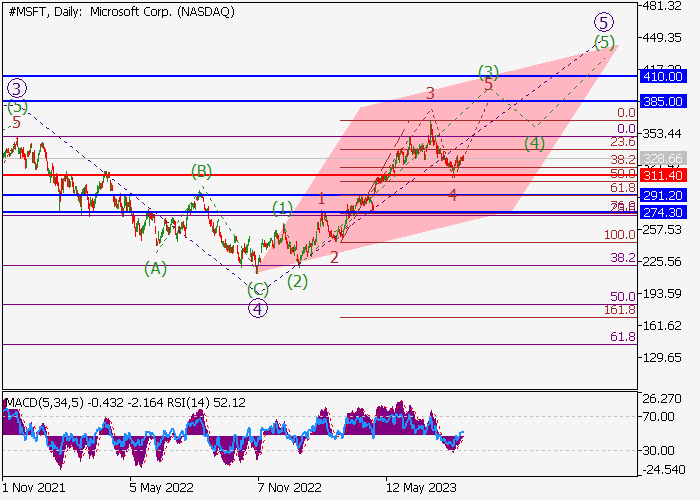

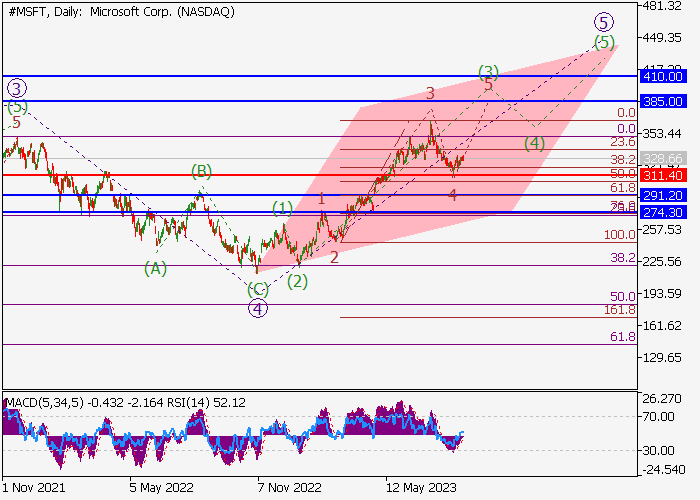

MICROSOFT CORP.: WAVE ANALYSIS

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 328.65 |

| Take Profit | 385.00, 410.00 |

| Stop Loss | 311.40 |

| Key Levels | 274.30, 291.20, 311.40, 385.00, 410.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 311.35 |

| Take Profit | 291.20, 274.30 |

| Stop Loss | 318.05 |

| Key Levels | 274.30, 291.20, 311.40, 385.00, 410.00 |

Growth is possible.

On the daily chart, the third wave of the higher level 3 ended, a downward correction formed as the fourth wave 4, and the fifth wave 5 develops, within which the wave (3) of 5 forms. Now, the third wave of the lower level 3 of (3) has ended, a local correction has formed as the fourth wave 4 of (3), and the formation of the fifth wave 5 of (3) has started. If the assumption is correct, the asset will grow to the area of 385.00–410.00. In this scenario, critical stop loss level is 311.40.

Main scenario

Long positions will become relevant above the level of 311.40 with the targets at 385.00–410.00. Implementation period: 7 days and more.

Alternative scenario

A breakout and the consolidation of the price below the level of 311.40 will let the asset go down to the area of 291.20–274.30.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.