- Most brokerage clients lost money in August 2023. But how much?Finance Magnates launches a new series of monthly analyses.

- Investing is a zero-sum game, where one person's win is another's loss. The majority of retail investors lose money, a fact underscored by risk warnings on nearly every regulated broker's website. But how many clients are actually profitable, and which investment firms have the highest percentage of such traders? Finance Magnates Intelligence set out to find out, and the results are detailed in this article.

-

TeleTrade and Saxo Bank Clients Show Highest Profitability

Finance Magnates publishes a quarterly list of the largest retail CFD brokers by volume (subscribe to the Quarterly Industry Report for full access). Based on this list, we selected 20 of the largest retail brokers who publish their clients' profit-loss ratios and update them monthly.

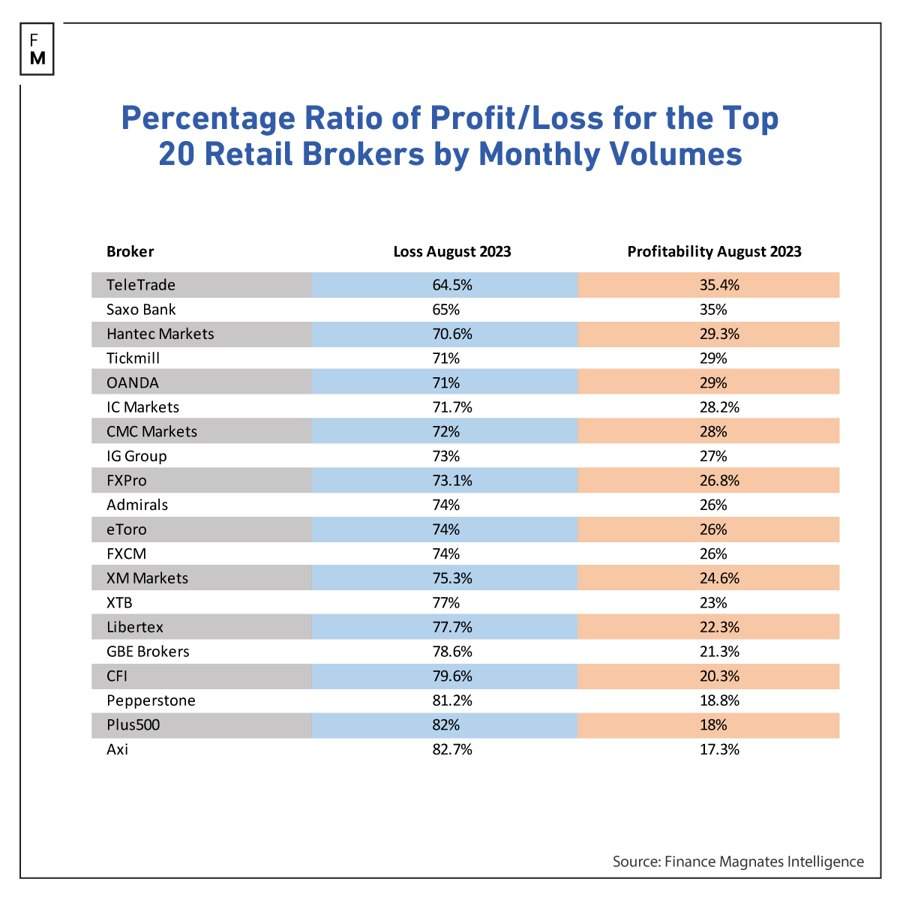

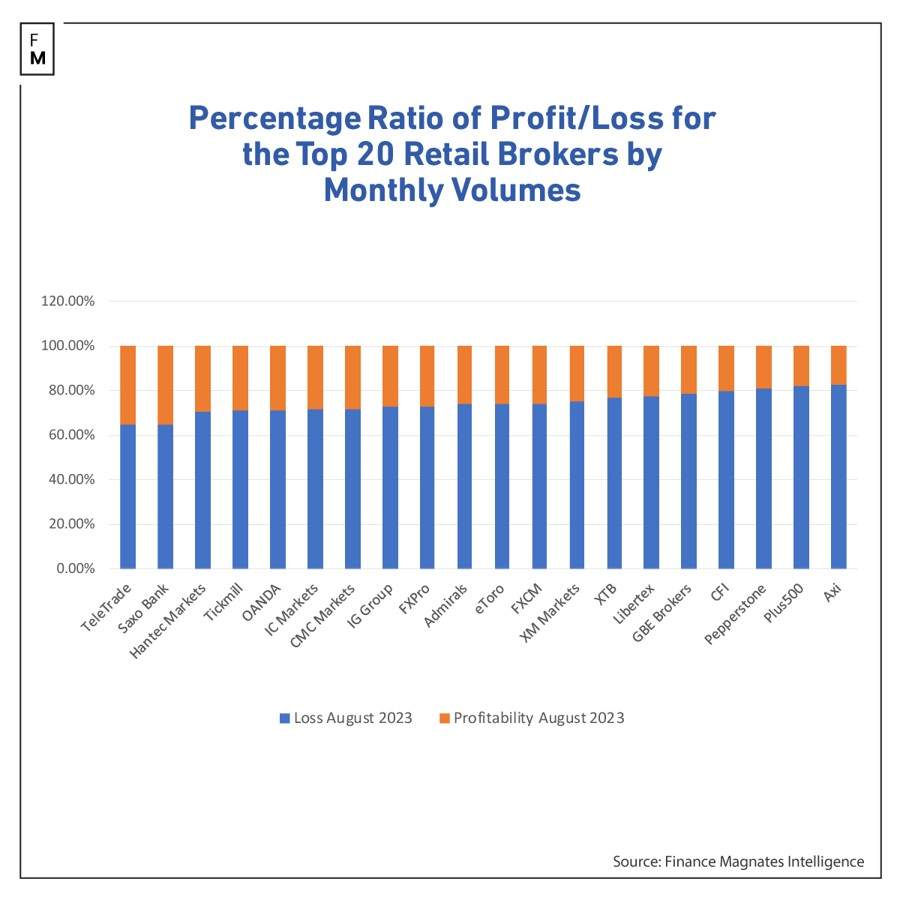

From the gathered data, only one in four investors made a profit (or did not lose) during August. Nearly 75% incurred losses, indicating that the number of profitable traders is relatively small, and most investors remain 'capital donors.'

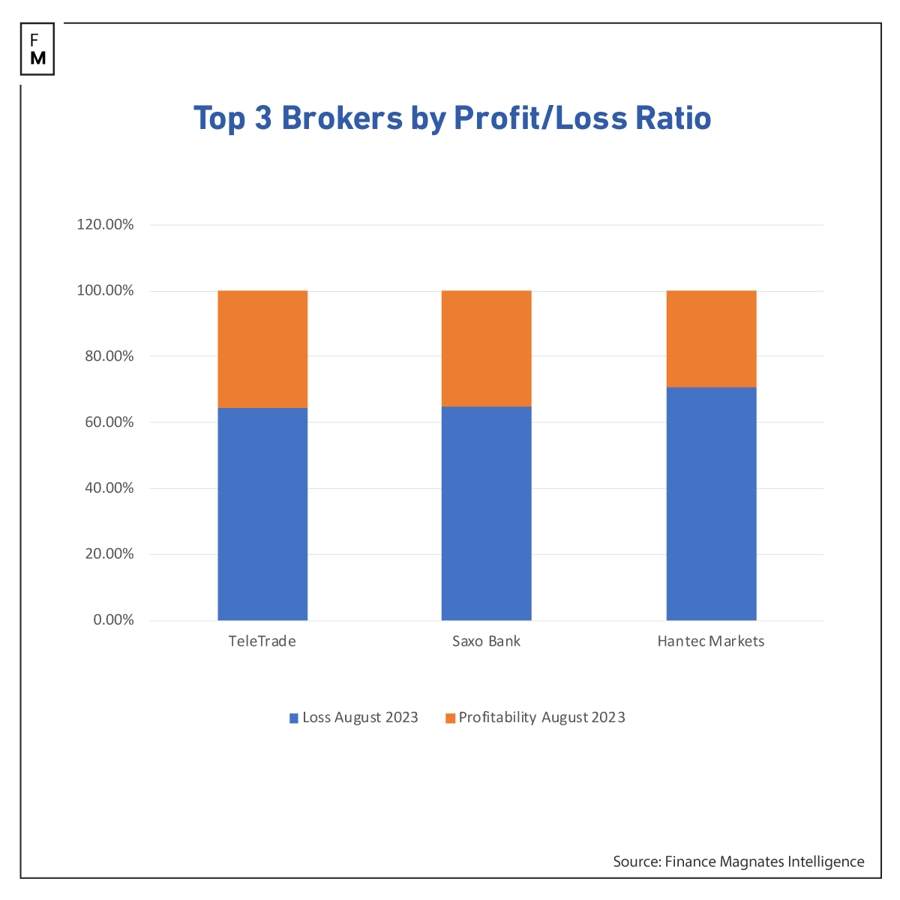

The ranking shows that clients of brokers TeleTrade and Saxo Bank achieved the highest profitability at 35%. Hantec Markets came in third with profitability of 29.38%, closely followed by Tickmill and OANDA at 29%.

The data also suggests that for the vast majority of surveyed brokers, profitability remained above 25%. For eight firms, however, it was lower. XM Markets had a profitability of 24.67%, and XTB had 23%. Only three brokers fell below 20% in the last month: Axi at 17.3%, Plus500 at 18%, and Pepperstone at 18.8%.

According to a recent study by Capital.com, individual traders looking to boost their profitability should focus on diversifying their investments and timing them properly. Most investors concentrate on just a few asset classes, but diversification across five different significantly increases average profitability.Methodology and Future Publications

As mentioned earlier, Finance Magnates Intelligence chose the 20 largest brokers by volume who publish monthly information on the percentage of profitability and losses. The list was then sorted by brokers where the highest percentage of clients were profitable.

This is the first publication of this kind of report. In the future edition, we will also compare dynamics changes between individual months, quarters, and years. The list of analyzed brokers may also change over time due to fluctuating monthly volumes among different brokers.

You can also check our recent report describing the change in monthly spot volumes of the most popular centrlized crypto exchanges.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now