USD/TRY: INFLATION IN TURKEY RISES TO 58.9% YOY

| Scenario | |

|---|---|

| Timeframe | Intraday |

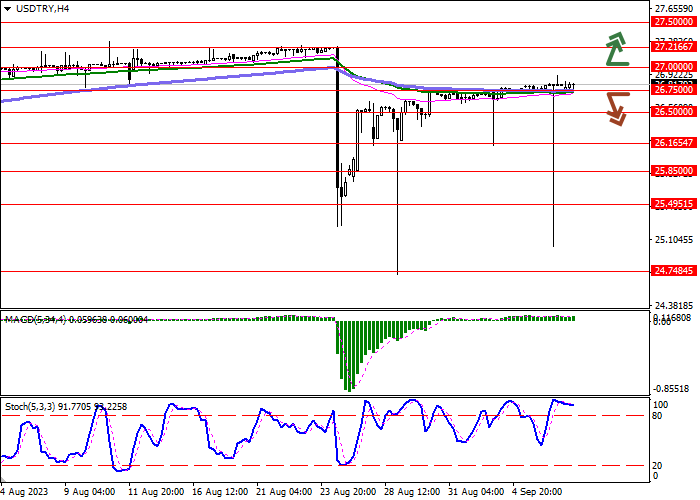

| Recommendation | SELL STOP |

| Entry Point | 26.7500 |

| Take Profit | 26.2000 |

| Stop Loss | 27.0000 |

| Key Levels | 25.8500, 26.1654, 26.5000, 26.7500, 27.0000, 27.2166, 27.5000, 27.7500 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 27.0000 |

| Take Profit | 27.5000 |

| Stop Loss | 26.7500 |

| Key Levels | 25.8500, 26.1654, 26.5000, 26.7500, 27.0000, 27.2166, 27.5000, 27.7500 |

Current trend

After a sharp rise in the lira at the end of August against the actions of the Turkish monetary authorities, today during the Asian session, the USD/TRY pair is slightly growing, testing 26.8000 for a breakout.

On August 24, the Central Bank of the Republic of Turkey raised the interest rate from 17.5% to 25.0%, although analysts expected slower growth. Officials noted that the tightening of monetary policy will continue until the forecast for rising prices changes. Thus, according to the results of August, the inflation rate accelerated from 47.8% to the December maximum of 58.94% YoY, and according to several independent analysts, the figure in August exceeds 120.0%. The regulator’s official forecast for the end of this year increased from 22.3% to 58.0%, while the international rating agency Moody’s Investors Service assumes that the value will reach 51.2%.

According to officials, the devaluation of the national currency contributed to the rapid development of negative dynamics. Thus, President Recep Tayyip Erdogan said that the authorities are starting to implement a medium-term plan for economic development. According to the Turkish Statistical Institute (TürkStat), Q2 gross domestic product (GDP) increased to 3.8% YoY compared to the forecast of 3.5%, with the services and construction sectors strengthening the most – by 6.6% and 6.4%, respectively, and the industrial sector (1.2%) – the least. Exports for the reporting period were corrected by –9.0% but imports grew by 20.3%. According to the June forecast of the World Bank, the Turkish economy will grow by 3.2% this year, by 4.3% in 2024, and by 4.1% in 2025.

The US dollar is strengthening after the publication of Institute of Supply Management (ISM) service PMI in August, which increased from 52.7 points to 54.5 points, while analysts expected it to decline to 52.5 points. The employment in the service sector for the same period changed from 50.7 points to 54.7 points, and the economic optimism from IBD/TIPP for September – from 40.3 points to 43.2 points, against the forecast of 41.1 points.

Support and resistance

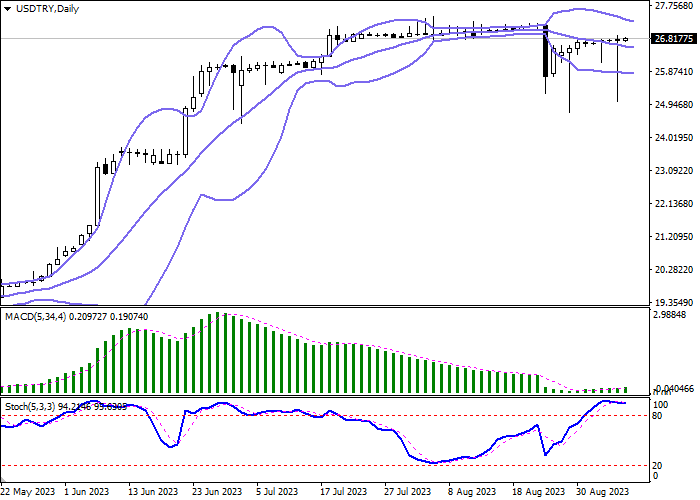

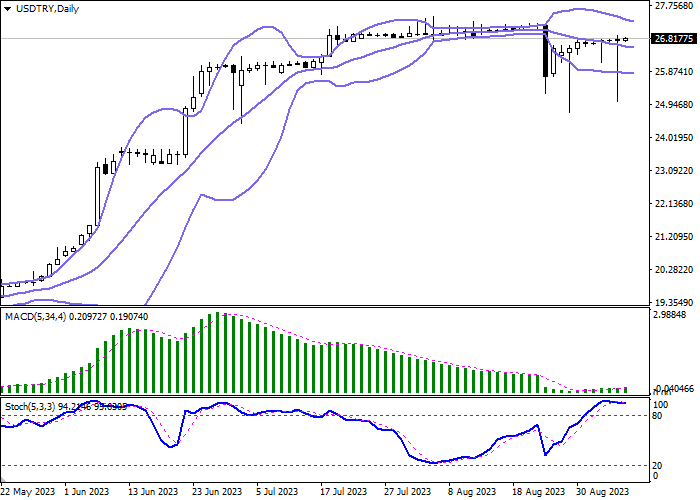

On the daily chart, Bollinger bands reverse into a horizontal plane: the price range is narrowing from above, reflecting the ambiguous nature of trading in the short term. The MACD indicator is reversing upwards, forming a new buy signal (the histogram tends to be above the signal line). Stochastic reached its highs and demonstrated flat dynamics, signaling that the US dollar may become overbought in the ultra-short term.

Resistance levels: 27.0000, 27.2166, 27.5000, 27.7500.

Support levels: 26.7500, 26.5000, 26.1654, 25.8500.

Trading tips

Short positions may be opened after a confident breakdown of 26.7500 with the target at 26.2000. Stop loss – 27.0000. Implementation period: 2–3 days.

Long positions may be opened after the growth and breakout of 27.0000 with the target at 27.5000. Stop loss – 26.7500.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.