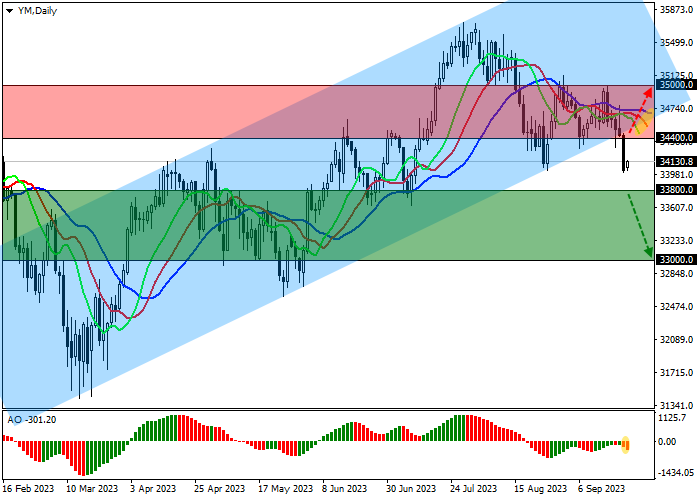

DJIA: TRADING BELOW THE SUPPORT LINE OF THE GLOBAL ASCENDING CHANNEL 35600.0–34200.0

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 33800.0 |

| Take Profit | 33000.0 |

| Stop Loss | 34100.0 |

| Key Levels | 33000.0, 33800.0, 34400.0, 35000.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 34400.0 |

| Take Profit | 35000.0 |

| Stop Loss | 34000.0 |

| Key Levels | 33000.0, 33800.0, 34400.0, 35000.0 |

Current trend

The Dow Jones index is correcting in the local trend, trading at 34130.0.

After the US Fed decided to keep the interest rate at 5.50%, as well as subsequent comments that the value may be increased in the future, investors are carefully assessing macroeconomic statistics. Thus, the average number of applications for unemployment benefits over the past four weeks decreased from 224.75K to 217.0K, and sales in the secondary housing market decreased from 4.07M to 4.04M for the seventh month in a row.

The main pressure on stock markets is exerted by the growth of bonds. Yesterday, an auction was held for the placement of 10-year TIPS, the rate for which was 2.094%, far exceeding the 1.495% recorded during the last placement. In turn, 10-year Treasury bonds are trading at a yield of 4.502%, having added 0.40% since yesterday's close, and the rate on 30-year securities increased by 0.55% to 4.577%.

The growth leaders in the index are UnitedHealth Group Inc. ( 1.83%), The Walt Disney Co. ( 0.26%), Intel Corp. ( 0.12%).

Among the leaders of the decline are Cisco Systems Inc. (-3.89%), Dow Inc. (-2.78%), Nike Inc. (-2.61%).

Support and resistance

On the daily chart, the index quotes continue their corrective dynamics, trading below the support line of the global ascending channel with the boundaries of 35600.0–34200.0.

Technical indicators reversed again and issued a new sell signal: the range of EMA fluctuations of the alligator indicator began to expand in the direction of decline, and the AO histogram forms new descending bars, moving away from the transition level.

Support levels: 33800.0, 33000.0.

Resistance levels: 34400.0, 35000.0.

Trading tips

If the asset reverses and declines and the price consolidates below the local support level of 33800.0, short positions can be opened with a target at 33000.0. Stop-loss – 34100.0. Implementation time: 7 days and more.

If the local growth continues, long positions that can be opened if the price overcomes the resistance level of 34400.0 with a target at 35000.0 and stop-loss at 34000.0 will be relevant.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.