Have you ever felt like you were caught in an endless whirlwind of trading that just wouldn't stop? Do you often chase new opportunities, only to find yourself trapped in a dangerous practice known as overtrading? If so, you're not alone. Overtrading is one of the common mistakes that often haunts the world of trading, and its consequences can damage your finances, emotions, and even your reputation as a trader.

In this article, we will explore the complexities of overtrading, identify the warning signs, and provide concrete strategies to avoid it. We will guide you through the journey of resisting the temptation to make unnecessary and harmful trades. Together, let's learn how to control our instincts, recognize the traps, and transform the way you trade to make it more efficient and profitable. Welcome to the journey toward smarter and wiser trading.

Understanding the Often Overlooked Pitfalls in the World of Trading

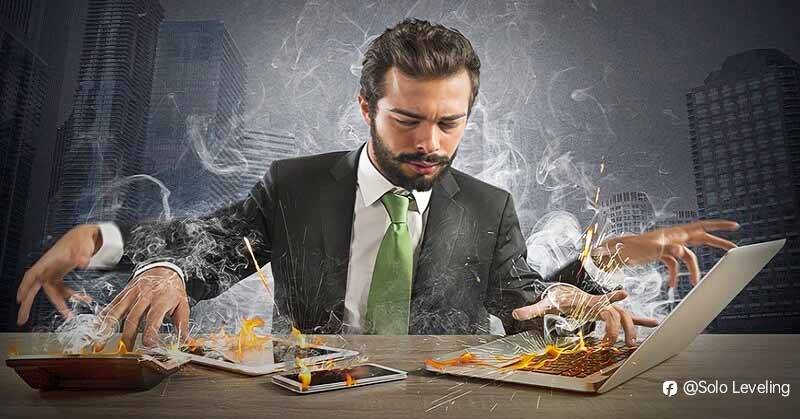

Overtrading is the excessive practice of making trades in the financial markets, where a trader engages in trading activities that go beyond healthy and rational limits. It occurs when a trader too frequently opens positions, invests too much money, or trades with sizes that are not in line with their account balance or established strategy. In simple terms, overtrading is like 'overcooking in the kitchen,' which leads to wasting ingredients and the potential of burning the dish.

Essentially, overtrading is driven by emotional impulses to keep participating in the market without a well-thought-out plan or careful analysis. It can happen when traders feel the need to 'get even' after experiencing losses or when they are tempted by rapid price fluctuations. As a result, financial risks increase, and often traders lose control of their portfolios. Overtrading is akin to speeding on a winding road; although it may feel enjoyable momentarily, the risks are very high, and the outcomes are often detrimental.

For those who are new to the world of trading, it's crucial to understand that overtrading is not a wise tactic. On the contrary, success in trading is typically associated with disciplined control and wise execution. By avoiding the traps of overtrading, you can keep your trading account safe and achieve more consistent results in the long run.

Risks and Consequences to Be Aware Of

At first glance, it might seem tempting to keep trading and try to maximize profits. However, it's essential to understand that overtrading can bring about several serious negative consequences that every trader should be wary of:

- Significant Financial Losses: Overtrading often means opening too many positions, too large positions, or positions with excessively high risks. Consequently, when the market moves against you, financial losses can quickly escalate. This can deplete your trading account rapidly and make recovery challenging.

- High Emotional Stress: Overtrading is often accompanied by high-pressure and stress. When you're caught in a cycle of excessive trading, the constant pressure to generate profits can take a toll on your emotional well-being. This can lead to anxiety, restlessness, and even health problems caused by stress.

- Emotional Instability: Overtrading can disrupt your emotional balance. When you feel trapped in non-stop trading, your mood can fluctuate dramatically. This can have a negative impact on your personal life, social relationships, and overall well-being.

- Damage to Trader Reputation: Uncontrolled overtrading can damage your reputation as a trader. A good reputation requires discipline, consistency, and success in risk management. When you frequently make overtrading mistakes, fellow traders and investors may lose trust in your abilities.

- Inability to Stick to Consistent Strategies: Overtrading often leads to deviations from the originally planned trading strategies. This can cause you to lose focus on your plan and analysis, reducing the likelihood of long-term success.

Understanding the potential negative impacts of overtrading, traders can be more cautious and wise in managing their trading activities. Taking steps to avoid overtrading is a key to maintaining a stable financial and emotional balance in the dynamic world of trading.

Control Your Emotions to Avoid Overtrading

In the world of trading, psychology often becomes the determining factor between success and failure. Overtrading, essentially, is the result of a trader's struggle with their own emotions. To understand how overtrading can occur, we need to delve deeper into trading psychology:

Emosional Urges: Overtrading is often triggered by emotional urges like greed, fear of missing out, or an inability to accept losses. When traders can't control these emotions, they tend to make unnecessary trades.

Weakening of Discipline: Trading psychology can weaken the discipline required to follow a trading plan. Traders who get too emotionally involved often forget the rules they've set for themselves.

FOMO (Fear of Missing Out): Trading psychology also encompasses the fear of missing out, where traders fear missing out on seemingly excellent profit opportunities. As a result, they enter positions without careful consideration.

How to Control Emotions While Trading?

- Solid Trading Plan: Create a clear and strict trading plan before entering the market. This plan should include your strategy, profit targets, and predefined risk levels.

- Use Stop-Loss Orders: Set up stop-loss orders for each of your positions. This helps avoid significant losses when the market moves against you.

- Limit the Number of Trades: Establish daily or weekly limits on the number of trades you will execute. This helps prevent overtrading.

- Tight Risk Management: Never invest more than you can afford to lose. Strict risk management will help you avoid substantial losses.

- Analyze Your Emotions: Understand your emotions while trading. If you feel overly emotional, consider taking a break or temporarily stopping trading.

- Education and Training: Learn more about trading psychology. Numerous books and resources are available to help traders control their emotions.

Recognizing the role of psychology in trading and implementing appropriate emotional control strategies, traders can increase their chances of success while avoiding the detrimental pitfalls of overtrading.

Conclusion

In the journey through this complex world of trading, we have delved deeper into the dangerous phenomenon known as overtrading. We've discussed the definition of overtrading, its serious negative impacts, and even understood the vital role of psychology in creating this trap.

In conclusion, avoiding overtrading is the key to maintaining success and balance in your trading. We want to remind you of the crucial points we've discussed:

- Definition of Overtrading: Overtrading is the excessive practice of making trades that can damage your trading account and emotional balance.

- Negative Impacts: Overtrading can result in significant financial losses, high stress, emotional instability, and damage to a trader's reputation.

- Trading Psychology: Emotional control is the key to avoiding overtrading. A solid trading plan, good risk management, and an understanding of emotional impulses are essential tools in resisting the temptation of overtrading.

Why is this important? Because avoiding overtrading is the first step toward wiser trading, which can maximize your profit potential while minimizing unnecessary loss risks. If you aspire to achieve long-term success in the world of trading, discipline and self-control are the keys.

So, remember the importance of sticking to your trading plan, controlling your emotions, and maintaining balance. By doing so, you'll be able to avoid the trap of overtrading and navigate the financial markets with greater confidence and wisdom. Happy and successful trading!

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

-THE END-