 143.75.

Trading tips

Long positions may be opened from 149.10 with the targets at 150.00, 151.56 and stop loss 148.50. Implementation time: 5–7 days.

Short positions may be opened below 146.87 with the targets at 145.31, 143.75 and stop loss around 147.80.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.