NZD/USD: TRADING IN A LONG-TERM DOWNTREND

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 0.6010 |

| Take Profit | 0.5890 |

| Stop Loss | 0.6040 |

| Key Levels | 0.5750, 0.5870, 0.5890, 0.6010, 0.6110, 0.6245 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6040 |

| Take Profit | 0.6110 |

| Stop Loss | 0.6010 |

| Key Levels | 0.5750, 0.5870, 0.5890, 0.6010, 0.6110, 0.6245 |

Current trend

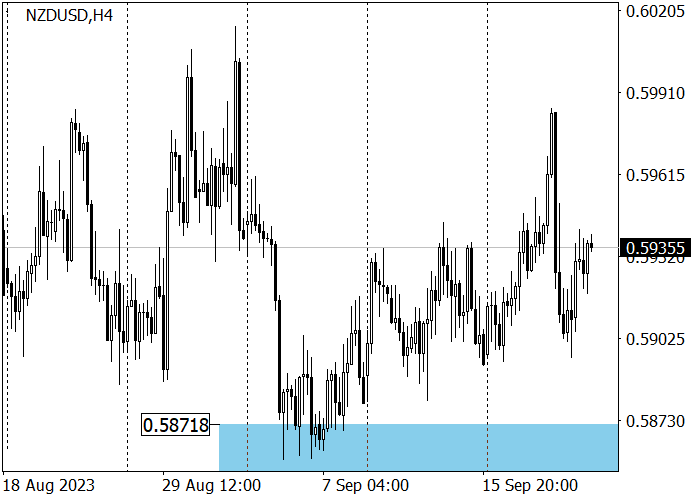

The NZD/USD pair is preparing to end the week with slight growth: after unsuccessful attempts to break the support area of 0.5890–0.5870 at the beginning of the month, the quotes reached 0.5940.

Positive dynamics are developing against the backdrop of New Zealand’s macroeconomic statistics: Q3 Westpac consumer sentiment index fell from 83.1 points to 80.2 points but export volumes increased from 6.55B New Zealand dollars to 7.28B New Zealand dollars, and imports fell from 5.38B New Zealand dollars to 4.99B New Zealand dollars. Q2 gross domestic product (GDP) rose from 0.0% to 0.9%, exceeding the forecast of 0.5%, and it adjusted from 2.2% to 1.8% YoY, higher than estimates by 1.2%. Credit card spending rose to 4.2% in August but Westpac’s Q3 consumer confidence index fell short of early estimates of 81.5 at 80.2, holding back the currency’s strength.

The asset is moving in a long-term downward trend: quotes reached the support area of 0.5890–0.5870 and began an upward correction, within which a test of the resistance level of 0.6010 is expected, from which new sales along the trend can be considered with the target at 0.5890 and further, 0.5750.

The medium-term trend is downward: after reaching zone 3 (0.5871–0.5853) in early September, the price corrects with a possible target at the trend resistance level of 0.6057–0.6039, from where new sales with the target at the September low of 0.5862 may be opened. If zone 3 is broken out, the next sales target will be zone 4 (0.5691–0.5673), which may take several weeks to reach.

Support and resistance

Resistance levels: 0.6010, 0.6110, 0.6245.

Support levels: 0.5890, 0.5870, 0.5750.

Trading tips

Short positions may be opened from 0.6010 with the target at 0.5890 and stop loss around 0.6040. Implementation time: 9–12 days.

Long positions may be opened above 0.6040 with the target at 0.6110 and stop loss around 0.6010.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.