EBAY INC.: MANAGEMENT EXPECTS EARNINGS PER SHARE IN THE RANGE OF 0.96–1.01 DOLLARS IN Q3

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 45.05 |

| Take Profit | 47.50 |

| Stop Loss | 44.00 |

| Key Levels | 40.00, 42.50, 45.00, 47.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 42.45 |

| Take Profit | 40.00 |

| Stop Loss | 43.50 |

| Key Levels | 40.00, 42.50, 45.00, 47.50 |

Current trend

The price of stocks of the American online retail company eBay Inc. is correcting around 43.95.

The issuer has published a statement on its website saying that it supports the proposal received by the Norwegian company Adevinta ASA regarding the optional repurchase of all shares. eBay Inc. owns a fairly large package of the issuer's securities and intends to keep most of it even if the offer is implemented.

The financial report for Q3 will be published on October 25. In the forecast, the company expects earnings per share in the range of 0.96–1.01 dollars, which coincides with analysts' assumptions of 0.99 dollars. Revenue expectations range from 2.46B dollars to 2.52B dollars, which also corresponds to the experts' estimate of 2.5B dollars. The dividends have not yet been determined, but they will obviously amount to 0.25 dollars per paper, which is equivalent to 2.25% per annum. The last payment took place on September 15, and taking into account stock quotes, the yield reached 2.23%.

Support and resistance

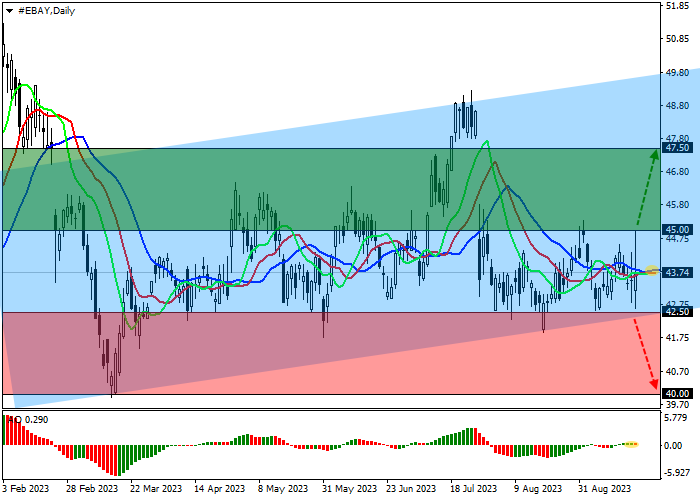

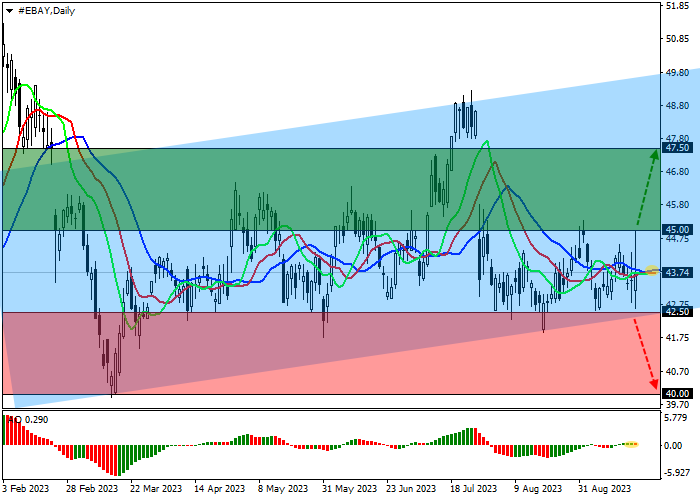

On the daily chart, the securities are trading within the local ascending corridor with the boundaries of 50.00–42.00, holding near the support line.

Technical indicators hold an unstable signal: the range of EMA fluctuations on the alligator indicator remains narrow, and the AO histogram forms new correction bars, being just above the transition level.

Support levels: 42.50, 40.00.

Resistance levels: 45.00, 47.50.

Trading tips

If the asset reverses and continues growth, as well as the price consolidates above the local maximum of 45.00, long positions will be relevant with a target at 47.50. Stop-loss – 44.00. Implementation time: 7 days and more.

If the asset reverses and declines and the price consolidates below the support level at 42.50, short positions can be opened with a target at 40.00 and stop-loss at 43.50.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.