WTI CRUDE OIL: “BLACK GOLD” QUOTES ARE APPROACHING 89.77

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 90.00 |

| Take Profit | 87.00 |

| Stop Loss | 91.50 |

| Key Levels | 74.00, 78.44, 83.40, 89.77, 93.50, 97.30 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 91.50 |

| Take Profit | 95.00 |

| Stop Loss | 90.00 |

| Key Levels | 74.00, 78.44, 83.40, 89.77, 93.50, 97.30 |

Current trend

WTI Crude Oil quotes are rising, trading at 88.57, after the publication of the monthly OPEC report, which reflected the insufficient level of oil supply on the market.

In the fourth quarter, the largest oil shortage in ten years of 3.0M barrels per day was recorded due to a reduction in supplies from Saudi Arabia and the Russian Federation. Also, as part of the OPEC deal, oil production decreased in August by 35.0K barrels per day, and as a result, the cartel maintained its forecast for the growth of global demand for “black gold” in 2023 at 2.4M barrels per day, and in 2024 – by 2.2M barrels per day.

At the same time, economic growth in the United States, the largest consumer of fuel, remains stable: thus, Q2 gross domestic product (GDP) amounted to 2.6% YoY, although tightening monetary policy and high inflation put pressure on the country’s economy. Today, August inflation data will be presented: the consumer price index is expected to rise from 0.2% to 0.6% MoM and from 3.2% to 3.6% YoY, while the core value will remain at 0.2% MoM and decrease from 4.7% to 4.3% YoY, allowing the regulator officials to pause in the “hawkish” cycle.

Yesterday, data from the American Petroleum Institute (API) was published, which, contrary to forecasts, reflected an increase from –5.521M barrels to 1.147 M barrels. The Energy Information Administration of the US Department of Energy (EIA) will record a correction from –6.307M barrels to –1.912M barrels earlier today.

Soon, there is no reason to reduce prices, and the only thing the “bears” can count on is a further slowdown in the Chinese economy and a technical correction on the chart.

Support and resistance

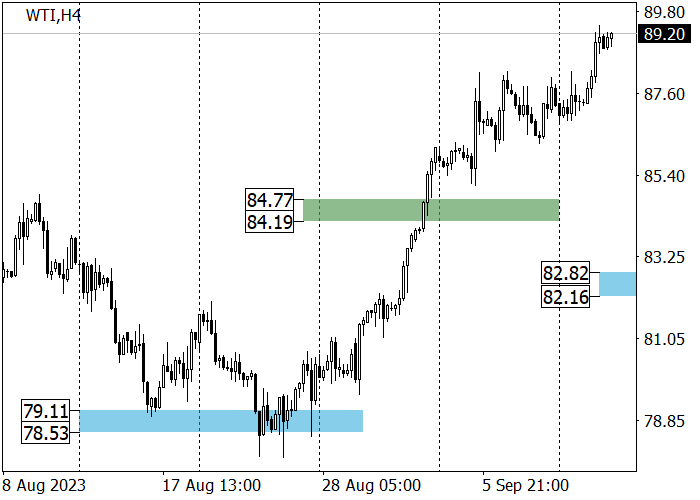

The long-term trend is upward: the price is approaching the resistance level of 89.77, after breaking through which an increase to 93.50 is possible, otherwise, a correction to the support level of 83.40 is expected. The RSI indicator (21) has entered the overbought area, which signals a possible price reversal.

The medium-term trend is upward: last week, the quotes consolidated above zone 3 (84.77–84.19), and the next target was zone 4 (91.45–90.79). The key support for the trend is shifting to the area 82.82–82.16, and if it is reached within the correction, long positions with the target at the current week’s high of 89.20 are relevant.

Resistance levels: 89.77, 93.50, 97.30.

Support levels: 83.40, 78.44, 74.00.

Trading tips

Short positions may be opened from 90.00 with the target at 87.00 and stop loss around 91.50. Implementation time: 9–12 days.

Long positions may be opened above 91.50 with the target at 95.00 and stop loss around 90.00.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.