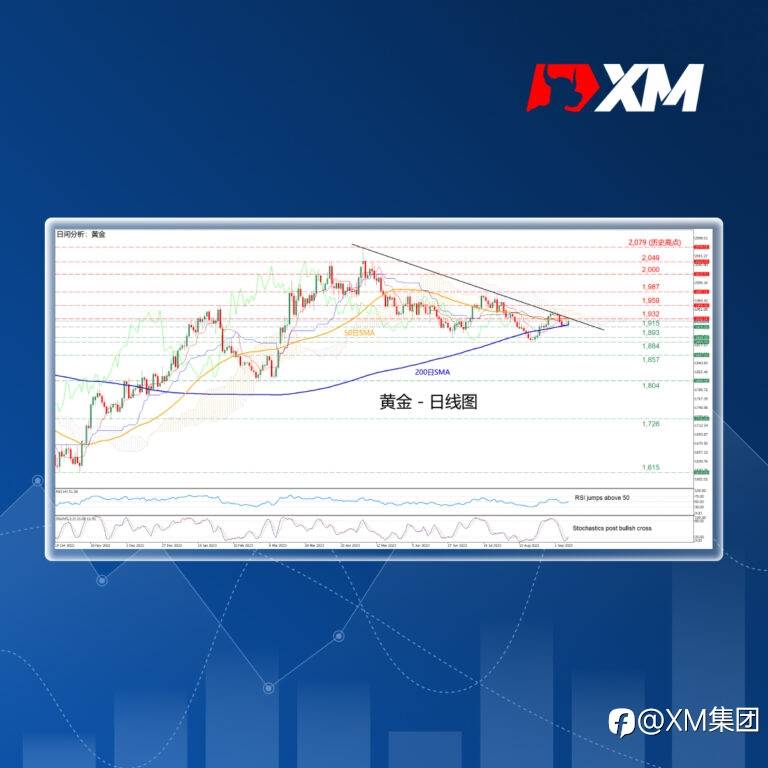

- 金价未能突破下降趋势线

- 200日SMA提供强劲支撑

- 金价能否重新测试关键阻力位?

金价多头在连结近期较低高点的下行趋势线遇阻后下跌。然而,200日移动平均线(SMA)提供支撑,短期震荡指标表明近期或将进一步上涨。

若金价走高,则5 月低点1,932可能初步形成阻力,此处与50 日移动平均线(SMA)重叠。若成功突破此处,多头或将推动金价突破下降趋势线并测试2 月高点1,959。继续上行,金价可能在7月高点 1,987 处停涨。

反之,若金价反转走低,则前期低点1,915 可能初步提供支撑。若成功跌破此处,金价或将跌至6月低点1,893。继续下行,五个月低点1,884或将提供支撑。

简而言之,金价自200 日移动平均线(SMA)强劲反弹后似乎重获动力。 然而,短期内金价需突破下行趋势线才有望转为看涨前景。

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Like this article? Show your appreciation by sending a tip to the author.

Leave Your Message Now